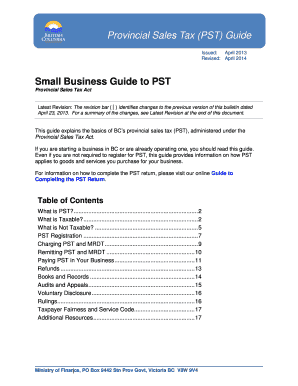

Small Business Guide to Provincial Sales Tax PST Rev Gov Bc Form

Understanding the Small Business Guide to Provincial Sales Tax PST Rev Gov BC

The Small Business Guide to Provincial Sales Tax PST Rev Gov BC serves as a comprehensive resource for businesses navigating the complexities of provincial sales tax regulations in British Columbia. This guide outlines the responsibilities of small businesses regarding PST, including registration, collection, and remittance of taxes. It is essential for ensuring compliance with provincial tax laws and avoiding potential penalties.

Businesses must familiarize themselves with the specific PST rates applicable to their products and services, as well as the exemptions that may apply. Understanding these elements can help businesses manage their tax obligations effectively and ensure they are operating within the legal framework.

Steps to Complete the Small Business Guide to Provincial Sales Tax PST Rev Gov BC

Completing the Small Business Guide to Provincial Sales Tax PST Rev Gov BC involves several key steps:

- Review the Guide: Start by thoroughly reading the guide to understand the requirements and processes involved in PST compliance.

- Gather Necessary Information: Collect all relevant business information, including your business number, sales data, and details of taxable and exempt items.

- Complete the Required Forms: Fill out the necessary forms as outlined in the guide, ensuring all information is accurate and complete.

- Submit the Forms: Follow the submission guidelines provided in the guide to ensure your forms are sent to the appropriate provincial authority.

- Maintain Records: Keep copies of all submitted documents and any correspondence with the provincial tax authority for your records.

Legal Use of the Small Business Guide to Provincial Sales Tax PST Rev Gov BC

The legal use of the Small Business Guide to Provincial Sales Tax PST Rev Gov BC is crucial for ensuring that businesses comply with provincial tax laws. This guide is designed to help businesses understand their obligations and rights under the law. Utilizing this guide effectively can help prevent legal issues related to tax compliance.

Businesses should ensure that they are using the most current version of the guide and that they understand the legal implications of the information provided. This includes recognizing the importance of accurate reporting and timely remittance of taxes collected.

Key Elements of the Small Business Guide to Provincial Sales Tax PST Rev Gov BC

Several key elements are essential for effectively utilizing the Small Business Guide to Provincial Sales Tax PST Rev Gov BC:

- Registration Requirements: Information on how to register for PST, including necessary documentation.

- Tax Rates: Detailed descriptions of applicable PST rates for various goods and services.

- Exemptions: Guidelines on what items or services may be exempt from PST.

- Filing Procedures: Instructions for filing PST returns and making payments.

- Compliance Tips: Best practices for maintaining compliance with PST regulations.

How to Obtain the Small Business Guide to Provincial Sales Tax PST Rev Gov BC

Obtaining the Small Business Guide to Provincial Sales Tax PST Rev Gov BC is straightforward. Businesses can typically access the guide through the official provincial government website or by contacting the provincial tax authority directly. It may also be available in print form at designated government offices.

Ensure that you are accessing the most recent version of the guide, as tax laws and regulations can change. Regularly checking for updates can help businesses stay compliant and informed.

Examples of Using the Small Business Guide to Provincial Sales Tax PST Rev Gov BC

Practical examples of using the Small Business Guide to Provincial Sales Tax PST Rev Gov BC can illustrate its application in real-world scenarios:

- Retail Business: A small retail store uses the guide to determine the correct PST rate for clothing and accessories, ensuring accurate tax collection at the point of sale.

- Service Provider: A consulting firm refers to the guide to understand which of its services are subject to PST, allowing it to comply with tax obligations.

- Online Sales: An e-commerce business utilizes the guide to navigate PST on online transactions, ensuring compliance with provincial regulations.

Quick guide on how to complete small business guide to provincial sales tax pst rev gov bc

Complete Small Business Guide To Provincial Sales Tax PST Rev Gov Bc effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It presents an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides all the features required to create, edit, and eSign your documents promptly without delays. Manage Small Business Guide To Provincial Sales Tax PST Rev Gov Bc on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Small Business Guide To Provincial Sales Tax PST Rev Gov Bc effortlessly

- Find Small Business Guide To Provincial Sales Tax PST Rev Gov Bc and then click Get Form to begin.

- Utilize the features we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, through email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Small Business Guide To Provincial Sales Tax PST Rev Gov Bc and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the small business guide to provincial sales tax pst rev gov bc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Small Business Guide To Provincial Sales Tax PST Rev Gov BC?

The Small Business Guide To Provincial Sales Tax PST Rev Gov BC provides comprehensive information for small businesses to understand and comply with tax regulations in British Columbia. It covers the essential aspects of PST, including rates, exemptions, and filing requirements, helping businesses navigate this complex area effectively.

-

How can the Small Business Guide To Provincial Sales Tax PST Rev Gov BC help my business?

By utilizing the Small Business Guide To Provincial Sales Tax PST Rev Gov BC, small business owners can ensure compliance with provincial tax laws, thereby avoiding costly penalties. This guide simplifies the tax process, enabling you to focus more on growing your business rather than worrying about tax obligations.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides features such as secure electronic signatures, document storage, and customizable templates, making it easy to manage and sign tax-related documents. These functionalities complement the Small Business Guide To Provincial Sales Tax PST Rev Gov BC by streamlining paperwork and ensuring swift compliance.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. With its competitive pricing plans, you can access essential features that support your efforts in managing the requirements outlined in the Small Business Guide To Provincial Sales Tax PST Rev Gov BC without breaking the bank.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your workflow management. This is crucial for businesses leveraging the Small Business Guide To Provincial Sales Tax PST Rev Gov BC, as it allows for streamlined processes and better data organization.

-

What are the benefits of eSigning documents for tax compliance?

eSigning documents simplifies the tax compliance process, making it faster and more efficient. With airSlate SignNow, businesses can securely sign, send, and store documents, which is essential when adhering to the guidelines in the Small Business Guide To Provincial Sales Tax PST Rev Gov BC.

-

How does airSlate SignNow ensure the security of tax documents?

airSlate SignNow prioritizes security with advanced encryption and authentication measures to protect sensitive tax documents. This is particularly important for businesses following the Small Business Guide To Provincial Sales Tax PST Rev Gov BC, as they need to safeguard their financial information.

Get more for Small Business Guide To Provincial Sales Tax PST Rev Gov Bc

- Writ of certiorari 2000 form

- 84 lumber donation form

- Out of state petitioner alcoholdrug evaluation uniform report 2013

- Illinois petitioner investigative alcoholdrug evaluation form

- Divorce papers oregon form

- Unmarried parents custody parenting time child support form

- Wisconsin disclosure form

- Omb no 1845 0102 form

Find out other Small Business Guide To Provincial Sales Tax PST Rev Gov Bc

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself