Form M 4852 Substitute for Form W 2, Wage and Tax

What is the Form M 4852 Substitute For Form W-2, Wage And Tax

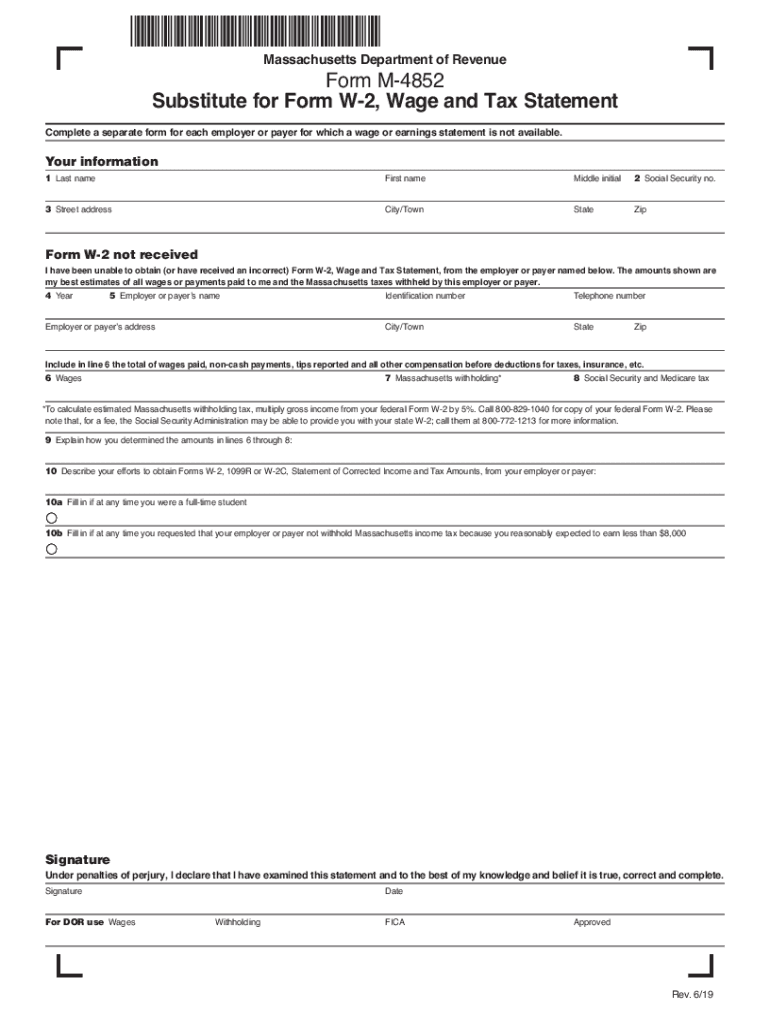

The Form M 4852 serves as a substitute for the W-2 wage tax statement when an employee does not receive their W-2 from their employer. This form is essential for accurately reporting income and taxes withheld during the tax year. It allows taxpayers to estimate their earnings and tax withholdings based on their own records, ensuring compliance with IRS regulations. The M 4852 is particularly useful for individuals who may have lost their W-2 or for those whose employers failed to provide it in a timely manner.

How to use the Form M 4852 Substitute For Form W-2, Wage And Tax

To use the Form M 4852, individuals must first gather their income documentation, such as pay stubs or bank statements, to estimate their total earnings and tax withholdings. Once the necessary information is collected, the form can be filled out with details including the employer's name, address, and the estimated amounts of wages and taxes withheld. After completing the form, it should be submitted along with the federal tax return. It is important to keep a copy of the M 4852 and any supporting documents for personal records and potential IRS inquiries.

Steps to complete the Form M 4852 Substitute For Form W-2, Wage And Tax

Completing the Form M 4852 involves several key steps:

- Gather income documentation, such as pay stubs or other records.

- Obtain the Form M 4852 from the appropriate state tax authority or the IRS website.

- Fill in the employer's information, including name and address.

- Estimate total wages earned and taxes withheld based on your records.

- Review the completed form for accuracy.

- Submit the form with your tax return to the IRS.

Legal use of the Form M 4852 Substitute For Form W-2, Wage And Tax

The legal use of the Form M 4852 is recognized by the IRS as a valid method for reporting wages when a W-2 is unavailable. It is crucial that the information provided on the M 4852 is accurate and based on reliable documentation to avoid penalties or issues with tax filings. Using the M 4852 responsibly ensures compliance with federal tax laws, allowing taxpayers to fulfill their obligations even when faced with challenges in obtaining their W-2.

Filing Deadlines / Important Dates

Filing deadlines for the Form M 4852 align with the general tax filing deadlines set by the IRS. Typically, individual tax returns must be filed by April fifteenth of each year. If you are using the M 4852, it is essential to submit it along with your tax return by this deadline to avoid penalties. Additionally, if you require an extension, be sure to file the necessary forms to extend your deadline while ensuring that any taxes owed are paid on time.

Penalties for Non-Compliance

Failure to file the Form M 4852 when required, or providing inaccurate information, can result in penalties from the IRS. These penalties may include fines for late filing, interest on unpaid taxes, and potential audits. It is important to ensure that all information submitted is accurate and that the form is filed by the appropriate deadlines to avoid these consequences. Keeping thorough records can help mitigate risks associated with non-compliance.

Quick guide on how to complete form m 4852 substitute for form w 2 wage and tax

Accomplish Form M 4852 Substitute For Form W 2, Wage And Tax effortlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers an excellent eco-friendly solution to traditional printed and signed documents, as you can easily access the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents swiftly without delays. Manage Form M 4852 Substitute For Form W 2, Wage And Tax on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to edit and electronically sign Form M 4852 Substitute For Form W 2, Wage And Tax effortlessly

- Locate Form M 4852 Substitute For Form W 2, Wage And Tax and click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your adjustments.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing out new document copies. airSlate SignNow manages all your document management needs in a few clicks from any device of your choosing. Edit and electronically sign Form M 4852 Substitute For Form W 2, Wage And Tax and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form m 4852 substitute for form w 2 wage and tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W2 wage tax statement?

A W2 wage tax statement is a form used to report an employee's annual wages and the taxes withheld from their paycheck. It is essential for tax filing as it provides recipients with information about their taxable income. By using airSlate SignNow, you can efficiently manage, send, and eSign your W2 wage tax statements.

-

How can airSlate SignNow help with W2 wage tax statements?

airSlate SignNow simplifies the process of creating, sending, and electronically signing W2 wage tax statements. Users can streamline their tax processes by integrating eSignature capabilities, ensuring documents are signed quickly and returned on time. This helps businesses remain compliant while saving valuable time and resources.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, ensuring you can find a suitable solution to manage your W2 wage tax statements effectively. The plans include features that allow for unlimited document signing and template creation. Check out our pricing page for more details and find the best fit for your organization's needs.

-

Is airSlate SignNow compliant with tax regulations for W2 wage tax statements?

Yes, airSlate SignNow is designed to be compliant with tax regulations, making it a reliable solution for managing W2 wage tax statements. Our platform ensures that all electronically signed documents meet legal requirements, giving you peace of mind during tax season. We prioritize security and compliance to protect sensitive financial information.

-

Can I integrate airSlate SignNow with my existing accounting software for W2 wage tax statements?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easy to generate and send W2 wage tax statements from your preferred platform. These integrations enhance workflow efficiency, allowing for smoother data transfer and management of employee tax documents.

-

What features does airSlate SignNow offer for eSignature on W2 wage tax statements?

airSlate SignNow includes multiple features specifically designed to facilitate the signing of W2 wage tax statements, such as customizable templates, automated reminders, and secure storage of signed documents. These features enhance your document management process, making it simple to ensure timely signatures and reduce errors.

-

How long does it take to prepare and send W2 wage tax statements using airSlate SignNow?

Preparing and sending W2 wage tax statements using airSlate SignNow is a swift process, often taking just minutes. By utilizing our automated templates and easy-to-use platform, businesses can reduce the time spent on these tasks signNowly. This efficiency allows you to focus on other important aspects of tax preparation.

Get more for Form M 4852 Substitute For Form W 2, Wage And Tax

Find out other Form M 4852 Substitute For Form W 2, Wage And Tax

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy