TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb Form

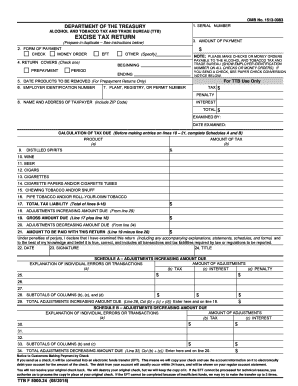

What is the TTB F 500024 Excise Tax Return?

The TTB F 500024 Excise Tax Return is a crucial document for businesses involved in the production or distribution of alcohol, tobacco, or firearms in the United States. This form is used to report and pay excise taxes to the Alcohol and Tobacco Tax and Trade Bureau (TTB). It is essential for compliance with federal regulations and helps ensure that businesses meet their tax obligations accurately and timely.

Steps to Complete the TTB F 500024 Excise Tax Return

Completing the TTB F 500024 Excise Tax Return involves several key steps:

- Gather necessary financial records, including sales, production, and inventory data.

- Accurately calculate the excise tax owed based on the applicable rates for your products.

- Fill out the form with the required information, ensuring all fields are completed correctly.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline to avoid penalties.

Legal Use of the TTB F 500024 Excise Tax Return

The TTB F 500024 Excise Tax Return must be completed and submitted in accordance with federal laws governing excise taxes. This form serves as a legal declaration of tax liability and must be filed accurately to avoid legal repercussions. Compliance with TTB regulations is essential for maintaining good standing with the federal government and avoiding fines.

Filing Deadlines / Important Dates

Filing deadlines for the TTB F 500024 Excise Tax Return vary based on the frequency of your tax reporting. Generally, businesses may be required to file monthly, quarterly, or annually. It is important to stay informed about specific due dates to ensure timely submission and avoid penalties for late filing.

Form Submission Methods

The TTB F 500024 Excise Tax Return can be submitted through various methods:

- Online submission via the TTB's electronic filing system.

- Mailing a paper form to the appropriate TTB office.

- In-person submission at designated TTB locations, if applicable.

Who Issues the Form?

The TTB F 500024 Excise Tax Return is issued by the Alcohol and Tobacco Tax and Trade Bureau (TTB), which is part of the U.S. Department of the Treasury. The TTB is responsible for regulating and collecting excise taxes on alcohol, tobacco, and firearms, ensuring compliance with federal laws.

Quick guide on how to complete ttb f 500024 excise tax return ttb f 500024 excise tax return ttb

Effortlessly Prepare TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb on Any Device

Web-based document management has surged in popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without hindrances. Handle TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb with Ease

- Obtain TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key paragraphs in your documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the information and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ttb f 500024 excise tax return ttb f 500024 excise tax return ttb

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb?

The TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb is a form used by businesses in the alcohol industry to report and pay excise taxes to the Alcohol and Tobacco Tax and Trade Bureau (TTB). It's crucial for compliance and helps ensure that your business meets federal regulations regarding alcohol production and distribution.

-

How can airSlate SignNow assist with submitting the TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb?

airSlate SignNow streamlines the process of preparing and submitting the TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb by allowing you to easily eSign and send documents securely. Our platform reduces administrative burdens and enhances compliance, making tax filing hassle-free.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to fit businesses of all sizes, giving you access to the tools needed to manage your documents and TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb with ease. Pricing is competitive and transparent, ensuring you can choose the plan that best meets your business needs.

-

What features does airSlate SignNow offer for managing the TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb?

With airSlate SignNow, you get features like customizable templates, secure eSigning, real-time document tracking, and automated workflows that simplify the management of the TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb. These features work together to enhance efficiency and ensure accuracy.

-

Can airSlate SignNow integrate with other business tools for filing the TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb?

Yes, airSlate SignNow integrates seamlessly with various business tools, such as accounting software and customer relationship management (CRM) systems. This connectivity helps ensure that all necessary data for the TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb is centralized, making your workflow more efficient.

-

How does airSlate SignNow enhance compliance when filing the TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb?

airSlate SignNow enhances compliance by providing an easy-to-use platform that ensures all documents are signed and completed accurately. This minimizes the risk of errors when submitting the TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb, helping you stay aligned with regulatory requirements.

-

Is airSlate SignNow suitable for businesses of all sizes for managing the TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb?

Absolutely! airSlate SignNow is designed to meet the needs of businesses ranging from startups to large enterprises. Its scalable solutions simplify the process of handling TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb regardless of your organization's size.

Get more for TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb

Find out other TTB F 500024 EXCISE TAX RETURN TTB F 500024 EXCISE TAX RETURN Ttb

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed