201118014 IRS Irs Form

What is the 201118014 IRS Irs

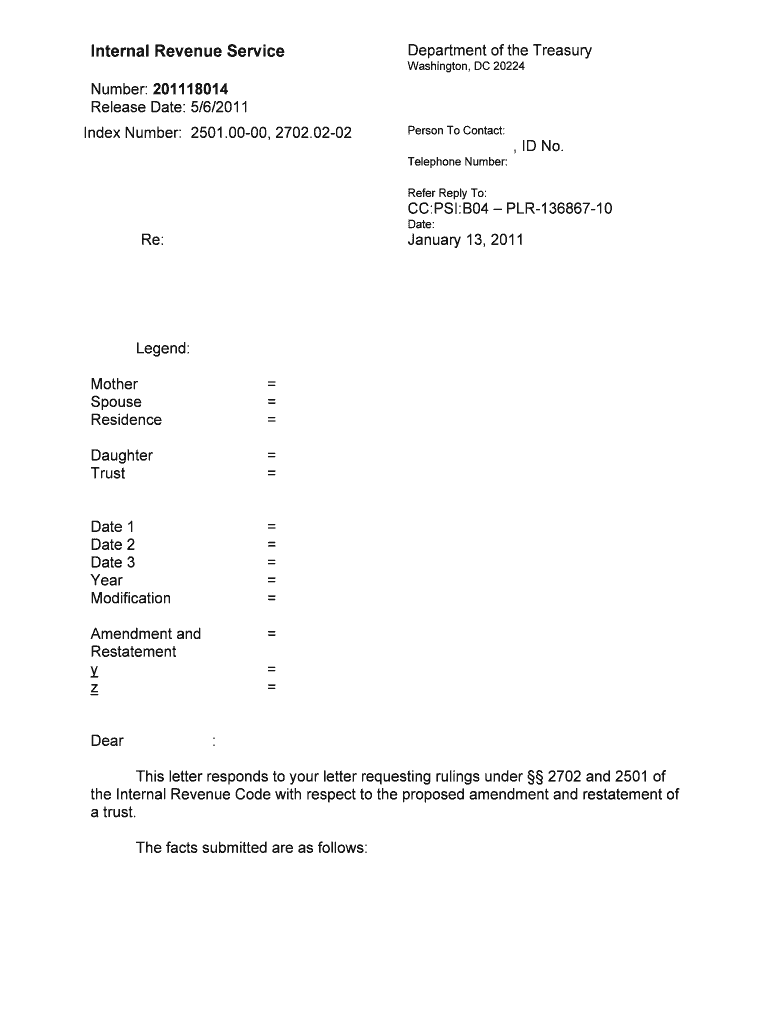

The 201118014 IRS form is a specific document used for reporting and tax purposes within the United States. This form is essential for various tax-related activities and is recognized by the Internal Revenue Service (IRS). It serves as a means for individuals and businesses to fulfill their tax obligations, ensuring compliance with federal laws. Understanding the purpose and requirements of this form is crucial for accurate and timely submissions.

How to use the 201118014 IRS Irs

Using the 201118014 IRS form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents and data required for completion. Next, carefully fill out the form, ensuring that all sections are completed as per IRS guidelines. After filling the form, review it for accuracy before submission. Utilizing digital tools can streamline this process, allowing for easier editing and signing.

Steps to complete the 201118014 IRS Irs

Completing the 201118014 IRS form involves a systematic approach:

- Gather necessary documents, such as income statements and previous tax returns.

- Access the form through the IRS website or a reliable digital platform.

- Fill out each section of the form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Sign the form electronically or manually, as required.

- Submit the form through the appropriate channels, whether online or via mail.

Legal use of the 201118014 IRS Irs

The legal use of the 201118014 IRS form is governed by federal tax regulations. To be considered valid, the form must be completed correctly and submitted by the specified deadlines. Electronic signatures are accepted, provided they comply with the requirements set forth by the ESIGN Act and UETA. This ensures that the form holds legal weight and can be used in any necessary legal contexts.

Filing Deadlines / Important Dates

Filing deadlines for the 201118014 IRS form are critical to avoid penalties. Typically, the form must be submitted by April 15 for individual taxpayers. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, especially during tax season, to ensure compliance and avoid late fees.

Form Submission Methods (Online / Mail / In-Person)

The 201118014 IRS form can be submitted through various methods, including:

- Online: Submit electronically through the IRS e-file system or authorized e-filing software.

- Mail: Send a physical copy of the completed form to the designated IRS address based on your location.

- In-Person: Visit a local IRS office for assistance with submission, though appointments may be necessary.

Quick guide on how to complete 201118014 irs irs

Complete [SKS] effortlessly on any device

Digital document handling has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily find the suitable form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to edit and eSign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Leave behind concerns over lost or misplaced files, tedious form navigation, or mistakes that require new document prints. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and facilitate seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 201118014 IRS Irs

Create this form in 5 minutes!

How to create an eSignature for the 201118014 irs irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 201118014 IRS Irs code?

The 201118014 IRS Irs code refers to specific guidelines and requirements set by the IRS. Understanding this code is crucial for ensuring compliance when processing tax documents and eSigning forms related to your business. By using airSlate SignNow, you can easily manage all documents associated with the 201118014 IRS Irs.

-

How can airSlate SignNow help with the 201118014 IRS Irs requirements?

airSlate SignNow provides an efficient platform for businesses to eSign and manage documents related to the 201118014 IRS Irs. Our tool ensures that all necessary compliance measures are met, consolidating your signing process in one place. Companies can save time and avoid costly errors with our easy-to-use interface.

-

What features does airSlate SignNow offer to assist with IRS-related documents?

airSlate SignNow offers features like customizable templates, bulk sending, and detailed audit trails that are essential for handling IRS-related documents, including those referencing the 201118014 IRS Irs. You can track modifications and ensure that all signers have completed necessary actions efficiently. This helps maintain accountability and compliance.

-

Is airSlate SignNow cost-effective for managing IRS documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. With pricing plans that cater to different needs, users can efficiently manage the signing of IRS documents such as those involving the 201118014 IRS Irs without breaking the bank. Streamlining document workflows can ultimately improve your bottom line.

-

Can airSlate SignNow integrate with other applications for IRS documentation?

Absolutely, airSlate SignNow integrates with a variety of applications, including those used for financial and tax reporting. This means you can automate your workflows and link crucial IRS documentation processes concerning the 201118014 IRS Irs within your existing systems. Seamless integration improves efficiency and minimizes errors.

-

What are the security measures in place for IRS documents at airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, especially those related to sensitive IRS information like the 201118014 IRS Irs. We employ encryption, secure access protocols, and two-factor authentication to protect your data. You can eSign and store IRS documents with peace of mind knowing that your information is secure.

-

How does airSlate SignNow simplify the eSigning process for IRS forms?

airSlate SignNow simplifies the eSigning process by allowing users to quickly send, sign, and store IRS forms such as those dealing with the 201118014 IRS Irs. Our intuitive interface enables both senders and recipients to complete their signatures effortlessly, reducing turnaround time for important documents. This efficiency can enhance your business operations signNowly.

Get more for 201118014 IRS Irs

- Jury instruction murder form

- Jury instruction first degree murder form

- Jury instruction second form

- Jury instruction manslaughter form

- Instruction juror document form

- Jury instruction kidnapping form

- North vancouver school district peak performance program

- How to edit a passport size photo in photoshop youtube form

Find out other 201118014 IRS Irs

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure