Tax Ohio Govstaticforms2021 Ohio it 1041 Ohio Department of Taxation

What is the Tax ohio govstaticforms2021 Ohio IT 1041 Ohio Department Of Taxation

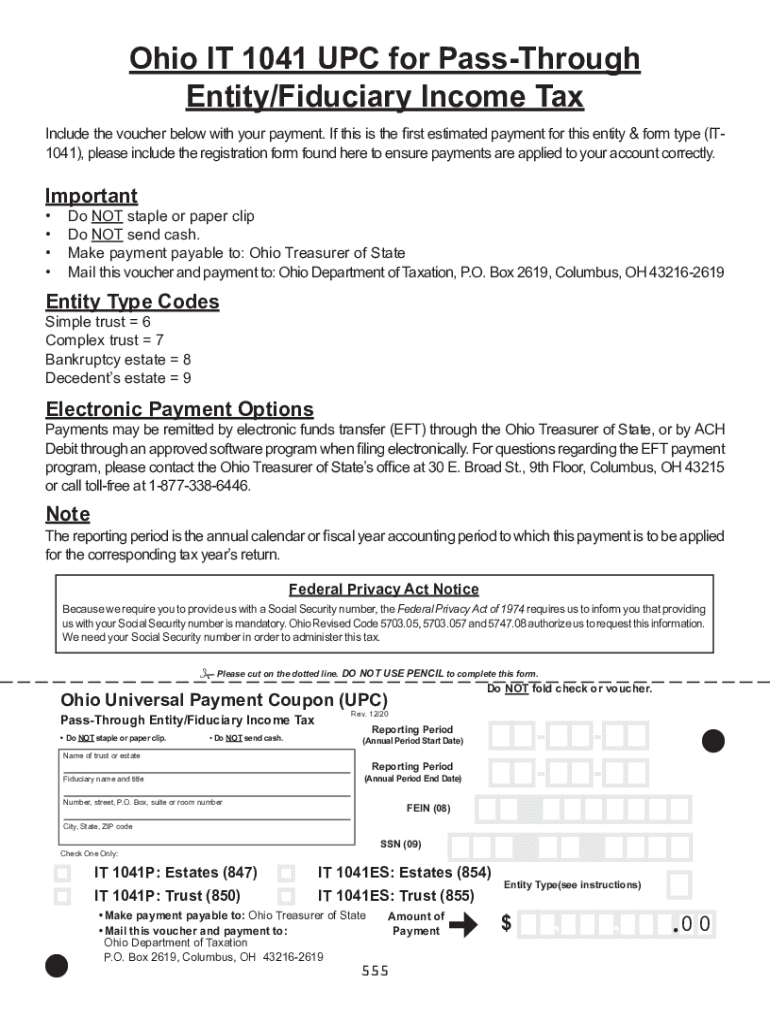

The Tax ohio govstaticforms2021 Ohio IT 1041 is a tax form issued by the Ohio Department of Taxation. This form is specifically designed for fiduciaries, such as trustees or executors, to report income earned by estates and trusts in Ohio. It is crucial for ensuring proper tax compliance for entities that manage assets on behalf of others. The form captures various income sources, deductions, and credits applicable to the estate or trust, allowing for accurate tax calculations.

Steps to complete the Tax ohio govstaticforms2021 Ohio IT 1041 Ohio Department Of Taxation

Completing the Tax ohio govstaticforms2021 Ohio IT 1041 requires careful attention to detail. Here are the essential steps:

- Gather necessary financial documents, including income statements and expense records for the estate or trust.

- Fill out the form with accurate information, ensuring all income and deductions are reported.

- Calculate the total tax liability based on the reported income.

- Review the completed form for accuracy to avoid errors that could lead to penalties.

- Sign and date the form, ensuring that all required signatures are obtained if there are multiple fiduciaries.

How to obtain the Tax ohio govstaticforms2021 Ohio IT 1041 Ohio Department Of Taxation

The Tax ohio govstaticforms2021 Ohio IT 1041 can be obtained directly from the Ohio Department of Taxation's official website. It is also available at local tax offices and can be requested via mail if necessary. Ensure you are using the correct version of the form for the tax year to avoid complications during submission.

Legal use of the Tax ohio govstaticforms2021 Ohio IT 1041 Ohio Department Of Taxation

The legal use of the Tax ohio govstaticforms2021 Ohio IT 1041 is essential for compliance with state tax laws. This form must be filed accurately and on time to avoid penalties. It serves as an official record of the income and expenses of the estate or trust, and its proper completion is necessary for the fiduciary to fulfill their legal obligations. Additionally, eSignature solutions can be used to sign the form digitally, ensuring it meets legal standards for electronic documents.

Filing Deadlines / Important Dates

Filing deadlines for the Tax ohio govstaticforms2021 Ohio IT 1041 are typically aligned with federal tax deadlines. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the tax year for the estate or trust. It is important to check for any specific deadlines that may apply, especially if there are extensions or special circumstances affecting the filing period.

Form Submission Methods (Online / Mail / In-Person)

The Tax ohio govstaticforms2021 Ohio IT 1041 can be submitted through various methods. Taxpayers have the option to file the form online through the Ohio Department of Taxation's e-filing system, which offers a streamlined process. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its own requirements and processing times, so it is advisable to choose the one that best fits your needs.

Quick guide on how to complete tax ohio govstaticforms2021 ohio it 1041 ohio department of taxation

Complete Tax ohio govstaticforms2021 Ohio IT 1041 Ohio Department Of Taxation effortlessly on any device

Web-based document management has gained traction with businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Tax ohio govstaticforms2021 Ohio IT 1041 Ohio Department Of Taxation on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Tax ohio govstaticforms2021 Ohio IT 1041 Ohio Department Of Taxation seamlessly

- Find Tax ohio govstaticforms2021 Ohio IT 1041 Ohio Department Of Taxation and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign Tax ohio govstaticforms2021 Ohio IT 1041 Ohio Department Of Taxation and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax ohio govstaticforms2021 ohio it 1041 ohio department of taxation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax ohio govstaticforms2021 Ohio IT 1041 form?

The Tax ohio govstaticforms2021 Ohio IT 1041 form is a tax return for estates and trusts in Ohio, which must be filed with the Ohio Department of Taxation. It reports the income and deductions related to the estate or trust's taxable income. Ensuring you understand how to complete this form is crucial for compliance.

-

How can airSlate SignNow assist with the Tax ohio govstaticforms2021 Ohio IT 1041?

airSlate SignNow offers a streamlined solution to electronically sign and manage the Tax ohio govstaticforms2021 Ohio IT 1041 form. Our platform makes it easy to collaborate with clients or beneficiaries, ensuring all necessary signatures and documents are collected efficiently and securely.

-

What are the benefits of using airSlate SignNow for estate tax forms?

By using airSlate SignNow, you can benefit from a cost-effective and user-friendly solution for eSigning the Tax ohio govstaticforms2021 Ohio IT 1041 and other essential documents. Our platform enhances workflow efficiency, reduces paperwork, and increases the speed at which forms are processed, ensuring timely submissions.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Our cost-effective solutions allow you to manage the signing of documents like the Tax ohio govstaticforms2021 Ohio IT 1041 without breaking the bank, while still enjoying robust features for document management.

-

Can I integrate airSlate SignNow with other applications for tax documents?

Absolutely! airSlate SignNow seamlessly integrates with various applications, such as CRM systems and cloud storage solutions, enhancing your ability to manage the Tax ohio govstaticforms2021 Ohio IT 1041. This integration helps ensure all relevant documents are accessible and manageable within your preferred platforms.

-

What security measures does airSlate SignNow provide for sensitive tax documents?

Security is a top priority at airSlate SignNow. We implement state-of-the-art security measures, including encryption and secure storage, to protect sensitive documents like the Tax ohio govstaticforms2021 Ohio IT 1041. This ensures that your tax information remains confidential and secure during the signing process.

-

How user-friendly is airSlate SignNow for signing tax forms?

airSlate SignNow is designed to be incredibly user-friendly, allowing individuals, accountants, and legal professionals to sign the Tax ohio govstaticforms2021 Ohio IT 1041 with ease. Our intuitive interface guides you through the signing process, making it accessible for users of all technical skill levels.

Get more for Tax ohio govstaticforms2021 Ohio IT 1041 Ohio Department Of Taxation

Find out other Tax ohio govstaticforms2021 Ohio IT 1041 Ohio Department Of Taxation

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile