Schwab Transfer on Death Form

What is the Schwab Transfer On Death Form

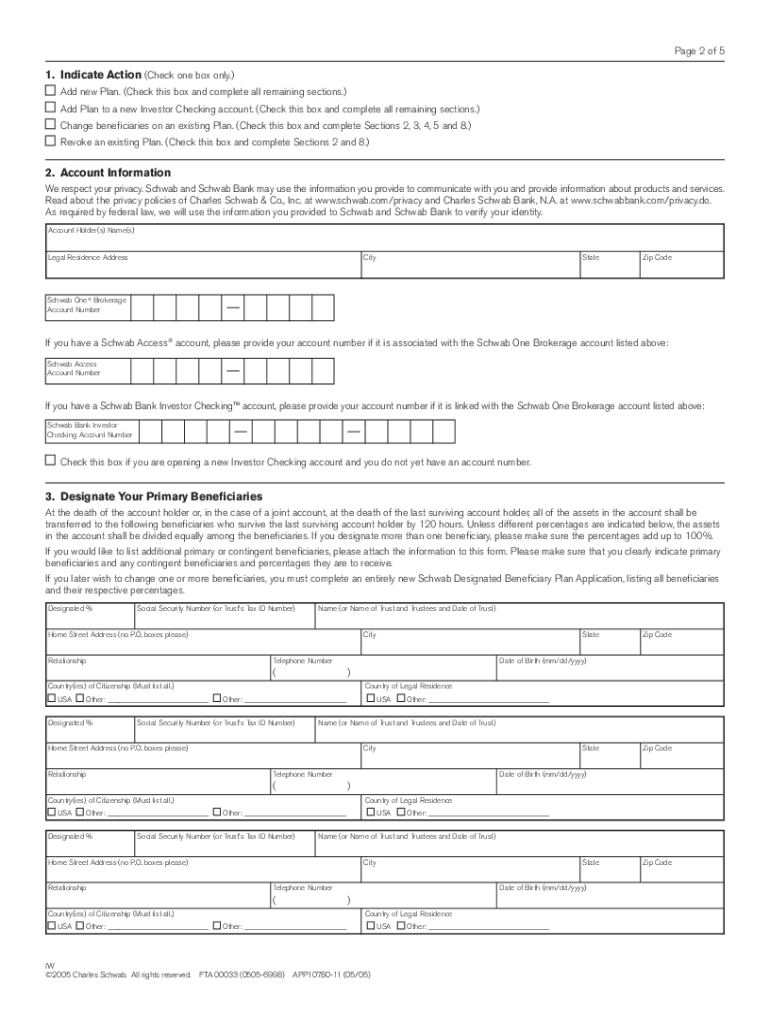

The Schwab Transfer On Death (TOD) form is a legal document that allows account holders to designate beneficiaries for their assets upon their death. This form ensures that the specified assets are transferred directly to the beneficiaries without going through probate, simplifying the process for heirs. It is particularly useful for individuals who wish to manage their estate planning efficiently and ensure that their loved ones receive their intended inheritance seamlessly.

How to use the Schwab Transfer On Death Form

Using the Schwab Transfer On Death form involves several straightforward steps. First, account holders must fill out the form with the necessary information, including the names and contact details of the beneficiaries. It is essential to clearly specify the percentage of assets each beneficiary will receive. Once completed, the form must be signed and dated by the account holder. After signing, it should be submitted to Charles Schwab for processing. This ensures that the beneficiaries are recognized and can claim their assets without delay.

Steps to complete the Schwab Transfer On Death Form

Completing the Schwab Transfer On Death form requires careful attention to detail. Here are the steps to follow:

- Obtain the Schwab Transfer On Death form from Charles Schwab's website or customer service.

- Fill in your personal information, including your account number and contact details.

- List the beneficiaries by providing their full names and relationship to you.

- Specify the percentage of the account each beneficiary will receive.

- Sign and date the form to validate it.

- Submit the completed form to Charles Schwab via the designated method.

Key elements of the Schwab Transfer On Death Form

Several key elements must be included in the Schwab Transfer On Death form to ensure its validity. These include:

- Account Holder Information: Full name, address, and account number.

- Beneficiary Details: Names, contact information, and relationships of all designated beneficiaries.

- Asset Distribution: Clear indication of how the assets will be divided among the beneficiaries.

- Signature: The account holder's signature and date to confirm the form's legitimacy.

Legal use of the Schwab Transfer On Death Form

The Schwab Transfer On Death form is legally binding when completed correctly. It complies with state laws regarding beneficiary designations and asset transfers. By using this form, account holders can ensure that their assets are transferred according to their wishes, avoiding potential disputes among heirs. It is advisable to consult with a legal professional to confirm that the form meets all necessary legal requirements in your state.

Form Submission Methods (Online / Mail / In-Person)

There are various methods to submit the Schwab Transfer On Death form. Account holders can choose to submit the form online through their Schwab account, ensuring a quick and efficient process. Alternatively, the completed form can be mailed to the designated Schwab address or delivered in person at a local Schwab branch. Each method has its advantages, so selecting the one that best fits your needs is essential.

Quick guide on how to complete schwab transfer on death form

Prepare Schwab Transfer On Death Form easily on any device

Online document management has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, alter, and eSign your files promptly without delays. Manage Schwab Transfer On Death Form on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Schwab Transfer On Death Form effortlessly

- Locate Schwab Transfer On Death Form and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from any device of your choosing. Revise and eSign Schwab Transfer On Death Form and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schwab transfer on death form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Charles Schwab transfer on death form?

The Charles Schwab transfer on death form is a document that allows you to designate beneficiaries for your assets. Upon your passing, these assets bypass probate and are transferred directly to the named beneficiaries. This simplifies the process for heirs and ensures your intentions are honored.

-

How do I complete the Charles Schwab transfer on death form?

To complete the Charles Schwab transfer on death form, you first need to obtain the form from the Charles Schwab website or your local branch. Fill out your details, list your beneficiaries, and sign the form. Ensure you follow the specific instructions provided by Schwab to avoid any complications.

-

Is there a fee for setting up a Charles Schwab transfer on death form?

Setting up a Charles Schwab transfer on death form is typically free of charge. However, you should confirm with Charles Schwab for any potential fees associated with managing or updating this form in the future. It's always best to verify any latest policies directly with Schwab.

-

Can I make changes to my Charles Schwab transfer on death form?

Yes, you can make changes to your Charles Schwab transfer on death form at any time. Simply fill out a new form with the updated information and submit it to Charles Schwab. Make sure that the previous form is revoked to avoid confusion.

-

What are the benefits of using a Charles Schwab transfer on death form?

The primary benefit of using a Charles Schwab transfer on death form is that it allows for the efficient and swift transfer of assets to beneficiaries without the need for probate. This can save time and money for your loved ones. Moreover, it gives you the peace of mind that your assets will be distributed according to your wishes.

-

Does the Charles Schwab transfer on death form cover all types of accounts?

The Charles Schwab transfer on death form generally applies to various account types, including brokerage accounts and retirement accounts. However, it’s essential to check directly with Charles Schwab for any specific account limitations or requirements regarding their transfer on death form.

-

Are there any restrictions on who I can name as beneficiaries on the Charles Schwab transfer on death form?

You can typically name any individual or entity as a beneficiary on your Charles Schwab transfer on death form, as long as they meet Schwab's guidelines. This could include family members, friends, or charitable organizations. Always ensure that the beneficiaries are willing to accept the inheritance.

Get more for Schwab Transfer On Death Form

- Certified corrections program owner tenant city of chicago cityofchicago form

- Jackson pollock nomogram form

- Atlanta commercial board forms

- Pop up shop application form ealing news extra

- Field trip garland isd form

- Apply for unabridged birth certificate at standard bank form

- Self certification affidavit delaware division of motor vehicles dmv de form

- Information changecorrections form 15 student name thesummitschool

Find out other Schwab Transfer On Death Form

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe