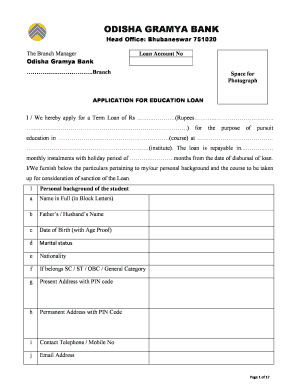

Odisha Gramya Bank Kyc Form

What is the Odisha Gramya Bank KYC Form

The Odisha Gramya Bank KYC form is a crucial document used by the bank to verify the identity of its customers. KYC stands for Know Your Customer, a process mandated by regulatory authorities to prevent fraud and ensure compliance with financial regulations. This form collects essential personal information, including the customer's name, date of birth, and identification details, to authenticate their identity and address. By completing this form, customers help the bank maintain secure and legitimate banking practices.

Steps to Complete the Odisha Gramya Bank KYC Form

Completing the Odisha Gramya Bank KYC form involves several straightforward steps:

- Download or collect the KYC form from the nearest Odisha Gramya Bank branch.

- Fill in your personal details, including your name, date of birth, and PAN number.

- Provide your address information and attach a recent passport-sized photograph.

- Include proof of identity and address, selecting from the list of acceptable documents provided in the form.

- Submit the completed form to a bank officer for verification.

Required Documents for the Odisha Gramya Bank KYC Form

To successfully complete the KYC process, customers must provide specific documents. The following are typically required:

- Passport-sized photograph

- PAN Card

- Aadhar Card or Voter ID for address proof

- Additional documents may be necessary for business accounts or unique cases.

Legal Use of the Odisha Gramya Bank KYC Form

The Odisha Gramya Bank KYC form serves a legal purpose by ensuring that the bank complies with anti-money laundering regulations and other financial laws. By verifying the identity of customers, the bank can mitigate risks associated with fraudulent activities and protect both the institution and its clients. This legal framework is essential for maintaining trust in the banking system.

Form Submission Methods

The Odisha Gramya Bank KYC form can be submitted through various methods to accommodate customer preferences:

- In-person submission at any Odisha Gramya Bank branch.

- Online submission through the bank's official digital platform, if available.

- Mail submission, though this method may require additional verification steps.

Penalties for Non-Compliance

Failing to submit a complete and accurate KYC form can result in significant consequences. Customers may face restrictions on their banking activities, including the inability to activate their accounts or process transactions. In severe cases, non-compliance can expose accounts to higher risks of fraud and financial loss, emphasizing the importance of timely and accurate form submission.

Quick guide on how to complete odisha gramya bank kyc form

Complete Odisha Gramya Bank Kyc Form effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents quickly without delays. Handle Odisha Gramya Bank Kyc Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Odisha Gramya Bank Kyc Form without hassle

- Find Odisha Gramya Bank Kyc Form and click Get Form to begin.

- Use the tools available to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to missing or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Odisha Gramya Bank Kyc Form and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the odisha gramya bank kyc form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Odisha Gramya Bank KYC form?

The Odisha Gramya Bank KYC form is a document required to verify the identity of customers opening accounts with the bank. This form ensures compliance with regulatory standards and helps prevent fraud. Completing the Odisha Gramya Bank KYC form is essential for maintaining a secure banking environment.

-

How can I obtain the Odisha Gramya Bank KYC form?

You can easily obtain the Odisha Gramya Bank KYC form from the bank's official website or by visiting any branch. The form is usually available for download in a PDF format, making it convenient for customers. Ensure you fill it out accurately to avoid any delays in your account setup.

-

What documents are required to fill out the Odisha Gramya Bank KYC form?

To complete the Odisha Gramya Bank KYC form, you'll need to provide proof of identity and address. Accepted documents include an Aadhar card, passport, utility bills, or a voter ID. Having these documents ready will simplify the process and help expedite your application.

-

Is there a fee associated with submitting the Odisha Gramya Bank KYC form?

No, there are typically no fees for submitting the Odisha Gramya Bank KYC form. The KYC process is a regulatory requirement aimed at protecting both the bank and the customers. It's important to check with the bank for any specific policies regarding fees, although they are generally waived.

-

How long does it take to process the Odisha Gramya Bank KYC form?

The processing time for the Odisha Gramya Bank KYC form can vary but generally takes a few business days. Once the form is submitted, the bank verifies the provided information to ensure compliance. You will be notified once your KYC verification is complete.

-

Can I submit the Odisha Gramya Bank KYC form online?

Yes, many banks, including Odisha Gramya Bank, offer online submission of the KYC form for customer convenience. Check their official website for details on the e-submission process. This option is particularly beneficial as it saves time and reduces the need for physical visits.

-

What should I do if my Odisha Gramya Bank KYC form is rejected?

If your Odisha Gramya Bank KYC form is rejected, it is important to review the feedback provided by the bank. Common reasons may include incomplete information or invalid documents. You can correct the issues and resubmit the form, so ensure all required documents are accurate and up to date.

Get more for Odisha Gramya Bank Kyc Form

- Volunteer worker application agreement boys and girls clubs form

- Review and approval form rev g

- Berechnung des umbauten raumes nach din 277 monheim am monheim form

- 4405 i form

- 35 1 ontario court services form

- Nurse form 2 certification of foreign nursing education

- Zusatzblatt familienangehrige form

- Totalisatorbetreiber anschrift telefon e mail adresse form

Find out other Odisha Gramya Bank Kyc Form

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast