Ohio Form it 4708 Composite Income Tax Return for Certain Investors in

What is the Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In

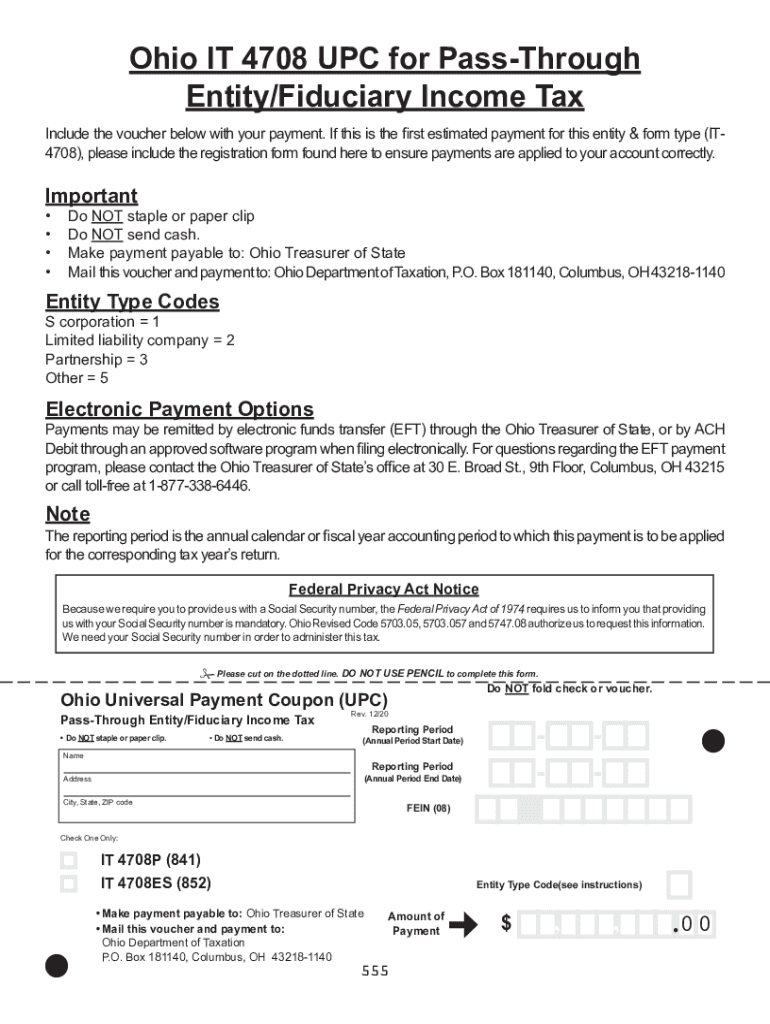

The Ohio Form IT 4708 Composite Income Tax Return is specifically designed for certain investors in Ohio who wish to report income from pass-through entities. This form allows non-resident investors to file a single return for income earned in Ohio, simplifying the tax process. The composite return aggregates the income of all eligible investors, allowing them to avoid filing individual returns for their share of income from partnerships, S corporations, or other pass-through entities. This form is particularly beneficial for investors who want to streamline their tax obligations while ensuring compliance with Ohio tax laws.

Steps to complete the Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In

Completing the Ohio Form IT 4708 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements from pass-through entities. Next, fill out the form by entering your personal information and the income details from each entity. Be sure to calculate the total income accurately, as this will affect your tax liability. After completing the form, review all entries for errors or omissions. Finally, sign and date the form before submission. Ensuring that all information is correct will help avoid potential penalties or delays in processing.

How to obtain the Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In

The Ohio Form IT 4708 can be obtained through the Ohio Department of Taxation's official website. It is available as a downloadable PDF, which can be printed and filled out by hand. Additionally, many tax preparation software programs include this form, allowing for easier digital completion. If you prefer a physical copy, you may also request the form directly from the Ohio Department of Taxation offices or through authorized tax professionals.

Filing Deadlines / Important Dates

When filing the Ohio Form IT 4708, it is crucial to be aware of the deadlines to avoid penalties. The form is typically due on the 15th day of the fourth month following the end of the tax year. For most taxpayers, this means the deadline falls on April 15. However, if the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to check for any updates or changes to deadlines each tax year to ensure timely filing.

Eligibility Criteria

To be eligible to file the Ohio Form IT 4708, investors must meet specific criteria. Primarily, the form is intended for non-resident individuals who have income from pass-through entities operating in Ohio. Additionally, the entities must elect to file the composite return on behalf of their investors. Each investor must also have a share of income that qualifies under Ohio tax laws. Understanding these eligibility requirements is essential for ensuring that the correct form is filed and that all tax obligations are met.

Penalties for Non-Compliance

Failure to comply with the requirements of the Ohio Form IT 4708 can result in significant penalties. Common penalties include late filing fees and interest on any unpaid taxes. If the form is not filed by the deadline, the Ohio Department of Taxation may impose a penalty of up to $50 for each month the form is late, with a maximum penalty of $500. Additionally, failure to pay any taxes owed can lead to further financial repercussions. It is crucial for investors to adhere to filing requirements to avoid these penalties.

Quick guide on how to complete ohio form it 4708 composite income tax return for certain investors in

Finalize Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to alter and eSign Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In seamlessly

- Obtain Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunts, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with a few clicks from any device you prefer. Adjust and eSign Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio form it 4708 composite income tax return for certain investors in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In?

The Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In is a tax form used by certain pass-through entities to report income on behalf of their non-resident investors. It simplifies the tax filing process, allowing investors to meet their state tax obligations more efficiently.

-

How can airSlate SignNow help with the Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In?

airSlate SignNow streamlines the process of signing and sending the Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In. Our platform allows you to electronically sign documents securely, ensuring compliance and simplifying tax filing for both entities and investors.

-

What are the pricing options for using airSlate SignNow to manage the Ohio Form IT 4708?

airSlate SignNow offers several pricing plans tailored to fit different business needs, allowing you to choose a cost-effective solution for managing the Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In. Each plan includes various features, ensuring you have the necessary tools for efficient document management and eSignature.

-

Is airSlate SignNow compliant with Ohio tax regulations for submitting the Form IT 4708?

Yes, airSlate SignNow is designed to comply with federal and state regulations, including those pertaining to the Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In. Our platform ensures that all electronically signed documents are legally valid and can be submitted with confidence.

-

What features does airSlate SignNow provide for managing tax documents like the Ohio Form IT 4708?

AirSlate SignNow includes features such as customizable templates, advanced document tracking, and secure cloud storage, which are essential for managing the Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In. These tools help streamline workflow and enhance collaboration amongst users.

-

Can I integrate airSlate SignNow with other software to manage the Ohio Form IT 4708?

Absolutely! airSlate SignNow offers integrations with a variety of business applications, allowing you to manage your workflow for the Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In seamlessly within your existing software ecosystem. This enhances efficiency and reduces the need for duplicate data entry.

-

What are the benefits of using airSlate SignNow for tax filing, particularly for the Ohio Form IT 4708?

Using airSlate SignNow for tax filing, particularly the Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In, provides several benefits, including increased accuracy, time savings, and enhanced security. Users can easily collect signatures and track the status of documents, ensuring a smoother filing process.

Get more for Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In

Find out other Ohio Form IT 4708 Composite Income Tax Return For Certain Investors In

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney