Global Tax Guide to Doing Business in the United Kingdom 2023-2026

Understanding the Revenue Registration Process

The revenue registration process is essential for businesses operating in the United States. This process involves submitting necessary documentation to ensure compliance with tax regulations. Proper registration allows businesses to operate legally and avoid penalties. Understanding the requirements and steps involved is crucial for smooth operations.

Required Documents for Revenue Registration

To complete the revenue registration, certain documents must be prepared and submitted. Commonly required documents include:

- Employer Identification Number (EIN)

- Business formation documents (e.g., Articles of Incorporation)

- Operating agreements or bylaws

- Identification documentation for business owners

Having these documents ready will streamline the registration process and ensure compliance with federal and state regulations.

Steps to Complete the Revenue Registration

Completing the revenue registration involves several key steps. Follow these to ensure a successful submission:

- Gather all required documents.

- Complete the revenue registration form accurately.

- Review the form for any errors or omissions.

- Submit the form electronically or by mail, depending on state requirements.

Each step is crucial for ensuring that your registration is processed without delays.

Penalties for Non-Compliance

Failure to comply with revenue registration requirements can lead to significant penalties. Common consequences include:

- Fines imposed by state or federal authorities.

- Inability to legally operate your business.

- Potential legal action against the business owners.

Understanding these penalties emphasizes the importance of timely and accurate registration.

Digital vs. Paper Version of the Revenue Registration

Businesses can choose between submitting the revenue registration form digitally or using a paper version. Digital submissions are often faster and may provide immediate confirmation of receipt. In contrast, paper submissions can take longer to process and may require additional follow-up. Evaluating the benefits of each method can help businesses decide the best approach for their needs.

Eligibility Criteria for Revenue Registration

Eligibility for revenue registration typically depends on the business structure and compliance with state regulations. Common criteria include:

- Legal formation of the business (e.g., LLC, Corporation, Partnership).

- Compliance with local business licensing requirements.

- Provision of accurate identification information for all owners.

Ensuring that all eligibility criteria are met will facilitate a smoother registration process.

Quick guide on how to complete global tax guide to doing business in the united kingdom

Complete Global Tax Guide To Doing Business In The United Kingdom seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents rapidly without delays. Handle Global Tax Guide To Doing Business In The United Kingdom on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Global Tax Guide To Doing Business In The United Kingdom effortlessly

- Obtain Global Tax Guide To Doing Business In The United Kingdom and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose your preferred method to deliver your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Global Tax Guide To Doing Business In The United Kingdom and guarantee excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the global tax guide to doing business in the united kingdom

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

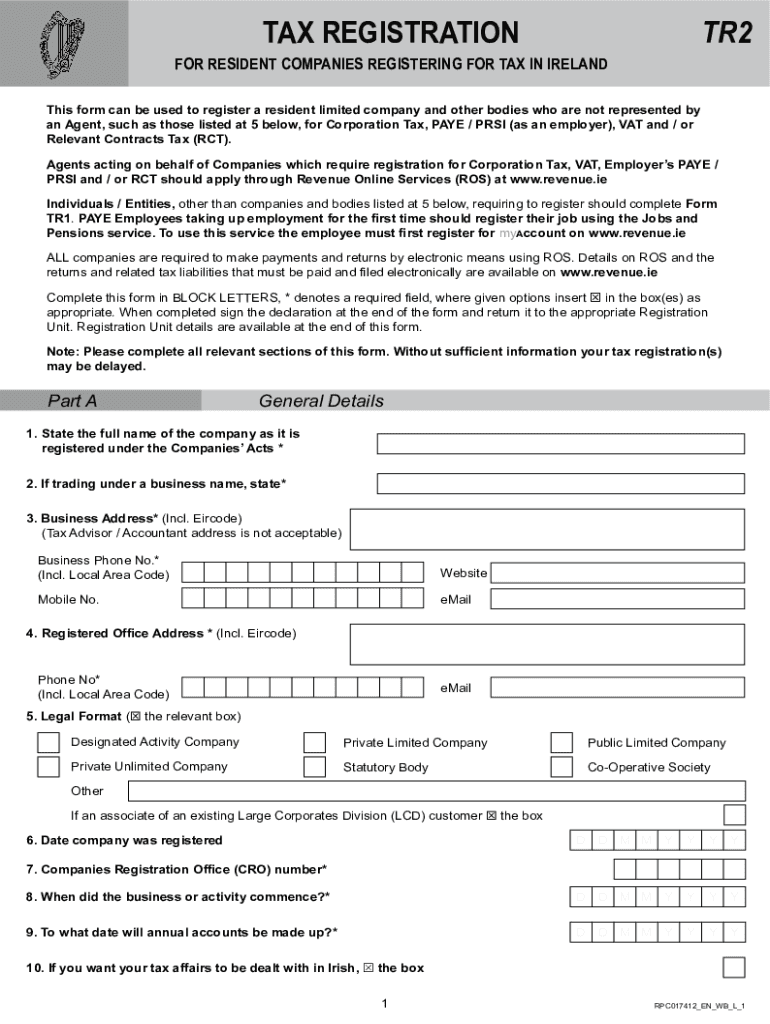

What is a TR2 form and how is it used?

The TR2 form is a specific type of document that can be electronically signed using airSlate SignNow. It is commonly utilized for various administrative procedures, ensuring that both parties have a legally binding agreement. With airSlate SignNow, the process of completing and managing your TR2 form becomes more streamlined and efficient.

-

How does airSlate SignNow simplify the process of filling out a TR2 form?

airSlate SignNow simplifies the filling out of a TR2 form by offering an intuitive interface that allows users to fill in required fields digitally. Document templates for TR2 forms are readily available, saving time and reducing errors. This ease of use makes airSlate SignNow a preferred choice for both businesses and individuals.

-

What are the pricing options for using airSlate SignNow for TR2 forms?

airSlate SignNow offers competitive pricing tiers that cater to different business needs, including options specifically for users who frequently manage TR2 forms. Plans may include features like unlimited signing, document storage, and integrations, ensuring you get a cost-effective solution. Visit our pricing page to find the best plan for your TR2 form management.

-

Can I integrate airSlate SignNow with other applications when working with a TR2 form?

Yes, airSlate SignNow supports a variety of integrations with popular applications that can enhance your workflow while managing a TR2 form. This includes tools like Google Drive, Dropbox, and various CRM systems. These integrations facilitate seamless data transfer, making it easier to organize and access your TR2 forms.

-

What features should I look for when using airSlate SignNow for TR2 forms?

When using airSlate SignNow for TR2 forms, look for features such as robust eSigning capabilities, secure document storage, and customizable templates. Additionally, tracking and audit trails are crucial for maintaining compliance and verifying signatures on your TR2 form. These features ensure a comprehensive solution for all your signing needs.

-

Are TR2 forms legally binding when signed with airSlate SignNow?

Yes, TR2 forms signed through airSlate SignNow are legally binding due to compliance with electronic signature laws, such as the ESIGN Act and UETA. This means that your electronically signed TR2 form carries the same weight as a traditional paper contract. You can confidently use airSlate SignNow for all your necessary document signing.

-

How can airSlate SignNow enhance my business's efficiency in handling TR2 forms?

By using airSlate SignNow for TR2 forms, businesses can signNowly enhance efficiency through automation and streamlined workflows. The platform enables quick turnaround times for document signing, reducing administrative burden. This allows your team to focus on core tasks while ensuring that your TR2 forms are processed swiftly and securely.

Get more for Global Tax Guide To Doing Business In The United Kingdom

Find out other Global Tax Guide To Doing Business In The United Kingdom

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself