CT IFTA 2, Application for International Fuel Tax Form

What is the CT IFTA 2, Application For International Fuel Tax

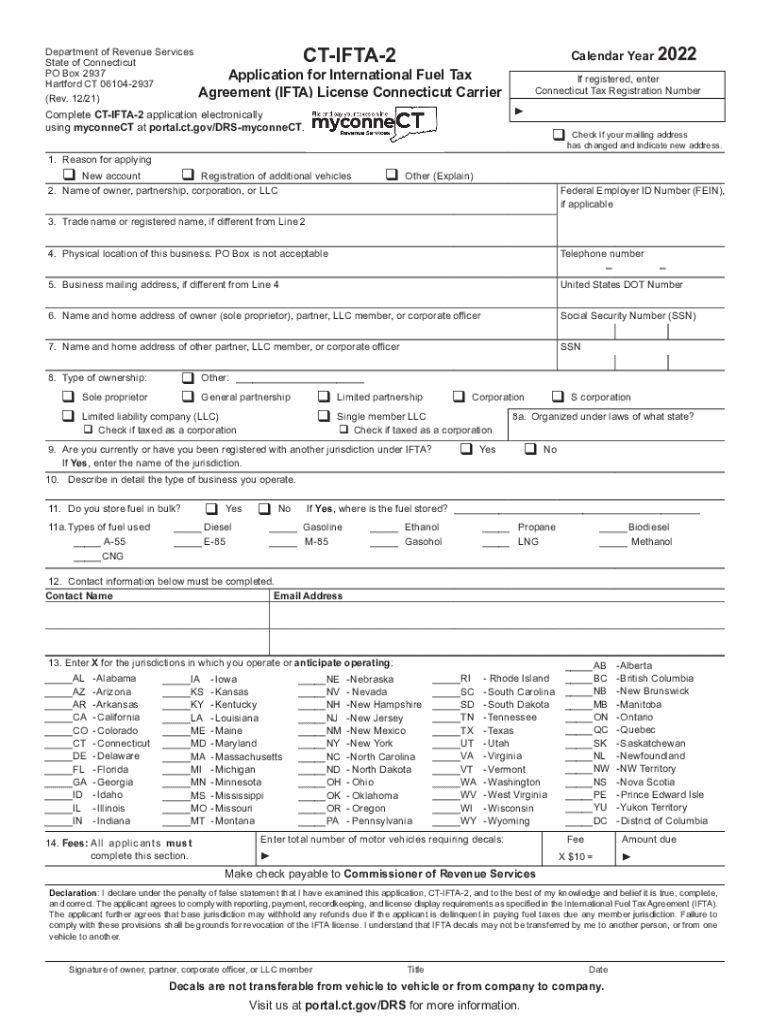

The CT IFTA 2, Application For International Fuel Tax, is a crucial document for businesses engaged in interstate travel and fuel usage. This application allows carriers to report their fuel consumption across multiple jurisdictions, ensuring compliance with the International Fuel Tax Agreement (IFTA). By utilizing this form, businesses can simplify their tax obligations and streamline their reporting processes. The form collects essential information about the carrier, including their business details, vehicle information, and fuel usage records.

Steps to complete the CT IFTA 2, Application For International Fuel Tax

Completing the CT IFTA 2 application involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business name, address, and the details of the vehicles you operate. Next, accurately record your fuel purchases and mileage for each jurisdiction where you operate. After compiling this data, fill out the application form, ensuring that all fields are completed correctly. Once the form is filled out, review it for any errors before submission. Finally, submit the application according to the specified guidelines, either electronically or via mail.

How to obtain the CT IFTA 2, Application For International Fuel Tax

The CT IFTA 2 application can be obtained through the Connecticut Department of Revenue Services (DRS) website or directly from their office. It is available in a downloadable format, allowing businesses to print and complete it manually or fill it out digitally. For those who prefer to submit their forms electronically, the DRS may provide an online portal for submission. Ensure you have the latest version of the form to avoid any compliance issues.

Legal use of the CT IFTA 2, Application For International Fuel Tax

Using the CT IFTA 2 application legally requires adherence to specific guidelines set forth by the IFTA. The application must be filled out truthfully and accurately, reflecting the actual fuel consumption and mileage of the vehicles operated. Misrepresentation or failure to report can lead to penalties or audits. Additionally, maintaining records that support the information provided in the application is essential for legal compliance and potential audits by tax authorities.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the CT IFTA 2 application is critical for compliance. Typically, the application must be submitted quarterly, with specific due dates set by the Connecticut DRS. It is important to stay informed about these dates to avoid late fees or penalties. Mark your calendar with these deadlines and ensure that all necessary documentation is prepared in advance to facilitate timely submission.

Required Documents

When completing the CT IFTA 2 application, certain documents are required to support your submission. These may include fuel purchase receipts, mileage logs, and any previous IFTA filings. Keeping organized records will not only assist in filling out the application accurately but also provide necessary evidence in case of an audit. Ensure all documents are up-to-date and readily available when preparing your application.

Quick guide on how to complete ct ifta 2 application for international fuel tax

Effortlessly Prepare CT IFTA 2, Application For International Fuel Tax on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage CT IFTA 2, Application For International Fuel Tax on any device using airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

The easiest way to modify and eSign CT IFTA 2, Application For International Fuel Tax effortlessly

- Obtain CT IFTA 2, Application For International Fuel Tax and click Get Form to initiate the process.

- Utilize the available tools to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with the tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature using the Sign feature, which is quick and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Alter and eSign CT IFTA 2, Application For International Fuel Tax and ensure superb communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct ifta 2 application for international fuel tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ct ifta phone number for customer support?

The ct ifta phone number for customer support can be found on the official website or your account dashboard. It is essential for resolving specific inquiries related to IFTA regulations and compliance. If you're experiencing issues with your account, we recommend calling this number for prompt assistance.

-

How can I use airSlate SignNow to manage my IFTA documents?

Using airSlate SignNow, you can easily manage your IFTA documents by sending and eSigning them in a secure online environment. With our user-friendly interface, you can quickly prepare and submit all necessary paperwork, streamlining the reporting process. For any queries, feel free to contact us using the ct ifta phone number.

-

What pricing plans does airSlate SignNow offer for IFTA services?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our plans are designed to provide you with affordable options for eSigning and document management. For more specific pricing information related to IFTA services, it's best to signNow out via the ct ifta phone number.

-

Are there any features specifically tailored for IFTA compliance in airSlate SignNow?

Yes, airSlate SignNow includes several features that are beneficial for IFTA compliance, such as secure document storage and audit trails. These features help you maintain accurate records and ensure timely submissions. If you have questions about these features, please call the ct ifta phone number for assistance.

-

Can airSlate SignNow integrate with other software I use for IFTA reporting?

Absolutely! airSlate SignNow offers various integrations with popular accounting and fleet management software, making it easier to manage your IFTA reporting. This seamless integration helps streamline your workflow without additional hassle. For detailed integration inquiries, don’t hesitate to contact us using the ct ifta phone number.

-

What benefits does airSlate SignNow provide for IFTA management?

The key benefits of using airSlate SignNow for IFTA management include increased efficiency, cost savings, and improved accuracy in document handling. Our platform simplifies the eSigning process, reducing turnaround times. You can learn more about these benefits by calling the ct ifta phone number.

-

Is airSlate SignNow secure enough for IFTA-related documents?

Yes, airSlate SignNow employs top-notch security protocols to ensure that your IFTA-related documents are safe and compliant. We offer encryption and secure storage for your sensitive information. For any security concerns, feel free to discuss them with us at the ct ifta phone number.

Get more for CT IFTA 2, Application For International Fuel Tax

- St elizabeth doctors note form

- Berkeley extension extension transcript or extension login form

- Tx okla kiwanis background form

- Veterinary drop off form 453445263

- Tenant management communication form revised xls shra

- Quarterly wage report 7823 form

- Asset protection trust template form

- Sample seating chart miami dade county public schools form

Find out other CT IFTA 2, Application For International Fuel Tax

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF