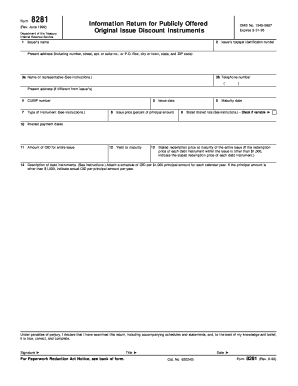

Form 8281 PDF

What is the Form 8281 PDF

The Form 8281 PDF is a document used by corporations to disclose the issuance of stock and other securities. This form is essential for reporting to the Internal Revenue Service (IRS) when a corporation issues stock, including details about the stock's type, amount, and the individuals or entities receiving it. The form helps ensure transparency in corporate transactions and compliance with federal tax regulations.

How to Obtain the Form 8281 PDF

To obtain the Form 8281 PDF, individuals can visit the IRS website, where the form is available for download. It is important to ensure that the most current version of the form is used, as tax regulations may change. The form can also be found in tax preparation software that supports IRS forms, allowing for easy access and completion.

Steps to Complete the Form 8281 PDF

Completing the Form 8281 PDF involves several key steps:

- Gather Information: Collect all necessary details about the stock issuance, including the type of stock, number of shares, and recipient information.

- Fill Out the Form: Enter the required information in the appropriate fields of the form. Ensure accuracy to avoid complications.

- Review for Accuracy: Double-check all entries for correctness, including names, amounts, and dates.

- Sign and Date: Ensure that the form is signed and dated by an authorized individual within the corporation.

- Submit the Form: Follow the submission guidelines to send the completed form to the IRS, either electronically or by mail.

IRS Guidelines for Form 8281

The IRS provides specific guidelines for completing and submitting Form 8281. Corporations must adhere to these guidelines to ensure compliance with tax laws. Key points include:

- Ensure that the form is submitted by the deadline, which is typically within a specific timeframe after the stock issuance.

- Provide accurate and complete information to avoid penalties or delays in processing.

- Retain copies of the submitted form for corporate records and future reference.

Filing Deadlines for Form 8281

Filing deadlines for Form 8281 are crucial for compliance. The form must be filed within a specified period following the issuance of stock. Typically, this is within 45 days of the stock issuance date. It is essential to check the IRS guidelines for any updates to deadlines, as they can vary based on specific circumstances or regulatory changes.

Legal Use of the Form 8281 PDF

The legal use of the Form 8281 PDF ensures that corporations comply with federal tax laws regarding stock issuance. Proper completion and timely submission of the form help avoid potential legal issues, including penalties for non-compliance. The form serves as a formal record of stock transactions, which can be critical in audits or legal proceedings.

Quick guide on how to complete form 8281 pdf

Complete Form 8281 Pdf effortlessly on any device

Virtual document management has become increasingly popular among businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your files quickly without delays. Manage Form 8281 Pdf on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Form 8281 Pdf effortlessly

- Find Form 8281 Pdf and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 8281 Pdf and guarantee exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8281 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the form 8281 instructions?

The form 8281 instructions provide guidance on how to properly complete and file the form, which is used for certain securities transactions. Understanding these instructions helps ensure compliance with IRS regulations and can prevent errors that may lead to penalties.

-

How does airSlate SignNow assist with form 8281 instructions?

airSlate SignNow simplifies the process of completing form 8281 by allowing users to easily fill out and eSign documents. Its user-friendly interface means that you can navigate the form 8281 instructions without hassle, ensuring all requirements are met efficiently.

-

What features does airSlate SignNow offer for managing form 8281?

AirSlate SignNow offers several features tailored for managing form 8281, including cloud storage, easy eSignature capabilities, and customizable templates. These tools help streamline your document workflow, making it easier to manage the form 8281 instructions and their implementation.

-

Is there a cost associated with using airSlate SignNow for form 8281 instructions?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including monthly and yearly subscriptions. Investing in this affordable solution empowers your team to efficiently follow the form 8281 instructions and enhances your overall document management.

-

Can I integrate airSlate SignNow with other software for managing form 8281 instructions?

Yes, airSlate SignNow supports numerous integrations with popular software applications. This capability allows users to seamlessly incorporate form 8281 instructions into their existing workflows, enhancing productivity and collaboration across various platforms.

-

How secure is my data when using airSlate SignNow for form 8281 instructions?

AirSlate SignNow prioritizes security by implementing robust encryption and secure access protocols. When handling sensitive information related to form 8281 instructions, you can trust that your data is protected against unauthorized access and bsignNowes.

-

What are the benefits of using airSlate SignNow for eSigning form 8281?

Using airSlate SignNow to eSign form 8281 offers numerous benefits including increased efficiency, reduced turnaround time, and enhanced accuracy. By following the form 8281 instructions within the platform, you can ensure that all parties involved can sign documents promptly and securely.

Get more for Form 8281 Pdf

Find out other Form 8281 Pdf

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe