Arizona Tpt Ez Fillable Form

What is the Arizona Tpt Ez Fillable Form

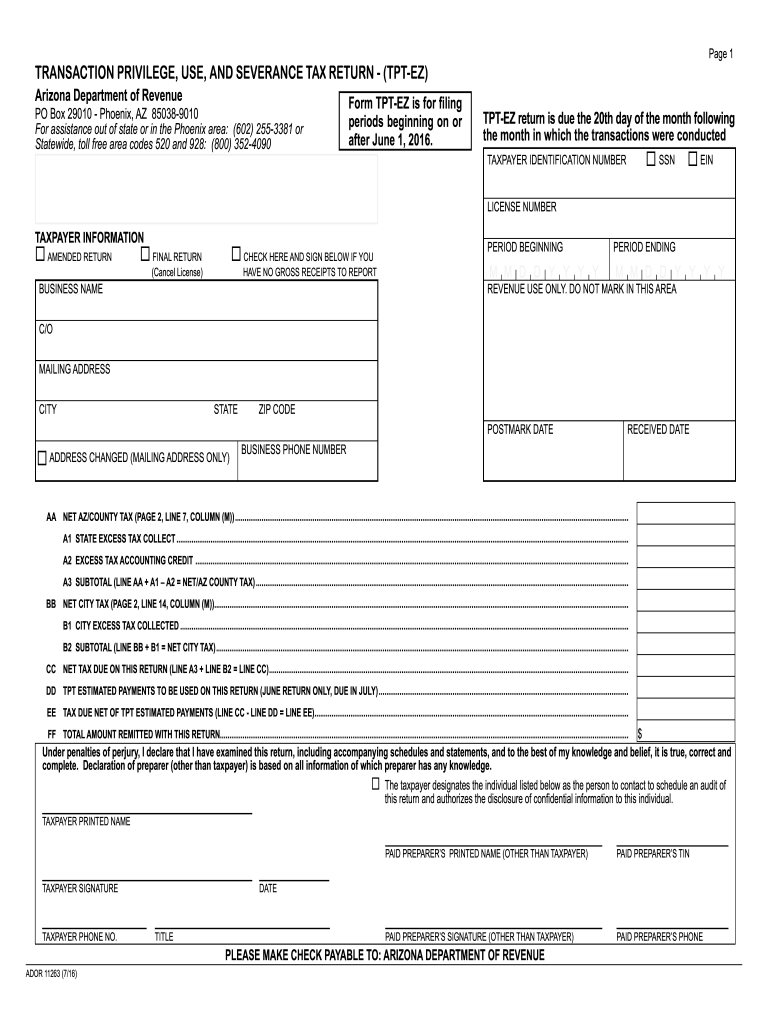

The Arizona Tpt Ez Fillable Form is a simplified document designed for businesses to report transaction privilege tax (TPT) obligations. This form is specifically tailored for small businesses and those with straightforward tax situations, allowing for an efficient and user-friendly filing process. It captures essential information regarding gross income, deductions, and tax calculations, ensuring compliance with state tax regulations.

How to use the Arizona Tpt Ez Fillable Form

Using the Arizona Tpt Ez Fillable Form is straightforward. Begin by downloading the form from the official Arizona Department of Revenue website or accessing it through a trusted e-signature platform. Fill in the required fields, including your business information, gross income, and any applicable deductions. Ensure that all entries are accurate to avoid delays or penalties. Once completed, you can submit the form electronically or print it for mail submission.

Steps to complete the Arizona Tpt Ez Fillable Form

Completing the Arizona Tpt Ez Fillable Form involves several key steps:

- Download the form from a reliable source.

- Provide your business name, address, and TPT identification number.

- Report your total gross income for the reporting period.

- Include any deductions that apply to your business.

- Calculate the total tax due based on the reported figures.

- Review the form for accuracy before submission.

Legal use of the Arizona Tpt Ez Fillable Form

The Arizona Tpt Ez Fillable Form is legally recognized for reporting transaction privilege taxes in Arizona. To ensure its legal validity, it must be completed accurately and submitted within the designated deadlines. Compliance with state tax laws is crucial, as failure to file correctly can result in penalties or interest on unpaid taxes. Utilizing a reliable e-signature service can further enhance the form's legal standing by providing an electronic certificate of completion.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Tpt Ez Fillable Form vary based on your business's reporting frequency. Generally, monthly filers must submit their forms by the 20th of the following month, while quarterly filers have deadlines on the last day of the month following the quarter's end. Annual filers should submit their forms by January 31 of the following year. Staying aware of these dates is essential to avoid late fees and maintain compliance.

Required Documents

To complete the Arizona Tpt Ez Fillable Form, you will need specific documents and information, including:

- Your business's TPT identification number.

- Records of gross income for the reporting period.

- Documentation for any deductions claimed.

- Previous tax returns, if applicable, for reference.

Form Submission Methods (Online / Mail / In-Person)

The Arizona Tpt Ez Fillable Form can be submitted through various methods to accommodate different preferences. You can file online via the Arizona Department of Revenue's e-filing system, which offers a streamlined process. Alternatively, you may print the completed form and mail it to the appropriate address. In-person submissions are also accepted at designated state offices, providing flexibility for those who prefer face-to-face interactions.

Quick guide on how to complete transaction privilege use and severance tax return tpt ez transaction privilege use and severance tax return tpt ez azdor

Effortlessly Prepare Arizona Tpt Ez Fillable Form on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Manage Arizona Tpt Ez Fillable Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Arizona Tpt Ez Fillable Form with Ease

- Locate Arizona Tpt Ez Fillable Form and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information carefully and then click on the Done button to save your modifications.

- Choose your preferred method to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Arizona Tpt Ez Fillable Form and ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the transaction privilege use and severance tax return tpt ez transaction privilege use and severance tax return tpt ez azdor

How to make an eSignature for your Transaction Privilege Use And Severance Tax Return Tpt Ez Transaction Privilege Use And Severance Tax Return Tpt Ez Azdor online

How to generate an electronic signature for the Transaction Privilege Use And Severance Tax Return Tpt Ez Transaction Privilege Use And Severance Tax Return Tpt Ez Azdor in Chrome

How to generate an eSignature for putting it on the Transaction Privilege Use And Severance Tax Return Tpt Ez Transaction Privilege Use And Severance Tax Return Tpt Ez Azdor in Gmail

How to make an electronic signature for the Transaction Privilege Use And Severance Tax Return Tpt Ez Transaction Privilege Use And Severance Tax Return Tpt Ez Azdor straight from your smart phone

How to create an electronic signature for the Transaction Privilege Use And Severance Tax Return Tpt Ez Transaction Privilege Use And Severance Tax Return Tpt Ez Azdor on iOS devices

How to create an eSignature for the Transaction Privilege Use And Severance Tax Return Tpt Ez Transaction Privilege Use And Severance Tax Return Tpt Ez Azdor on Android

People also ask

-

What is tpt ez and how does it work?

tpt ez is a powerful tool within airSlate SignNow that streamlines document signing and management. With its easy-to-use interface, businesses can quickly send and eSign documents, enhancing workflow efficiency. This feature is especially beneficial for teams looking to cut down on paperwork.

-

What are the benefits of using tpt ez?

Using tpt ez ensures a cost-effective solution for document management, minimizing the time spent on manual processes. The ability to easily eSign documents improves collaboration and productivity while maintaining compliance and security. Ultimately, tpt ez enhances the overall efficiency of your business operations.

-

How does tpt ez integrate with other software?

tpt ez offers seamless integration with a variety of popular software tools such as CRM systems and cloud storage solutions. This allows businesses to incorporate eSigning and document management into their existing workflows efficiently. Integrating tpt ez ensures that you have a cohesive tech ecosystem without disruption.

-

Is there a cost associated with using tpt ez?

Yes, there is a cost associated with tpt ez, but it remains affordable compared to traditional paperwork methods. Pricing plans cater to different business sizes, ensuring that every organization can find a suitable plan. By investing in tpt ez, businesses save on printing, shipping, and storage costs.

-

Can tpt ez be used on mobile devices?

Absolutely! tpt ez is designed to be mobile-friendly, allowing users to send and eSign documents on-the-go. This flexibility means that you can manage your documents anytime, anywhere, directly from your mobile device, enhancing convenience for busy professionals.

-

What types of documents can I send using tpt ez?

tpt ez supports a wide variety of document types, including contracts, agreements, invoices, and more. This versatility enables businesses to handle all their signing needs in one platform. With tpt ez, you streamline document processes within a single, accessible solution.

-

How secure is the tpt ez solution?

Security is a top priority for tpt ez. The solution uses advanced encryption protocols to protect your documents and data throughout the signing process. Businesses can trust tpt ez to provide a secure environment that meets compliance standards.

Get more for Arizona Tpt Ez Fillable Form

- Ttb f 500024 excise tax return ttb f 500024 excise tax return ttb form

- Bid bond request form your name contractor obligee

- Ultracool 0020 0040 5060hz binfoservb ag infoserv form

- Formulaire 4001

- Electricity quiz answers form

- 50 team double elimination bracket form

- Ms athletic participation form windows 5starassets blob core windows

- Virtual office agreement template form

Find out other Arizona Tpt Ez Fillable Form

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now