List Supplement Tax Form

What is the List Supplement Tax

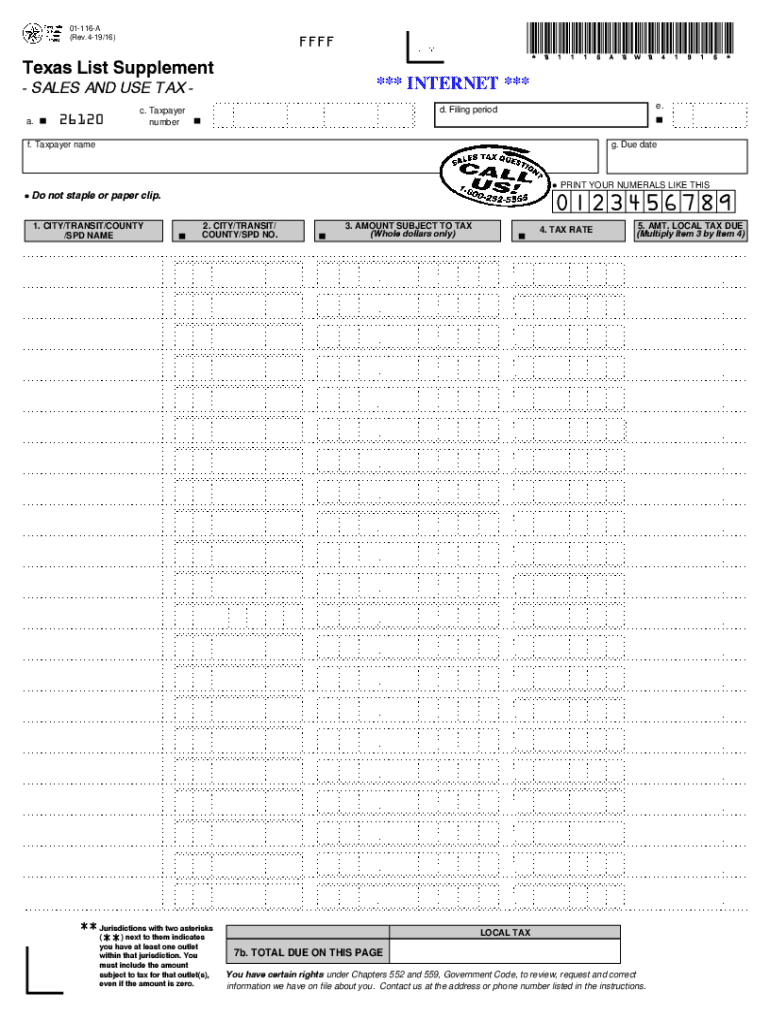

The List Supplement Tax is a specific tax form used in Texas, primarily for reporting sales and use tax for certain transactions. This form is essential for businesses that need to disclose the sale of taxable items and services. It helps ensure compliance with state tax regulations and provides a clear record of taxable sales. Understanding this tax form is crucial for businesses operating in Texas, as it directly impacts their tax obligations and reporting accuracy.

How to use the List Supplement Tax

Using the List Supplement Tax involves accurately reporting sales and use tax on the 01116a form. Businesses must gather all relevant sales data, including the types of goods sold and their corresponding sales prices. Once the data is compiled, it should be entered into the appropriate sections of the form. It is important to ensure that all entries are accurate to avoid any discrepancies that could lead to penalties. After completing the form, businesses can submit it electronically or via mail, depending on their preference.

Steps to complete the List Supplement Tax

Completing the List Supplement Tax involves several key steps:

- Gather all necessary sales records and receipts related to taxable sales.

- Fill out the 01116a form, ensuring all information is accurate and complete.

- Review the form for any errors or omissions before finalizing it.

- Submit the completed form either online or by mailing it to the appropriate state department.

Following these steps helps ensure that the submission is compliant with Texas tax regulations and minimizes the risk of errors.

Legal use of the List Supplement Tax

The legal use of the List Supplement Tax is governed by Texas state tax laws. This form must be used by businesses to report sales and use tax accurately. Compliance with these regulations is critical, as failure to file or inaccuracies in reporting can lead to penalties. The form serves as an official document that can be referenced in case of audits or inquiries from tax authorities. Therefore, understanding the legal implications of using the List Supplement Tax is vital for maintaining compliance.

Required Documents

To complete the List Supplement Tax, certain documents are required:

- Sales records and receipts for all taxable sales.

- Previous tax filings, if applicable, for reference.

- Any supporting documentation that may clarify sales transactions.

Having these documents on hand will streamline the completion process and ensure accuracy in reporting.

Filing Deadlines / Important Dates

Filing deadlines for the List Supplement Tax are crucial for businesses to adhere to avoid penalties. Typically, the form must be submitted quarterly or annually, depending on the business's sales volume. It is important to check the Texas Comptroller's website for specific dates and any changes to the filing schedule. Keeping track of these deadlines helps ensure timely submissions and compliance with state tax regulations.

Penalties for Non-Compliance

Non-compliance with the List Supplement Tax requirements can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Businesses must understand the importance of timely and accurate filings to avoid these consequences. Staying informed about tax obligations and maintaining organized records can help mitigate the risk of non-compliance.

Quick guide on how to complete list supplement tax

Complete List Supplement Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage List Supplement Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to edit and eSign List Supplement Tax with ease

- Find List Supplement Tax and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign List Supplement Tax and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the list supplement tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Texas 01116A sales and how does it work?

Texas 01116A sales refer to a specific regulatory framework for sales in the state of Texas. This framework enables businesses to streamline their sales processes while ensuring compliance with state laws. Leveraging tools like airSlate SignNow, businesses can efficiently manage contracts and eSign documents in accordance with Texas 01116A sales requirements.

-

What are the key features of airSlate SignNow for Texas 01116A sales?

AirSlate SignNow offers a range of features that are beneficial for managing Texas 01116A sales, including document templates, eSignature capabilities, and real-time tracking. These features help streamline the sales signing process, making it faster and more efficient. Businesses can also integrate airSlate SignNow with their existing tools for enhanced productivity.

-

How can airSlate SignNow improve my Texas 01116A sales process?

By using airSlate SignNow, businesses can signNowly enhance their Texas 01116A sales process through automation and easy document management. This user-friendly platform allows for quick eSigning and tracking of documents, minimizing the time spent on administrative tasks. This efficiency translates into a more focused sales effort, ultimately boosting overall sales conversion rates.

-

Is there a trial period for airSlate SignNow, specifically for Texas 01116A sales users?

Yes, airSlate SignNow offers a free trial that allows potential users to explore its features, including those tailored for Texas 01116A sales. During the trial, users can experience the benefits of eSigning and document management before committing to a subscription. This helps businesses assess how well the platform fits their Texas 01116A sales needs.

-

What are the pricing options for airSlate SignNow for Texas 01116A sales?

AirSlate SignNow provides various pricing plans that cater to different business sizes and needs, including those focusing on Texas 01116A sales. Each plan is designed to offer a cost-effective solution with essential features for document management and eSigning. Interested businesses can select a plan that matches their budget while ensuring compliance with Texas sales regulations.

-

Can I integrate airSlate SignNow with other tools for Texas 01116A sales?

Absolutely! AirSlate SignNow offers seamless integrations with various platforms and applications to facilitate better workflow for Texas 01116A sales. This ensures that users can leverage the functionality of airSlate SignNow alongside other business tools, enhancing efficiency and collaboration throughout the sales process.

-

What security features does airSlate SignNow offer for Texas 01116A sales?

AirSlate SignNow prioritizes security, offering features like encryption, secure access controls, and audit trails for all documents, making it ideal for Texas 01116A sales. These features ensure that sensitive sales documents and customer information are protected. Businesses can confidently manage and sign documents, knowing that their data is secure.

Get more for List Supplement Tax

Find out other List Supplement Tax

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure