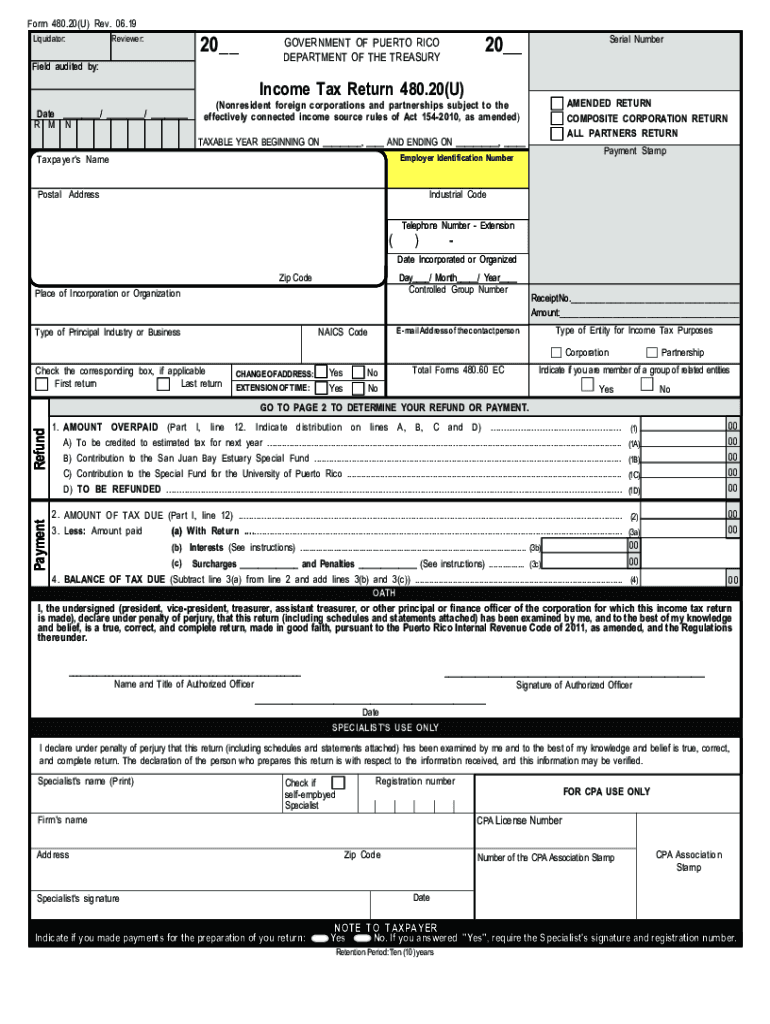

Income Tax Return 480 20U Form

What is the Income Tax Return 480 20U

The Income Tax Return 480 20U form is a document used by individuals and businesses in the United States to report their income and calculate their tax obligations. This form is specifically designed for taxpayers who have certain types of income that may not be reported on standard tax forms. It is essential for ensuring compliance with federal tax regulations and accurately reflecting one's financial situation.

How to use the Income Tax Return 480 20U

Using the Income Tax Return 480 20U involves several key steps. First, gather all necessary financial documents, including income statements, receipts, and any relevant tax documents. Next, carefully fill out the form, ensuring that all information is accurate and complete. Pay close attention to sections that require specific details about income sources and deductions. Once completed, review the form for any errors before submission.

Steps to complete the Income Tax Return 480 20U

Completing the Income Tax Return 480 20U involves the following steps:

- Gather all required documents, including W-2s, 1099s, and other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income accurately in the designated sections.

- Calculate deductions and credits that apply to your situation.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail, as preferred.

Legal use of the Income Tax Return 480 20U

The legal use of the Income Tax Return 480 20U is crucial for ensuring compliance with tax laws. This form must be filled out truthfully and accurately, as any discrepancies can lead to penalties or audits. The form serves as a legal declaration of income and tax liability, and it is essential to retain copies for personal records. Proper use of this form helps protect taxpayers from legal repercussions associated with incorrect filings.

Filing Deadlines / Important Dates

Filing deadlines for the Income Tax Return 480 20U are typically aligned with the federal tax filing calendar. Taxpayers should be aware of key dates, such as:

- April 15: Standard deadline for filing individual tax returns.

- October 15: Deadline for those who filed for an extension.

- Specific deadlines for estimated tax payments, if applicable.

Required Documents

To complete the Income Tax Return 480 20U, several documents are necessary. These may include:

- W-2 forms from employers.

- 1099 forms for freelance or contract income.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

Quick guide on how to complete income tax return 480 20u

Complete Income Tax Return 480 20U effortlessly on any device

Managing documents online has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Income Tax Return 480 20U on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Income Tax Return 480 20U with ease

- Find Income Tax Return 480 20U and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Edit and eSign Income Tax Return 480 20U and ensure excellent communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax return 480 20u

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 480 20?

Form 480 20 is a tax document used in Puerto Rico for reporting income and tax information. It is essential for both individuals and businesses to accurately complete this form to ensure compliance with local tax regulations.

-

How can airSlate SignNow help with Form 480 20?

airSlate SignNow simplifies the process of completing and eSigning Form 480 20. Our platform provides templates and easy integration solutions that allow users to fill out and share the form digitally, saving time and reducing errors.

-

Is there a cost associated with using airSlate SignNow for Form 480 20?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs. Users can choose the plan that best suits their requirements and access the tools necessary to manage and submit Form 480 20 efficiently.

-

What features does airSlate SignNow offer for managing Form 480 20?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These features streamline the process of handling Form 480 20, allowing users to operate more efficiently.

-

Can I integrate airSlate SignNow with other applications for Form 480 20?

Yes, airSlate SignNow offers seamless integrations with numerous applications, making it easy to manage Form 480 20 alongside your existing workflows. This enhances productivity by connecting your tools in one cohesive platform.

-

Is airSlate SignNow secure for submitting Form 480 20?

Absolutely! airSlate SignNow utilizes advanced security measures, including encryption and secure data storage, to protect your sensitive information while handling Form 480 20. You can trust us to keep your data safe during the document signing process.

-

What benefits does using airSlate SignNow provide for Form 480 20 management?

Using airSlate SignNow for Form 480 20 management increases efficiency, reduces processing errors, and accelerates completion times. Our user-friendly platform ensures that you can manage documents with ease, enhancing your overall workflow.

Get more for Income Tax Return 480 20U

- Booklet an form

- Rule 24 application for services pdf hennepin county form

- Mi w4 form

- Transitional housing program template form

- Eliminating limiting beliefs for good form

- St120 form

- St 405 the south carolina department of revenue sctax form

- Driver vision evaluation wyoming department of transportation dot state wy form

Find out other Income Tax Return 480 20U

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online