Mississippi LLC Certificate of Formation Step by Step LLC University 1999-2026

What is the Mississippi LLC Certificate of Formation?

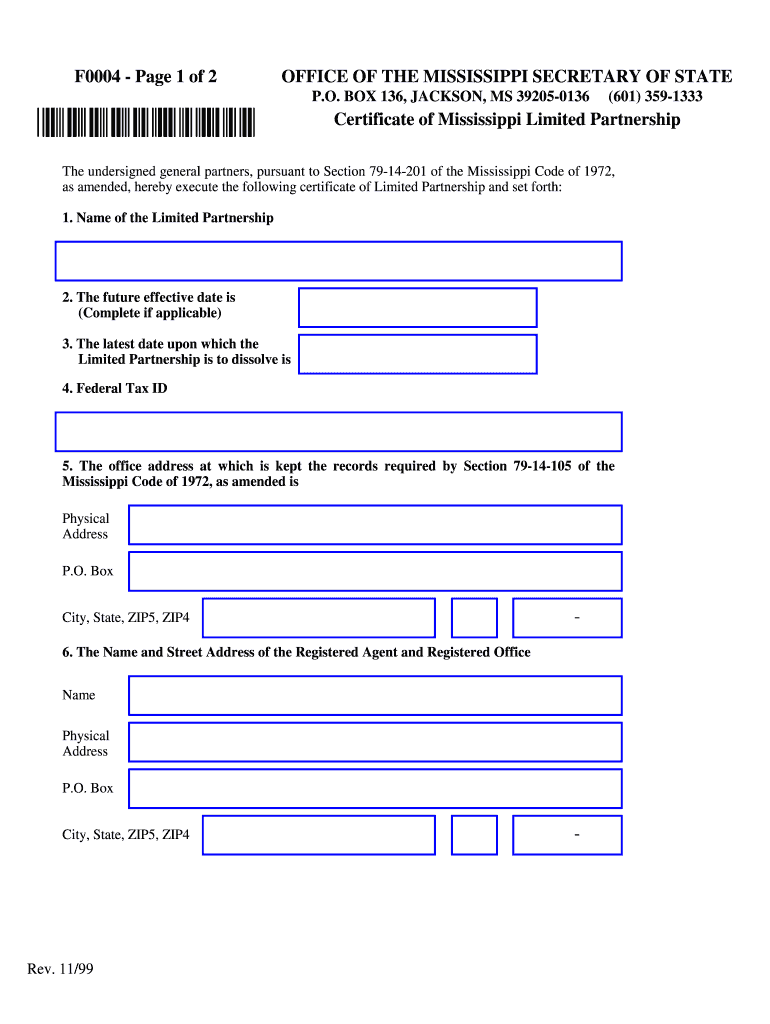

The Mississippi LLC Certificate of Formation is a legal document required to establish a limited liability company (LLC) in the state of Mississippi. This document outlines essential information about the LLC, including its name, duration, registered agent, and the purpose of the business. Filing this certificate with the Mississippi Secretary of State is a crucial step in forming an LLC, as it officially registers the business entity and provides it with legal recognition.

Key Elements of the Mississippi LLC Certificate of Formation

When preparing the Mississippi LLC Certificate of Formation, several key elements must be included to ensure compliance with state regulations. These elements typically consist of:

- Name of the LLC: The name must be unique and include "Limited Liability Company" or an abbreviation such as "LLC."

- Registered Agent: The document must specify a registered agent who will receive legal documents on behalf of the LLC.

- Duration: The duration of the LLC, which can be perpetual or for a specified period.

- Principal Office Address: The primary location where the business will operate.

- Purpose: A brief description of the business activities the LLC will engage in.

Steps to Complete the Mississippi LLC Certificate of Formation

Completing the Mississippi LLC Certificate of Formation involves several straightforward steps:

- Choose a Name: Select a unique name that complies with Mississippi naming requirements.

- Designate a Registered Agent: Identify an individual or business entity authorized to act as the registered agent.

- Fill Out the Certificate: Provide all necessary information in the certificate form, ensuring accuracy.

- File the Certificate: Submit the completed certificate to the Mississippi Secretary of State, either online or by mail.

- Pay the Filing Fee: Include the required filing fee, which is necessary for processing the certificate.

How to Obtain the Mississippi LLC Certificate of Formation

To obtain the Mississippi LLC Certificate of Formation, individuals must access the form through the Mississippi Secretary of State's website or office. The form can be filled out online for convenience or printed and completed manually. Once completed, the form must be submitted along with the applicable filing fee. It is advisable to check for any updates or changes to the form or filing process before submission.

Legal Use of the Mississippi LLC Certificate of Formation

The Mississippi LLC Certificate of Formation serves as the foundational document for establishing an LLC in the state. It is legally binding and must be filed to gain the benefits of limited liability protection. This document is essential for opening business bank accounts, entering contracts, and ensuring compliance with state regulations. Properly maintaining the certificate and any amendments is crucial for the ongoing legal status of the LLC.

Form Submission Methods

The Mississippi LLC Certificate of Formation can be submitted through various methods:

- Online: Filing electronically through the Mississippi Secretary of State's website is often the quickest option.

- By Mail: The completed form can be printed and mailed to the Secretary of State’s office.

- In-Person: Individuals may also choose to deliver the form directly to the Secretary of State’s office.

Quick guide on how to complete mississippi llc certificate of formation step by step llc university

Manage Mississippi LLC Certificate Of Formation step by step LLC University anytime, anywhere

Your daily corporate tasks may need additional focus when handling state-specific business documents. Reclaim your work hours and reduce the expenses related to document-driven processes with airSlate SignNow. airSlate SignNow offers a variety of pre-made business documents, including Mississippi LLC Certificate Of Formation step by step LLC University, which you can utilize and distribute with your business associates. Manage your Mississippi LLC Certificate Of Formation step by step LLC University smoothly with robust editing and eSignature features and send it directly to your recipients.

How to obtain Mississippi LLC Certificate Of Formation step by step LLC University in a few clicks:

- Select a form pertinent to your state.

- Click on Learn More to view the document and ensure its accuracy.

- Choose Get Form to commence working with it.

- Mississippi LLC Certificate Of Formation step by step LLC University will instantly open within the editor. No further actions are required.

- Utilize airSlate SignNow’s advanced editing tools to complete or modify the form.

- Pick the Sign option to create your signature and electronically sign your document.

- When finished, simply click Done, save changes, and access your document.

- Dispatch the form via email or text, or use a link-to-fill feature with partners or allow them to download the documents.

airSlate SignNow signNowly reduces your time handling Mississippi LLC Certificate Of Formation step by step LLC University and makes it easy to find necessary documents in one place. A comprehensive library of forms is organized and created to address essential business processes needed for your organization. The enhanced editor minimizes the possibility of errors, enabling you to easily correct mistakes and review your documents on any device before sending them out. Start your free trial today to discover all the advantages of airSlate SignNow for your daily business operations.

Create this form in 5 minutes or less

FAQs

-

How do I fill out a convocation form step by step for Shivaji University?

Online application form will be available on university website in exam section/ convocation.http://www.unishivaji.ac.in/exam...For more detail watch following videoThen fill up these form online and then take a print out of sameAttach photo copy of the final mark sheet with fee receipt.Submit the same form at Convocation Section at university office or send it by post.

-

How is a single-member LLC owned by a nonresident alien taxed? Should I fill out a W-8 or am I deemed not to have U.S. activities?

Based on the facts as you have presented them:You are selling a product, as I see it, and not a service - although there's something of a gray area here, this is more like an intangible asset than it is providing a personal service for compensation. That product is being offered to US-based customers who are using it in the US - your focus is building up your market in the US, and you are doing that under the auspices of an LLC which is US-based. Looking at all of the facts and circumstances surrounding the conduct of your business, as you have presented them and as the IRS will look at them if asked, I conclude that you are conducting a business in the US and your income from US sources is effectively connected with the conduct of that business in the US, which means that you are subject to US taxes on that income.With that conclusion, Form W-8ECI is the proper form to provide to your US sources if you wish to prevent withholding on the income from your business.I want to add one point, since this seems to be coming up frequently - while an LLC is a disregarded entity for tax purposes, it is still a legal entity in the US - and the fact that you, as a nonresident alien, choose to operate a business under the auspices of a US-based LLC is a piece of evidence that can, under the appropriate set of facts and circumstances, be used by the IRS to support an argument that you are conducting business in the US and that your income from that business that comes from US sources should be taxable in the U.S. You should not assume that as a nonresident alien you have carte blanche to create a US LLC, operate a business under its auspices, and then at tax time argue that the income should not be taxable in the US because the LLC is a disregarded entity. The IRS will look at all of the facts and circumstances surrounding your business, including your choice of a US-based entity as the face of your business, and while that decision alone won't be dispositive, it will certainly be considered.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

What are the steps (in depth) to create and open a self-storage facility by obtaining an LLC towards the construction of the buildings, assuming you already have the land?

First, do not make assumptions that because you own land that it is the “right” place for a storage facility. The choice of site is based upon the demographics and need, not ownership. The first thing I would do is to consult an expert and do an evaluation on the demographics and need as you really do not want to flood the market with storage units that are not needed. If you are independently wealthy and will finance your facility for cash, then you are in the position to flood a market and receive little or no return on your facility. If not, you will need a business plan.If you are qualified to prepare an indepth business plan to present to a bank or finance company, then by all means prepare one. You will need to have viable estimates of the cost of your facility including all of the soft costs, development costs, and construction costs. Then you will prepare a financial forecast as to the return on your facility. This is mandatory for financing or for your personal use, to insure that you are making a good investment and will cash flow for the banks. All of this data is available from resource manuals which are fairly detailed. Alternatively, you could higher a financial specialist on self-storage to develop your plan with documentation.As to getting the LLC, that is about a 15 minute exercise on a computer in Florida or 20 minutes with a competent attorney.Somewhere along the line, probably as you are developing the business plan and estimating the costs, you will need to design your site. This can be done by a competent engineer or you, if you are qualified. In any event, you will probably use a competent engineer for your development order and site plan, so I recommend having the engineer develop and design your site plan. He or she will also be able to advise you on site development requirements and you can get the quotes to do them.Then there is the item of unit mix. This is a complex issue which again can be done by yourself, or with the help of an expert. Many of the self storage building manufacturers and suppliers can be of assistance here. Research in to the unit sizes of successful complexes will be helpful here.After you have your site plan and unit mix per building, your engineer or you, if you know the system or are prepared to learn, can apply for your development order. Zoning, density, land use, design features, traffic counts, drainage and environmental impact as well as buffering are among the items that will be considered.Once you have your DO, you can get hard quotes on your site work and buildings. At this point, I assume you have your financing in place. The rest is simple. Obtain quotes from General Contractors. Provide them your preferred sourcing for buildings, if you are buying package buildings, give them a copy of the DO and the site lay out surveys, etc. When you have the quotes, select your General Contractor and proceed with development. The contract should have periodic payments that the bank or you will disburse funds.Your selected engineering firm will confirm that the site is constructed to the specifications and obtain governmental approvals. When the buildings are erected, the governmental inspections will be performed during the process. When you have your statement of Compliance from the Government for the DO and the Final approved documents for your buildings, you are ready to open for business.As you see, many things are concurrent. You need to employ experts, engineers, and licensed contractors to complete the job. It is nice to own the land, but ascertaining if it is a good site for self storage due to geophysical anomalies or market conditions is first. Business plan is second. Financing is third. Fourth is the DO. Fifth is bidding and construction. Sixth is opening.Good luck…

Create this form in 5 minutes!

How to create an eSignature for the mississippi llc certificate of formation step by step llc university

How to generate an electronic signature for your Mississippi Llc Certificate Of Formation Step By Step Llc University online

How to create an eSignature for your Mississippi Llc Certificate Of Formation Step By Step Llc University in Chrome

How to create an eSignature for putting it on the Mississippi Llc Certificate Of Formation Step By Step Llc University in Gmail

How to create an eSignature for the Mississippi Llc Certificate Of Formation Step By Step Llc University from your mobile device

How to make an electronic signature for the Mississippi Llc Certificate Of Formation Step By Step Llc University on iOS

How to generate an electronic signature for the Mississippi Llc Certificate Of Formation Step By Step Llc University on Android devices

People also ask

-

What is a certificate of formation in Mississippi?

A certificate of formation in Mississippi is a vital document required for creating a legal business entity. It outlines key details such as the business name, address, and purpose. Filing this document is the first step in registering your business in the state, ensuring compliance with Mississippi laws.

-

How can airSlate SignNow help with obtaining a certificate of formation in Mississippi?

airSlate SignNow streamlines the process of preparing and filing your certificate of formation in Mississippi. Our user-friendly platform allows you to electronically sign and send required documents swiftly. This not only saves time but also ensures accuracy in your submissions.

-

What are the costs associated with filing a certificate of formation in Mississippi?

The costs for filing a certificate of formation in Mississippi typically include state filing fees, which can vary based on the business structure. Using airSlate SignNow can help reduce administrative costs associated with document preparation and management, providing a cost-effective solution for businesses.

-

Are there specific requirements for a certificate of formation in Mississippi?

Yes, in Mississippi, a certificate of formation must meet specific requirements set by the Secretary of State. Key details include the entity name, registered agent information, and business duration. airSlate SignNow simplifies compliance by providing resources to ensure your certificate of formation is properly formatted.

-

Can I make changes to my certificate of formation after filing?

Yes, changes can be made to your certificate of formation in Mississippi after it has been filed. Typically, you'll need to submit an amendment form to the Mississippi Secretary of State. Utilizing airSlate SignNow can help manage these changes efficiently with our easy-to-use document tools.

-

What features does airSlate SignNow offer for managing business documents?

airSlate SignNow provides an array of features designed for managing business documents, including eSignature, document templates, and secure cloud storage. These features facilitate the effective handling of your certificate of formation in Mississippi, making it easier to track changes and maintain compliance.

-

How does airSlate SignNow integrate with other business tools?

airSlate SignNow seamlessly integrates with various business tools such as CRM systems, cloud storage solutions, and project management applications. This integration enhances your workflow when dealing with documents like the certificate of formation in Mississippi, ensuring that all processes are streamlined and efficient.

Get more for Mississippi LLC Certificate Of Formation step by step LLC University

- Civil cover sheet wyoming form

- Pre operative anesthesia health form delaware surgery center

- Student registration anne arundel county public schools aacps form

- Doh 4332 form

- Sart advocate intake form doc designlayout jrsainfo

- Hud form 56001

- Product wholesale agreement template form

- Drone business contract template form

Find out other Mississippi LLC Certificate Of Formation step by step LLC University

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now