Individual Long Form Return DOCX 2016

What is the Individual Long Form Return docx

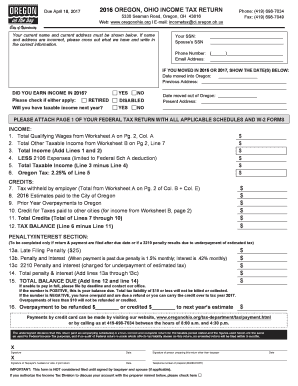

The Individual Long Form Return docx is a comprehensive tax document used by individuals in the United States to report their income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for those who have more complex financial situations, such as self-employed individuals or those with multiple income sources. It allows taxpayers to provide detailed information about their earnings, expenses, and any applicable tax credits, ensuring accurate reporting and compliance with federal tax laws.

How to use the Individual Long Form Return docx

Using the Individual Long Form Return docx involves several steps to ensure that all necessary information is accurately captured. Start by gathering all relevant financial documents, including W-2s, 1099s, and any records of deductions or credits you plan to claim. Next, open the docx file and begin filling it out, ensuring that you provide complete and accurate information. Pay special attention to sections that require detailed explanations, as these can significantly impact your tax liability. Once completed, review the document for accuracy before submitting it to the IRS.

Steps to complete the Individual Long Form Return docx

Completing the Individual Long Form Return docx involves a systematic approach:

- Gather necessary documents, including income statements and expense records.

- Open the docx file and fill in personal information, such as name, address, and Social Security number.

- Report income from various sources, ensuring all amounts are accurate.

- Detail any deductions or credits you are eligible for, providing supporting documentation where required.

- Review the completed form for any errors or omissions.

- Save the document securely and prepare for submission.

Legal use of the Individual Long Form Return docx

The Individual Long Form Return docx is legally binding when completed and submitted according to IRS guidelines. It is crucial to ensure that all information is truthful and accurate, as providing false information can lead to penalties or legal repercussions. The form must be signed electronically or physically, depending on the submission method, to affirm its authenticity. Compliance with federal tax laws is essential to avoid audits or fines.

Filing Deadlines / Important Dates

Filing deadlines for the Individual Long Form Return docx are critical to ensure compliance with IRS regulations. Typically, the deadline for submitting your tax return is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers may also request an extension, allowing additional time to file, but any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents

To accurately complete the Individual Long Form Return docx, several documents are typically required:

- W-2 forms from employers detailing wages and tax withheld.

- 1099 forms for any freelance or contract work.

- Records of any additional income, such as interest or dividends.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Documentation for any tax credits being claimed.

Form Submission Methods (Online / Mail / In-Person)

The Individual Long Form Return docx can be submitted through various methods, providing flexibility for taxpayers. The most common submission methods include:

- Online filing through IRS-approved software, which often provides step-by-step guidance.

- Mailing a printed copy of the completed form to the appropriate IRS address.

- In-person submission at designated IRS offices, although this method is less common.

Quick guide on how to complete individual long form return docx

Effortlessly Prepare Individual Long Form Return docx on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily access the right form and securely keep it online. airSlate SignNow equips you with all necessary tools to swiftly create, edit, and eSign your documents without any holdups. Manage Individual Long Form Return docx on any device with the airSlate SignNow Android or iOS applications and enhance any document-related processes today.

How to Edit and eSign Individual Long Form Return docx with Ease

- Find Individual Long Form Return docx and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark pertinent sections of the documents or obscure sensitive details with tools offered by airSlate SignNow designed specifically for that function.

- Generate your signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to preserve your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Edit and eSign Individual Long Form Return docx to ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct individual long form return docx

Create this form in 5 minutes!

How to create an eSignature for the individual long form return docx

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Individual Long Form Return docx?

An Individual Long Form Return docx is a comprehensive document used for filing personal tax returns in detail. This format allows users to include various income sources, deductions, and credits, ensuring a thorough reporting of financial information. Creating an Individual Long Form Return docx is essential for individuals who have complex financial situations.

-

How does airSlate SignNow help with Individual Long Form Return docx?

airSlate SignNow streamlines the process of preparing and sending your Individual Long Form Return docx. With a simple interface, users can easily fill out their forms, ensure accuracy, and send them for eSignature. This eliminates the hassle of traditional document handling and speeds up the filing process.

-

Is there a cost associated with using airSlate SignNow for Individual Long Form Return docx?

Yes, airSlate SignNow offers various pricing plans designed to suit different needs, including those who need to manage Individual Long Form Return docx. Each plan includes features tailored for document management and eSigning, providing excellent value for both individuals and businesses. You can choose a plan that best fits your usage and budget.

-

What features does airSlate SignNow offer for Individual Long Form Return docx creation?

airSlate SignNow offers a range of features for creating Individual Long Form Return docx, including customizable templates, data fields, and intuitive editing tools. Additionally, users can easily integrate their documents with cloud storage services, ensuring seamless access and sharing. These features make it easier to prepare your tax returns accurately.

-

Can I track the status of my Individual Long Form Return docx sent for eSignature?

Absolutely! airSlate SignNow provides tracking capabilities for all documents sent, including Individual Long Form Return docx. You can check the status in real-time, receive notifications when the document is opened or signed, and maintain full visibility throughout the process. This ensures that you stay informed every step of the way.

-

Is airSlate SignNow compliant with legal regulations for Individual Long Form Return docx?

Yes, airSlate SignNow is designed to comply with legal regulations related to document signing and storing, ensuring your Individual Long Form Return docx is handled securely. Our platform adheres to industry standards for data protection and eSignature laws, giving you confidence that your sensitive information is safe. Compliance is a priority for our service.

-

What integrations are available for airSlate SignNow when dealing with Individual Long Form Return docx?

airSlate SignNow integrates with a wide array of applications that can enhance your workflow around Individual Long Form Return docx. Popular integrations include cloud storage systems like Google Drive and Dropbox, as well as business tools like CRM platforms. These integrations allow you to streamline your document management and eSigning processes.

Get more for Individual Long Form Return docx

- And treatment consent form

- Accident exchange of information form town of new hartford

- Arkansas small estate affidavit form 23

- Irs publication 17 pdf form

- Form 14216 3 apps irs

- International distributor agreement template form

- International loan agreement template form

- Occupational therapy contract template form

Find out other Individual Long Form Return docx

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document