Arizona Form 321 Credit for Contributions to Qualifying Charitable Organizations

What is the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations

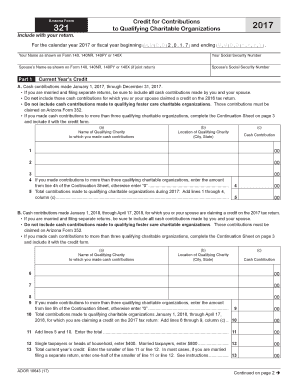

The Arizona Form 321 is a tax form that allows individuals to claim a credit for contributions made to qualifying charitable organizations. This credit is designed to encourage donations to charities that provide essential services to Arizona residents. By completing this form, taxpayers can reduce their state tax liability, making it a beneficial tool for both the donor and the charitable organizations. The form specifically targets contributions made to organizations that meet the criteria set by the Arizona Department of Revenue, ensuring that the funds support legitimate causes.

Eligibility Criteria for Arizona Form 321

To qualify for the Arizona Form 321 credit, taxpayers must meet specific eligibility criteria. Contributions must be made to organizations that are recognized as qualifying charitable organizations by the state. These organizations typically focus on providing assistance in areas such as health care, education, and public safety. Additionally, the taxpayer must have a valid Arizona tax identification number and must not have exceeded the contribution limits set by the state. Understanding these criteria is essential for ensuring that contributions are eligible for the tax credit.

Steps to Complete the Arizona Form 321

Completing the Arizona Form 321 involves several straightforward steps. First, gather all necessary documentation, including proof of contributions to qualifying charities. Next, download the form from the Arizona Department of Revenue website or obtain a physical copy. Fill out the form by providing your personal information, including your name, address, and taxpayer identification number. Indicate the total amount of contributions made during the tax year and ensure that you provide the names and identification numbers of the charities. Finally, review the form for accuracy before submitting it to the appropriate state agency.

Filing Deadlines for Arizona Form 321

Filing deadlines for the Arizona Form 321 align with the general tax filing deadlines set by the state. Typically, taxpayers must submit their forms by April 15 of the tax year, unless an extension has been granted. It is crucial to stay informed about any changes to these deadlines, as late submissions may result in penalties or the loss of the tax credit. Taxpayers are encouraged to file as early as possible to ensure that their contributions are recognized and credited appropriately.

Required Documents for Arizona Form 321

When completing the Arizona Form 321, certain documents are required to substantiate the contributions made. Taxpayers must provide receipts or acknowledgment letters from the qualifying charitable organizations that confirm the amount donated. It is also advisable to keep copies of bank statements or canceled checks that reflect the contributions. These documents serve as proof in case of an audit and ensure that the taxpayer can substantiate their claims on the form.

Examples of Using the Arizona Form 321

Examples of using the Arizona Form 321 include various scenarios where taxpayers contribute to qualifying charitable organizations. For instance, an individual who donates $500 to a local food bank can claim this amount on their Form 321, potentially reducing their state tax liability. Similarly, contributions to educational scholarships or health care services also qualify. Each example highlights how taxpayers can effectively leverage their charitable contributions to benefit both the community and their financial situation.

Quick guide on how to complete arizona form 321 credit for contributions to qualifying charitable organizations

Effortlessly Prepare Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers a fantastic eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and eSign Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations with Ease

- Find Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information carefully and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow manages all your document-related needs in just a few clicks from your chosen device. Modify and eSign Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

Create this form in 5 minutes!

How to create an eSignature for the arizona form 321 credit for contributions to qualifying charitable organizations

How to create an eSignature for the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations online

How to create an eSignature for your Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations in Chrome

How to create an electronic signature for signing the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations in Gmail

How to make an electronic signature for the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations straight from your mobile device

How to make an electronic signature for the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations on iOS

How to make an electronic signature for the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations on Android devices

People also ask

-

What is the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations?

The Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations allows taxpayers to receive a tax credit for donations made to qualified charities in Arizona. This credit is designed to encourage charitable giving and can signNowly reduce your state tax liability. By contributing to eligible organizations, you can support your community while benefiting financially.

-

How can I claim the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations?

To claim the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations, you will need to complete the form and include it with your state income tax return. Ensure you have receipts or documentation for your contributions to support your claim. It's advisable to review the eligibility criteria for organizations to maximize your tax benefits.

-

What are the benefits of using airSlate SignNow for managing Arizona Form 321 documentation?

Using airSlate SignNow for managing your Arizona Form 321 documentation streamlines the process of sending and eSigning forms electronically. Our platform is user-friendly and cost-effective, allowing you to quickly prepare and submit your tax documents without the hassle of paper forms. This efficiency can save you time and ensure accuracy in your submissions.

-

Are there any costs associated with using airSlate SignNow for Arizona Form 321?

airSlate SignNow offers a variety of pricing plans that cater to different business needs, including options for individual users and teams. By using our platform, you can efficiently manage your Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations without incurring signNow costs. Explore our pricing page to find the best plan for your requirements.

-

Can I integrate airSlate SignNow with other software for Arizona Form 321 processing?

Yes, airSlate SignNow offers seamless integrations with various software applications that can enhance your workflow for processing the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations. This flexibility allows you to connect with accounting or tax preparation software, making it easier to keep track of your contributions and tax credits.

-

What types of organizations qualify for the Arizona Form 321 Credit?

To qualify for the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations, donations must be made to qualifying charities recognized by the Arizona Department of Revenue. These typically include non-profit organizations that provide services to low-income individuals or families, among others. Always check the latest guidelines to ensure your contributions are eligible.

-

How does airSlate SignNow ensure the security of my Arizona Form 321 submissions?

airSlate SignNow prioritizes the security of your documents, including the Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations, by employing advanced encryption and secure storage protocols. Our platform is designed to protect your sensitive information throughout the eSigning process, ensuring that your data remains confidential and compliant with regulations.

Get more for Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations

Find out other Arizona Form 321 Credit For Contributions To Qualifying Charitable Organizations

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast