Form MT 203 Distributor of Tobacco Products Tax Return Revised 321

What is the Form MT 203 Distributor of Tobacco Products Tax Return Revised 321

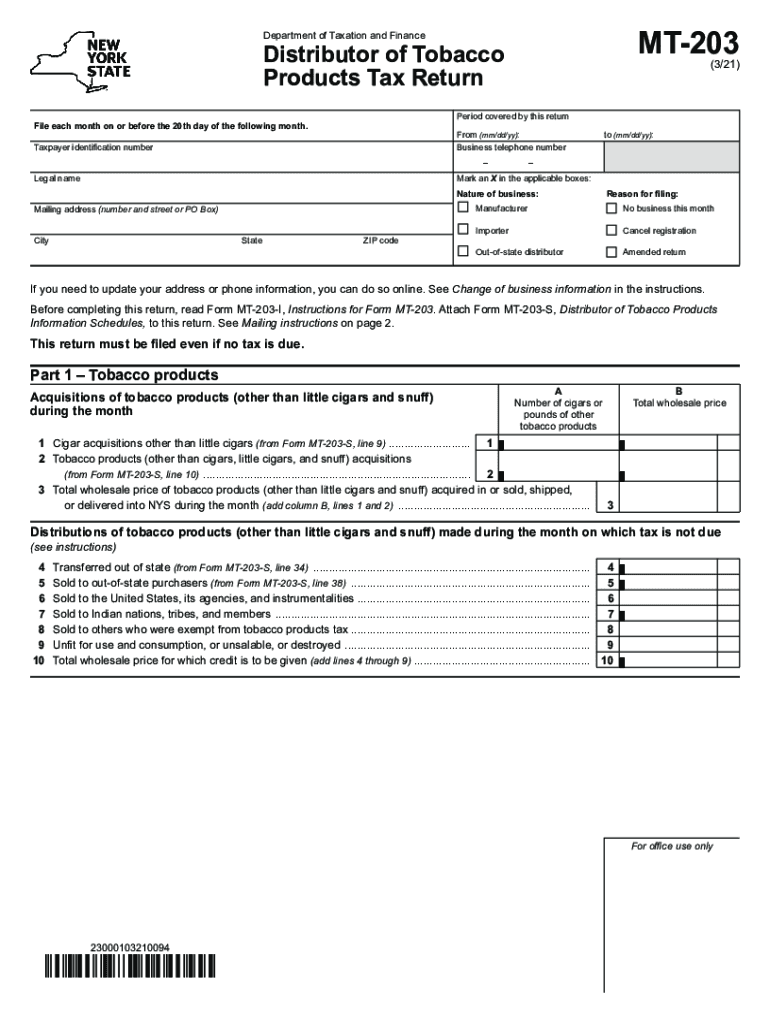

The Form MT 203 Distributor of Tobacco Products Tax Return Revised 321 is a specific tax return used by distributors of tobacco products in the United States. This form is essential for reporting the distribution and sale of tobacco products, ensuring compliance with federal and state tax regulations. It captures critical information about the quantity and type of tobacco products distributed, which is vital for tax assessment and regulatory purposes. Understanding this form is crucial for businesses involved in the tobacco industry to maintain accurate records and adhere to legal requirements.

How to use the Form MT 203 Distributor of Tobacco Products Tax Return Revised 321

Using the Form MT 203 involves several key steps to ensure proper completion and submission. First, gather all necessary information regarding the tobacco products distributed during the reporting period. This includes details such as product types, quantities, and sales figures. Next, accurately fill out the form, ensuring that all required fields are completed. Once the form is filled out, review it for accuracy before submitting it to the appropriate tax authority. It is important to keep a copy of the submitted form for your records, as it may be needed for future reference or audits.

Steps to complete the Form MT 203 Distributor of Tobacco Products Tax Return Revised 321

Completing the Form MT 203 involves a systematic approach to ensure accuracy. Start by downloading the most recent version of the form from an official source. Next, follow these steps:

- Enter your business information, including name, address, and tax identification number.

- Provide details about the reporting period for which you are filing.

- List all tobacco products distributed, including quantities and types.

- Calculate the total tax owed based on the quantities reported.

- Sign and date the form to certify its accuracy.

After completing these steps, submit the form according to the guidelines provided by the tax authority.

Legal use of the Form MT 203 Distributor of Tobacco Products Tax Return Revised 321

The legal use of the Form MT 203 is governed by federal and state regulations concerning tobacco distribution. This form must be completed accurately to ensure compliance with tax laws. Failing to file the form or providing incorrect information can result in penalties, including fines and legal action. It is essential for distributors to understand the legal implications of the information reported on this form, as it serves as a record of their tobacco distribution activities and tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form MT 203 are typically set by the relevant tax authority and can vary based on the reporting period. It is crucial for distributors to be aware of these deadlines to avoid late filing penalties. Generally, forms are due on a quarterly basis, but specific dates may differ. Keeping a calendar of important dates related to tax filings can help ensure timely submissions and maintain compliance with regulations.

Penalties for Non-Compliance

Non-compliance with the requirements of the Form MT 203 can lead to significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal repercussions. Distributors should be aware that repeated failures to file or inaccuracies in reporting can escalate penalties, including the possibility of criminal charges in severe cases. Maintaining accurate records and timely submissions is essential to mitigate these risks.

Quick guide on how to complete form mt 203 distributor of tobacco products tax return revised 321

Effortlessly Prepare Form MT 203 Distributor Of Tobacco Products Tax Return Revised 321 on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly option to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without any hold-ups. Manage Form MT 203 Distributor Of Tobacco Products Tax Return Revised 321 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and eSign Form MT 203 Distributor Of Tobacco Products Tax Return Revised 321 with Ease

- Locate Form MT 203 Distributor Of Tobacco Products Tax Return Revised 321 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize essential sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form MT 203 Distributor Of Tobacco Products Tax Return Revised 321 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mt 203 distributor of tobacco products tax return revised 321

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an mt 203 and how does it work?

An mt 203 is a financial message used for bank transfers, specifically for funds being transferred between financial institutions. In the context of airSlate SignNow, it ensures that documents related to these transactions can be sent and signed securely, streamlining the process for users.

-

How can airSlate SignNow assist in preparing an mt 203?

airSlate SignNow allows users to easily prepare and customize their mt 203 documents, ensuring all necessary fields are filled out correctly. With a user-friendly interface, it simplifies the process of creating financial documents, making it suitable for both novices and experts.

-

Is there a cost associated with using airSlate SignNow for mt 203?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features specifically designed for managing documents like mt 203, ensuring you find a solution that fits your budget.

-

What features of airSlate SignNow enhance the mt 203 document management process?

airSlate SignNow offers features such as real-time collaboration, advanced security, and eSigning capabilities for mt 203 documents. These features make it easier to manage and track your documents, ensuring compliance and security throughout the process.

-

Can I integrate airSlate SignNow with other tools for mt 203 processing?

Absolutely! airSlate SignNow provides seamless integrations with various business applications, enhancing your mt 203 processing. This allows for smoother workflows and minimizes the need for switching between multiple platforms.

-

What benefits does airSlate SignNow provide for managing mt 203 documents?

By using airSlate SignNow for your mt 203 documents, you benefit from increased efficiency and reduced turnaround times. The platform's secure eSignature capabilities and document tracking ensure that your financial transactions are handled swiftly and securely.

-

How secure is airSlate SignNow for handling mt 203 documents?

Security is a top priority for airSlate SignNow, providing end-to-end encryption and compliance with legal regulations for mt 203 documents. This ensures that sensitive financial information remains protected during the entire document flow.

Get more for Form MT 203 Distributor Of Tobacco Products Tax Return Revised 321

- Virginia form dc 475

- Customer request form axis bank

- Cbp 507employee report of unsafe conditions local 2595 form

- Work study application form

- Printable tep bills for tucson form

- 4924 withholding certificate for michigan pension or annuity payments mi w 4p 771975077 form

- Joint bidding agreement template form

- Joint boat ownership agreement template form

Find out other Form MT 203 Distributor Of Tobacco Products Tax Return Revised 321

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple