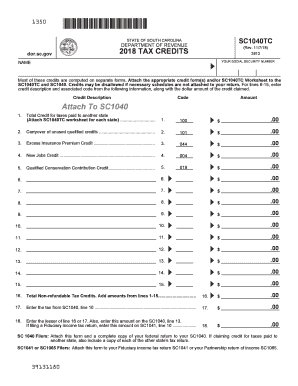

TAX CREDITS Form

What is the tax credits?

Tax credits are financial incentives provided by the federal and state governments to reduce the amount of tax owed by individuals or businesses. Unlike deductions that lower taxable income, tax credits directly reduce the tax liability. They can be non-refundable, meaning they can reduce your tax bill to zero but not below that, or refundable, allowing you to receive a refund if the credit exceeds your tax owed. Understanding the various types of tax credits available is essential for maximizing potential savings.

How to obtain the tax credits

Obtaining tax credits typically involves completing specific forms and meeting eligibility criteria set by the IRS or state tax authorities. For federal tax credits, you may need to fill out forms such as the 1040 or specific schedules that correspond to various credits. State tax credits often require separate applications. It's important to review the requirements for each credit to ensure compliance and maximize your benefits.

Steps to complete the tax credits

Completing the tax credits form involves several key steps:

- Gather necessary documentation, including income statements and previous tax returns.

- Identify which tax credits you qualify for based on your financial situation and filing status.

- Complete the appropriate forms, ensuring all information is accurate and complete.

- Review your completed forms for any errors before submission.

- Submit your forms electronically or via mail by the designated deadline.

Legal use of the tax credits

To legally utilize tax credits, taxpayers must adhere to the regulations established by the IRS and relevant state authorities. This includes accurately reporting income, claiming only eligible credits, and maintaining supporting documentation. Misuse of tax credits can lead to penalties, including fines and interest on unpaid taxes. It's crucial to stay informed about the legal requirements associated with each credit to ensure compliance.

Eligibility criteria

Eligibility for tax credits varies based on the specific credit type. Common factors include income level, filing status, and specific circumstances such as age or disability. For instance, the Earned Income Tax Credit (EITC) has income limits and requires taxpayers to have earned income from employment or self-employment. Reviewing the eligibility criteria for each credit is essential to determine which ones you can claim.

Filing deadlines / Important dates

Filing deadlines for tax credits align with the annual tax return submission dates. Typically, individual tax returns are due on April fifteenth of each year. However, if you need additional time, you can file for an extension, which generally extends the deadline by six months. It's important to be aware of specific deadlines for claiming certain credits, as they can vary. Marking these dates on your calendar can help you avoid missing out on potential savings.

Examples of using the tax credits

Tax credits can significantly impact your financial situation. For example, the Child Tax Credit allows eligible parents to reduce their tax liability by a specified amount per qualifying child. Another example is the American Opportunity Tax Credit, which helps offset the costs of higher education for eligible students. Understanding how these credits apply to your situation can lead to substantial savings on your tax bill.

Quick guide on how to complete tax credits

Complete TAX CREDITS seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without holdups. Manage TAX CREDITS on any device using airSlate SignNow's Android or iOS applications and simplify any document-based procedure today.

How to modify and electronically sign TAX CREDITS effortlessly

- Find TAX CREDITS and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure confidential details using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors requiring the printing of new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign TAX CREDITS while ensuring effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax credits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are TAX CREDITS and how can they benefit my business?

TAX CREDITS are incentives provided by the government to reduce your tax liability, and they can signNowly benefit your business by lowering the amount you owe in taxes. By leveraging these credits, businesses can reinvest savings into growth opportunities, which helps improve cash flow and overall profitability.

-

How can airSlate SignNow help with managing TAX CREDITS documentation?

airSlate SignNow streamlines the process of managing TAX CREDITS documentation by allowing you to easily prepare, send, and eSign essential tax forms. Our solution ensures that all your documents are securely stored and accessible, making it simpler to track your claimed credits and stay compliant with tax regulations.

-

What features does airSlate SignNow offer to support the claim of TAX CREDITS?

Our platform offers features like customizable templates, automated workflows, and real-time tracking that can enhance your process of claiming TAX CREDITS. With these tools, you can ensure that all necessary documents are completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for TAX CREDITS management?

Yes, there are subscription plans tailored to fit various budgets, allowing you to choose what best meets your needs for managing TAX CREDITS. Given the potential tax savings and efficiency gains, many users find that the cost is minimal compared to the benefits.

-

Can airSlate SignNow integrate with other accounting tools to help with TAX CREDITS?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software to streamline your TAX CREDITS management process. This integration ensures that your tax documents are aligned with your financial records, making it easier to track eligible credits.

-

What benefits can I expect from using airSlate SignNow for claiming TAX CREDITS?

Using airSlate SignNow for claiming TAX CREDITS provides numerous benefits, including increased efficiency, enhanced document security, and simplified tracking of submissions. This can help you save time and reduce the likelihood of errors when claiming your credits.

-

How does airSlate SignNow ensure the security of my TAX CREDITS documents?

Security is a priority for airSlate SignNow, and we employ advanced encryption protocols and compliance certifications to protect your TAX CREDITS documents. All documents are stored securely to prevent unauthorized access, ensuring peace of mind as you manage sensitive information.

Get more for TAX CREDITS

- Pearl izumi warranty form

- Certificate of final electrical inspection form

- Application form for monthly car allowance in lieu of duty car mauritius

- Address change form michigan state disbursement unit michigan department of health and human services this form is to be used

- Loan service request emirates nbd form

- Isr buds sheet form

- Mis 5185 on off campus school activity form

- Sarasota county florida department of highway safety and motor form

Find out other TAX CREDITS

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online