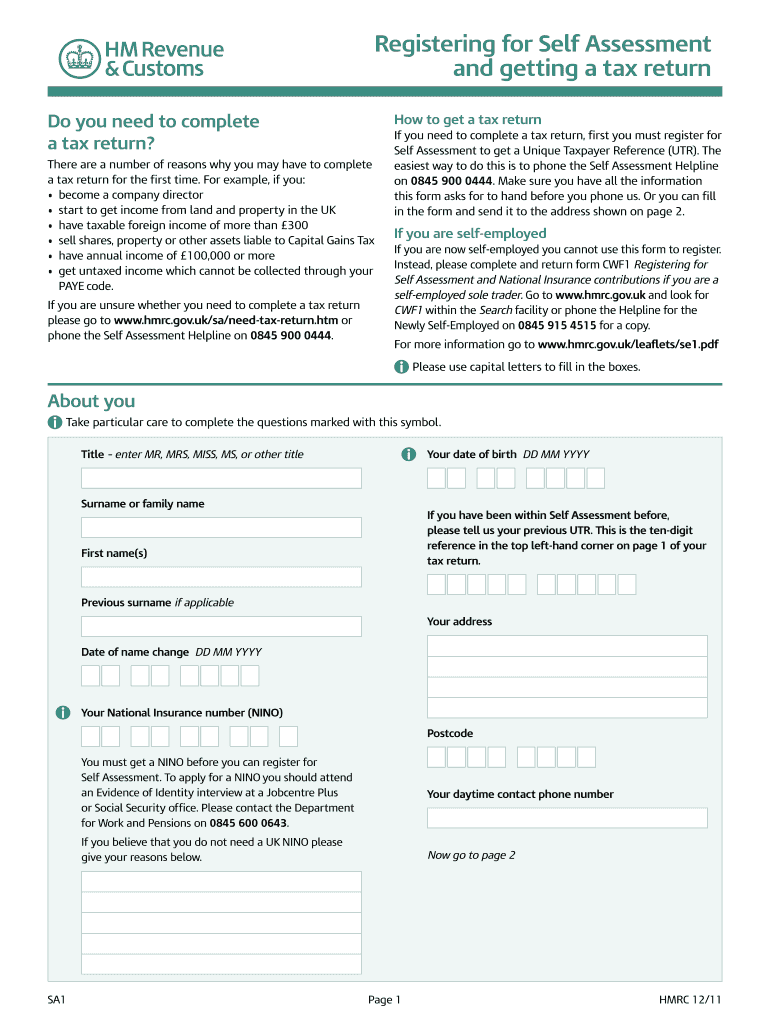

Form SA1 Registering for Self Assessment and Getting a Tax Return 2011-2026

Understanding the SA1 Form for Self-Assessment Registration

The SA1 form is a crucial document for individuals in the United States who need to register for self-assessment and obtain a tax return. This form is primarily used by those who are not already in the self-assessment system but need to report their income to the Internal Revenue Service (IRS). Completing the SA1 form accurately ensures that you are compliant with tax regulations and can avoid potential penalties.

Steps to Complete the SA1 Form

Filling out the SA1 form involves several important steps:

- Gather necessary information, including your personal details, income sources, and any relevant financial documentation.

- Access the SA1 form, which can typically be downloaded in PDF format from the IRS website or other authorized sources.

- Fill in the form carefully, ensuring that all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified methods, which may include online submission or mailing it to the appropriate IRS office.

Obtaining the SA1 Form

The SA1 form can be obtained in several ways. You can download the SA1 form PDF from the IRS website or request a physical copy through your local IRS office. It is essential to ensure that you are using the most current version of the form to comply with the latest tax regulations.

Legal Use of the SA1 Form

Using the SA1 form correctly is vital for legal compliance. The form must be filled out and submitted in accordance with IRS guidelines. Failure to submit the SA1 form or providing inaccurate information may result in penalties or legal issues. It is advisable to familiarize yourself with the legal requirements surrounding the form to ensure proper usage.

Required Documents for the SA1 Form

When completing the SA1 form, certain documents are typically required to support your application. These may include:

- Proof of identity, such as a Social Security number or Individual Taxpayer Identification Number.

- Documentation of income sources, including W-2 forms, 1099s, or other relevant financial statements.

- Any prior tax returns, if applicable, to provide context for your current financial situation.

Filing Deadlines for the SA1 Form

It is crucial to be aware of the filing deadlines associated with the SA1 form. Generally, the form must be submitted by a specific date, often aligned with the annual tax return deadlines. Failing to meet these deadlines can result in late fees or other penalties. Always check the IRS guidelines for the most current deadlines to ensure timely submission.

Quick guide on how to complete form sa1 registering for self assessment and getting a tax return

Complete Form SA1 Registering For Self Assessment And Getting A Tax Return seamlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without any delays. Handle Form SA1 Registering For Self Assessment And Getting A Tax Return on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process now.

The simplest way to modify and electronically sign Form SA1 Registering For Self Assessment And Getting A Tax Return effortlessly

- Obtain Form SA1 Registering For Self Assessment And Getting A Tax Return and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Modify and electronically sign Form SA1 Registering For Self Assessment And Getting A Tax Return and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form sa1 registering for self assessment and getting a tax return

Create this form in 5 minutes!

How to create an eSignature for the form sa1 registering for self assessment and getting a tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an SA1 form and why is it important?

The SA1 form is a crucial document for businesses that need to comply with regulatory requirements. It serves as a standardized method for collecting essential information needed for various transactions and processes. Understanding the SA1 form's purpose can streamline your business operations and enhance compliance.

-

How can airSlate SignNow help me manage my SA1 forms?

airSlate SignNow provides a powerful platform to manage your SA1 forms electronically. With its user-friendly interface and eSignature capabilities, you can send, sign, and store your SA1 forms securely. This not only saves time but also ensures that your documents are legally binding.

-

What are the pricing options for using airSlate SignNow to handle SA1 forms?

airSlate SignNow offers several pricing plans tailored to different business needs, making it affordable for anyone needing to manage SA1 forms. Plans include features like unlimited document signing and cloud storage for your forms. You can choose a plan that best fits your business size and requirements.

-

Are there any specific features designed for SA1 form management?

Yes, airSlate SignNow includes features specifically designed for SA1 form management, such as customizable templates and bulk sending options. These tools help streamline the process of filling out and signing SA1 forms for multiple recipients. You can also automate reminders and notifications to ensure timely responses.

-

Can I integrate other applications with airSlate SignNow when working with SA1 forms?

Absolutely! airSlate SignNow seamlessly integrates with various applications, allowing you to manage your SA1 forms alongside your existing workflows. Whether it's CRM systems, cloud storage, or project management tools, these integrations enhance efficiency and improve collaboration.

-

What security measures does airSlate SignNow implement for SA1 forms?

airSlate SignNow prioritizes security with robust measures like encryption and secure storage for your SA1 forms. The platform complies with industry standards to ensure that your documents are safe from unauthorized access. You can confidently send and manage sensitive information knowing it is well-protected.

-

Is it easy to track the status of my SA1 forms with airSlate SignNow?

Yes, tracking the status of your SA1 forms is straightforward with airSlate SignNow. The platform provides real-time updates on document progress, so you always know when your forms have been sent, viewed, and signed. This transparency helps you maintain control over your document workflows.

Get more for Form SA1 Registering For Self Assessment And Getting A Tax Return

- Tpn referral form

- A document solution checklist meniko form

- Printful packing slip form

- 15aa form

- Colorado individual performance profile colorado department of bb

- Kaufvertrag ber eine gebrauchte jagdwaffe ljv nrw form

- Inspection checklist retaining walls form

- Tauhara geothermal charitable trust project application form organisation details organisationroopu name contact person

Find out other Form SA1 Registering For Self Assessment And Getting A Tax Return

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter