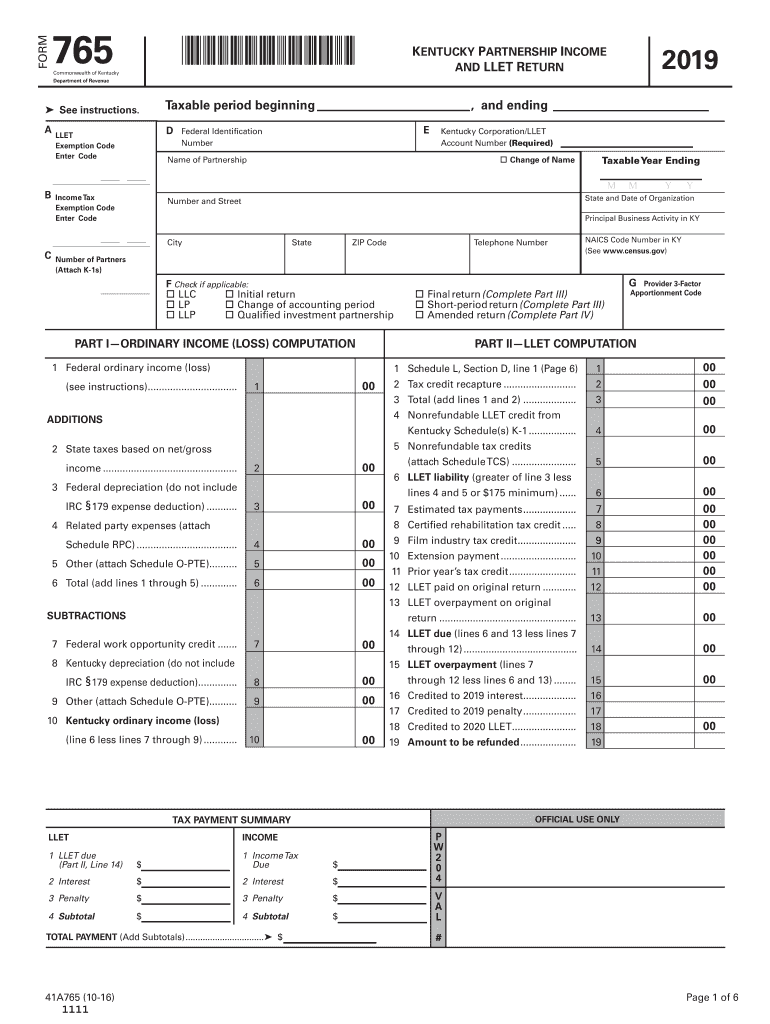

1500010263 Kentucky Department of Revenue Form

Understanding the limited liability entity tax

The limited liability entity tax is a specific tax imposed on certain business structures, such as limited liability companies (LLCs) and partnerships, within the United States. This tax is designed to ensure that these entities contribute to state revenue while benefiting from the legal protections and advantages that limited liability status provides. Each state may have its own regulations and rates associated with this tax, making it essential for business owners to familiarize themselves with local laws.

Eligibility criteria for the limited liability entity tax

To determine if your business is subject to the limited liability entity tax, consider the following criteria:

- The business must be organized as a limited liability entity, such as an LLC or a partnership.

- The entity must be registered to do business in the state where the tax is imposed.

- The business must meet any minimum income requirements set by the state.

Understanding these criteria helps ensure compliance and avoid potential penalties associated with non-compliance.

Steps to complete the limited liability entity tax form

Completing the limited liability entity tax form typically involves several steps:

- Gather necessary documentation, including your entity's formation documents and financial records.

- Access the appropriate form for your state, ensuring it is the correct version for the current tax year.

- Fill out the form accurately, providing all required information about your business and its financial performance.

- Review the completed form for accuracy and completeness before submission.

- Submit the form by the designated deadline, either online, by mail, or in person, depending on your state's requirements.

Filing deadlines for the limited liability entity tax

Filing deadlines for the limited liability entity tax vary by state, but they generally fall within specific timeframes each year. It is crucial for business owners to be aware of these deadlines to avoid late fees or penalties. Typically, the deadlines align with the annual tax return filing dates, but some states may have unique schedules. Always check with your state's revenue department for the most accurate and up-to-date information.

Penalties for non-compliance with the limited liability entity tax

Failure to comply with the limited liability entity tax requirements can result in various penalties, including:

- Monetary fines that can accumulate over time.

- Interest on any unpaid tax amounts.

- Potential legal action against the business entity.

Understanding these consequences emphasizes the importance of timely and accurate filing to maintain compliance.

Form submission methods for the limited liability entity tax

Business owners have several options for submitting the limited liability entity tax form, including:

- Online submission through the state's revenue department website, which is often the most efficient method.

- Mailing a paper form to the appropriate state office, ensuring it is postmarked by the filing deadline.

- In-person submission at designated state offices, which may also provide immediate confirmation of receipt.

Choosing the right submission method can streamline the process and ensure compliance with state regulations.

Quick guide on how to complete 1500010263 kentucky department of revenue

Effortlessly Prepare 1500010263 Kentucky Department Of Revenue on Any Device

The management of online documents has gained traction among businesses and individuals alike. It serves as an excellent eco-conscious alternative to conventional printed and signed documents, allowing you to locate the correct template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly and without delays. Manage 1500010263 Kentucky Department Of Revenue on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to Edit and eSign 1500010263 Kentucky Department Of Revenue with Ease

- Obtain 1500010263 Kentucky Department Of Revenue and then click Get Form to initiate the process.

- Use the tools we provide to complete your document.

- Emphasize important parts of the documents or mask sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you'd like to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, the hassle of tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign 1500010263 Kentucky Department Of Revenue and guarantee excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1500010263 kentucky department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is limited liability entity tax?

Limited liability entity tax refers to the taxes levied on businesses structured as limited liability entities, such as LLCs. Understanding this tax is crucial for business owners to manage their finances effectively. airSlate SignNow can assist in keeping your tax documents organized and easily accessible for your accounting needs.

-

How does airSlate SignNow help with limited liability entity tax documentation?

airSlate SignNow simplifies the process of managing documents related to limited liability entity tax. With features that allow for eSigning and document sharing, users can quickly gather necessary signatures and maintain compliance. This level of organization can save time and reduce stress when tax season arrives.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of all businesses, including those navigating limited liability entity tax. These plans provide various features at affordable rates, ensuring that companies can find a solution that fits their budget while enhancing document management and eSigning capabilities.

-

Are there any features specifically designed for limited liability entity tax management?

Yes, airSlate SignNow includes features such as template creation and automated workflows, which can be beneficial for managing limited liability entity tax. These tools help streamline the preparation and submission of tax documents, ensuring all necessary files are ready for timely filing. This reduces the risk of errors and penalties associated with tax submissions.

-

Can airSlate SignNow integrate with accounting software for limited liability entity tax?

Absolutely! airSlate SignNow easily integrates with leading accounting software, which is essential for handling limited liability entity tax. These integrations facilitate seamless data transfer and document sharing, making it easier to keep your financial records up to date and compliant with tax regulations.

-

What benefits do I gain from using airSlate SignNow for limited liability entity tax?

Using airSlate SignNow can enhance your efficiency when managing limited liability entity tax. It provides a secure and user-friendly platform for eSigning and organizing documents. With this solution, you can reduce the time spent on paperwork, minimizing errors that could impact your tax filings.

-

Is there customer support available for questions about limited liability entity tax?

Yes, airSlate SignNow offers customer support to assist users with queries related to limited liability entity tax. Our support team is knowledgeable about our features and can guide you on how to best utilize the platform for your specific tax needs. We're here to ensure you have the resources necessary for a smooth experience.

Get more for 1500010263 Kentucky Department Of Revenue

- Kansas oil assessment rendition form

- The domestic partnership act new jersey income taxinheritance tax form

- Consent and waiver of notice florida form

- Dental screening form 17941645

- Form fin 438 coloured fuel account certification sbr gov bc

- Guidance notes for form r432013

- Maine revenue services certificate of maine gov maine form

- Joint ip ownership agreement template form

Find out other 1500010263 Kentucky Department Of Revenue

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors