Form 200 Local Intangibles Tax Return Rev 7 21 Form 200 Local Intangibles Tax Return County Taxes

What is the Form 200 Local Intangibles Tax Return Rev 7 21

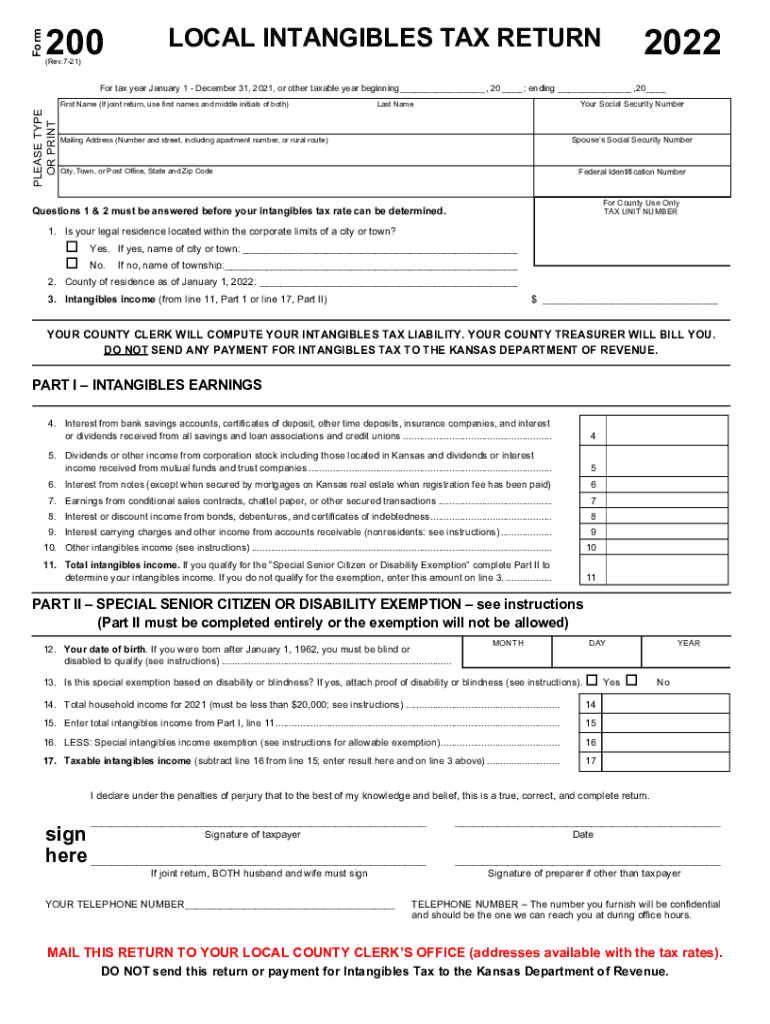

The Form 200 Local Intangibles Tax Return Rev 7 21 is a tax document used by businesses and individuals to report local intangible assets for tax purposes. This form is essential for calculating the local taxes owed on intangible property, which may include stocks, bonds, and other financial instruments. Understanding the purpose of this form is crucial for compliance with local tax regulations, ensuring that all applicable taxes are accurately reported and paid.

Steps to Complete the Form 200 Local Intangibles Tax Return Rev 7 21

Completing the Form 200 Local Intangibles Tax Return Rev 7 21 involves several key steps:

- Gather all necessary financial information regarding your intangible assets.

- Fill out the form with accurate data, including the value of each intangible asset.

- Review the completed form for any errors or omissions.

- Sign and date the form to certify its accuracy.

- Submit the form by the designated deadline to the appropriate local tax authority.

Legal Use of the Form 200 Local Intangibles Tax Return Rev 7 21

The legal use of the Form 200 Local Intangibles Tax Return Rev 7 21 is governed by local tax laws. It serves as a formal declaration of intangible assets and is required for compliance with tax obligations. Proper completion and submission of this form can help avoid penalties and ensure that taxpayers meet their legal responsibilities. It is important to retain a copy of the submitted form for your records and any future inquiries from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form 200 Local Intangibles Tax Return Rev 7 21 vary by jurisdiction. Typically, the form must be filed annually by a specified date, often coinciding with other local tax deadlines. It is essential to check with your local tax authority for the exact due date to avoid late fees or penalties. Marking these important dates on your calendar can help ensure timely compliance.

Form Submission Methods

The Form 200 Local Intangibles Tax Return Rev 7 21 can usually be submitted through various methods, including:

- Online submission via the local tax authority's website.

- Mailing a physical copy of the form to the designated address.

- In-person submission at local tax offices.

Choosing the appropriate submission method can streamline the filing process and ensure that your form is received on time.

Required Documents

When completing the Form 200 Local Intangibles Tax Return Rev 7 21, certain documents may be required to support the information provided. These may include:

- Financial statements detailing the value of intangible assets.

- Previous tax returns for comparison.

- Any documentation related to the acquisition or sale of intangible assets.

Having these documents ready can facilitate the completion of the form and ensure accuracy in reporting.

Quick guide on how to complete form 200 local intangibles tax return rev 7 21 form 200 local intangibles tax return county taxes

Complete Form 200 Local Intangibles Tax Return Rev 7 21 Form 200 Local Intangibles Tax Return County Taxes seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely maintain it online. airSlate SignNow offers all the resources needed to create, modify, and electronically sign your documents promptly and without interruptions. Manage Form 200 Local Intangibles Tax Return Rev 7 21 Form 200 Local Intangibles Tax Return County Taxes on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to edit and electronically sign Form 200 Local Intangibles Tax Return Rev 7 21 Form 200 Local Intangibles Tax Return County Taxes effortlessly

- Locate Form 200 Local Intangibles Tax Return Rev 7 21 Form 200 Local Intangibles Tax Return County Taxes and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark essential sections of your documents or obscure sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your requirements in document management within a few clicks from any device you prefer. Modify and electronically sign Form 200 Local Intangibles Tax Return Rev 7 21 Form 200 Local Intangibles Tax Return County Taxes to ensure outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 200 local intangibles tax return rev 7 21 form 200 local intangibles tax return county taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 200 Local Intangibles Tax Return Rev 7 21?

The Form 200 Local Intangibles Tax Return Rev 7 21 is a specific tax form used for reporting local intangibles taxes in various counties. It is vital for businesses trying to comply with local tax regulations and ensure they are accurately filing their taxes. Utilizing airSlate SignNow can simplify the process of completing and eSigning this form.

-

How do I complete the Form 200 Local Intangibles Tax Return Rev 7 21?

To complete the Form 200 Local Intangibles Tax Return Rev 7 21, you need to gather all relevant financial data for your intangibles. You can then use airSlate SignNow to securely fill out the form online, ensuring all fields are properly completed. Once filled, you can easily eSign and submit the form to your local tax authority.

-

What are the benefits of using airSlate SignNow for the Form 200 Local Intangibles Tax Return?

Using airSlate SignNow for the Form 200 Local Intangibles Tax Return Rev 7 21 allows for a seamless and efficient process. You can easily eSign documents, track submissions, and store documents securely. The platform enhances collaboration and reduces the time spent on paperwork, ensuring you adhere to county tax deadlines.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing varies based on the features and number of users needed. Investing in this service simplifies the filing of documents like the Form 200 Local Intangibles Tax Return Rev 7 21, potentially saving your business money in the long run.

-

Can I integrate airSlate SignNow with other software for filing Form 200 Local Intangibles Tax Return?

Yes, airSlate SignNow offers integrations with a variety of popular business software, making it easier to manage your documents. This ensures that you can access all the necessary tools and data while preparing your Form 200 Local Intangibles Tax Return Rev 7 21. Streamlining these processes contributes to efficient tax preparation.

-

How secure is my information when using airSlate SignNow?

airSlate SignNow prioritizes security and employs advanced encryption to protect your data. When using the platform for the Form 200 Local Intangibles Tax Return Rev 7 21, you can trust that your sensitive financial and personal information is safeguarded. Compliance with industry standards further enhances the security of your documents.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides various features such as document templates, eSignatures, and collaboration tools specifically designed to streamline the management of tax documents. These features are particularly useful when working on forms like the Form 200 Local Intangibles Tax Return Rev 7 21. The platform enhances efficiency and ensures accuracy in the tax filing process.

Get more for Form 200 Local Intangibles Tax Return Rev 7 21 Form 200 Local Intangibles Tax Return County Taxes

- Adult abuse neglect exploitation central registry release of information dcf ks

- Fm csvlrd 01 page 1 of 2 form

- Chain of custody prism analytical technologies inc form

- Iehp transportation number form

- Initial application public housing new ulm form

- Training plan template trainers advice form

- State of hawaii hawaii state judiciary form

- Joint parenting agreement template form

Find out other Form 200 Local Intangibles Tax Return Rev 7 21 Form 200 Local Intangibles Tax Return County Taxes

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online