Real Property Tax Credit Form

What is the Real Property Tax Credit

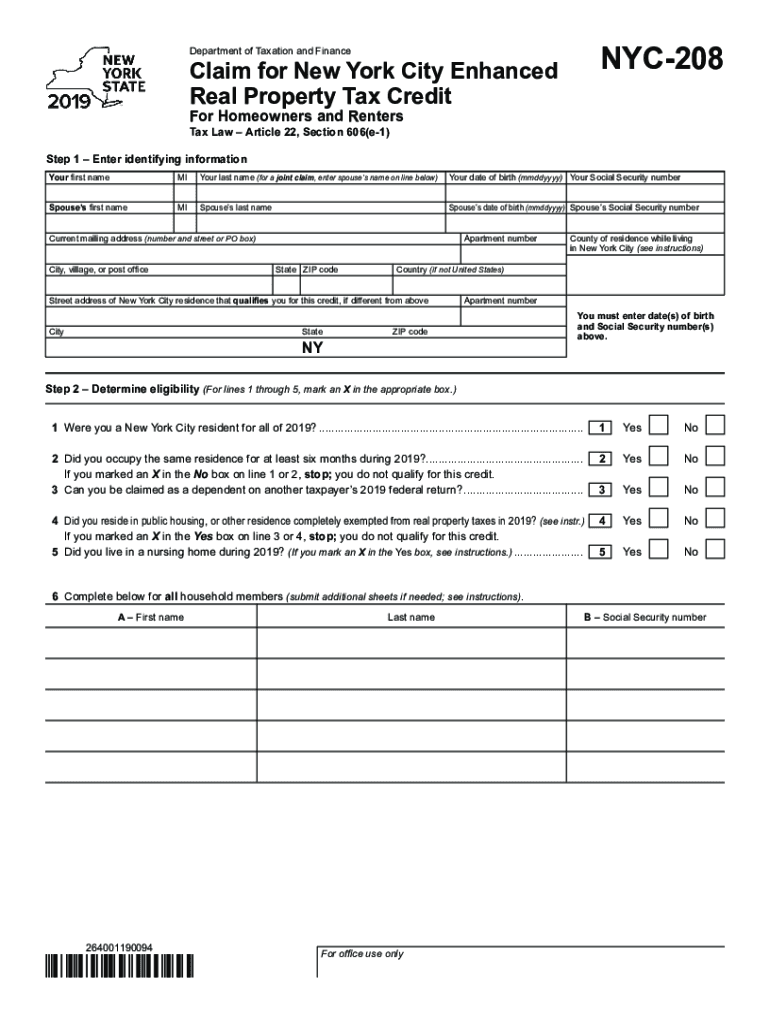

The Real Property Tax Credit is a financial benefit designed to reduce the property tax burden for eligible homeowners in New York. This credit is particularly aimed at those who meet specific income and residency criteria, allowing them to receive a reduction in their property taxes. The enhanced version of this credit provides additional benefits for qualifying individuals, ensuring that more residents can access financial relief. Understanding the details of this credit is essential for homeowners looking to alleviate their tax responsibilities.

Eligibility Criteria

To qualify for the Real Property Tax Credit, applicants must meet certain eligibility criteria. These typically include:

- Being a resident of New York State.

- Owning and occupying a residential property.

- Meeting income limits set by the state.

- Filing a complete and accurate application by the specified deadline.

It is important to review the specific income thresholds and property requirements to ensure eligibility before applying.

Steps to Complete the Real Property Tax Credit

Completing the Real Property Tax Credit form involves several key steps:

- Gather necessary documentation, including proof of income and property ownership.

- Access the NYS Form NYC-208, which is specifically designed for this credit.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the form by the deadline, either online or via mail.

Following these steps carefully can help ensure a smooth application process and increase the likelihood of receiving the credit.

Required Documents

When applying for the Real Property Tax Credit, certain documents are required to support your application. These may include:

- Proof of identity (such as a driver's license or state ID).

- Income statements (W-2 forms, tax returns, etc.).

- Documentation of property ownership (deed, mortgage statement).

- Any additional forms or statements as specified by the application instructions.

Having these documents ready can streamline the application process and help avoid delays.

Form Submission Methods

Applicants can submit the Real Property Tax Credit form through various methods. These include:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing a printed version of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if available.

Choosing the right submission method can depend on personal preference and the urgency of the application.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial for applicants seeking the Real Property Tax Credit. Typically, the deadline for submitting the NYC-208 form aligns with the annual tax filing season. It is essential to check the specific date each year, as it may vary. Missing the deadline can result in the inability to claim the credit for that tax year.

Quick guide on how to complete real property tax credit

Complete Real Property Tax Credit effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Real Property Tax Credit on any platform with airSlate SignNow's Android or iOS applications and simplify any document-based task today.

How to modify and eSign Real Property Tax Credit seamlessly

- Find Real Property Tax Credit and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred way to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Real Property Tax Credit while ensuring excellent communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the real property tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is nyc208 and how does it work with airSlate SignNow?

Nyc208 is a specific business solution integrated with airSlate SignNow that enhances document management and eSigning capabilities. By utilizing nyc208, you can streamline your workflow and ensure that all signed documents are stored securely and efficiently. This integration simplifies the signing process, making it easy for users to send and receive documents for signature.

-

How much does airSlate SignNow cost for nyc208 users?

The pricing for airSlate SignNow tailored for nyc208 users is competitive and designed to suit various business sizes. You can choose a plan that fits your needs, whether you require basic features or advanced functionality. For detailed pricing information, visit the airSlate SignNow website to explore the options available for nyc208.

-

What features does airSlate SignNow offer for nyc208?

AirSlate SignNow offers a range of features for nyc208, including easy electronic signing, document templates, and secure cloud storage. These features enhance productivity and allow users to manage their documents seamlessly. Additionally, integration with popular applications further expands the capabilities of airSlate SignNow for businesses using nyc208.

-

What are the benefits of using airSlate SignNow with nyc208?

By using airSlate SignNow with nyc208, businesses can enjoy greater efficiency, reduced turnaround times, and improved document security. This solution automates the signing process, allowing teams to focus on their core responsibilities without the hassle of manual paperwork. Furthermore, users benefit from compliance with legal standards when using the eSigning features of airSlate SignNow.

-

Can I integrate airSlate SignNow with other applications while using nyc208?

Yes, airSlate SignNow supports various integrations that allow you to connect seamlessly with other applications while using nyc208. This means you can enhance your document workflow by linking to CRMs, storage solutions, and more. The flexibility of airSlate SignNow makes it easy for businesses to adopt the tools they already use alongside nyc208.

-

Is airSlate SignNow secure for handling sensitive documents in nyc208?

Absolutely, airSlate SignNow takes security seriously by implementing advanced encryption and compliance measures to protect sensitive documents within the nyc208 framework. Every eSigned document is stored securely, ensuring confidentiality and integrity. Additionally, airSlate SignNow complies with legal frameworks that govern electronic signatures.

-

How easy is it to set up airSlate SignNow for nyc208?

Setting up airSlate SignNow for nyc208 is very straightforward. Once you've created your account, you can easily configure your settings and start sending documents for eSignature. The platform is user-friendly, ensuring that even those with minimal technical skills can navigate it with ease.

Get more for Real Property Tax Credit

- Acca application form pdf

- City of madison indiana application for pace program form

- Pay fixation form

- Sbi standing instruction form pdf

- F0022 page 1 of 2 office of the mississippi secretary of form

- Admission form 2 the parc

- City of lapeer individual income tax return due april 30 l 1040 form

- Nurse contract template form

Find out other Real Property Tax Credit

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple