Pari Passu Letter Format

Understanding the Pari Passu Letter Format

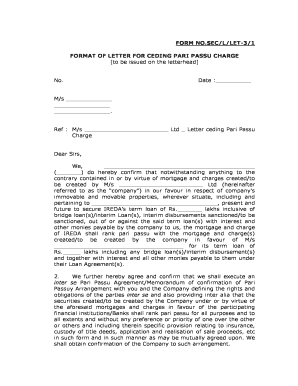

The pari passu letter is a crucial document in financial and legal transactions, particularly in the context of secured lending. This letter confirms that multiple creditors have equal rights to a debtor's assets. The format typically includes essential details such as the names of the parties involved, the nature of the debt, and the specific assets secured. It ensures that all creditors are treated equally in the event of liquidation or bankruptcy, thereby protecting their interests.

Key Elements of the Pari Passu Letter Format

A well-structured pari passu letter should include several key elements to ensure clarity and legal validity. These elements are:

- Parties Involved: Clearly identify all creditors and the debtor.

- Description of Debt: Specify the nature and amount of the debt being secured.

- Asset Description: Detail the assets that are subject to the pari passu charge.

- Governing Law: Indicate the jurisdiction under which the letter is governed.

- Signatures: Include signatures from all parties to validate the agreement.

Steps to Complete the Pari Passu Letter Format

Completing a pari passu letter involves several steps to ensure that all necessary information is accurately captured. Follow these steps:

- Gather information on all creditors and the debtor.

- Draft the letter using the standard format, ensuring all key elements are included.

- Review the document for accuracy and completeness.

- Obtain signatures from all parties involved.

- Store the signed letter securely for future reference.

Legal Use of the Pari Passu Letter Format

The pari passu letter serves a significant legal purpose in protecting the rights of creditors. In the event of a borrower's insolvency, this letter ensures that all creditors have equal claims to the secured assets. It is essential for maintaining transparency and fairness in financial transactions. Legal professionals often recommend using this format to avoid disputes among creditors and to uphold the principles of equitable treatment.

Examples of Using the Pari Passu Letter Format

Practical examples of the pari passu letter format can illustrate its application in real-world scenarios. For instance, in a syndicate loan arrangement, multiple banks may issue loans to a single borrower. A pari passu letter would be used to confirm that all banks have equal rights to the collateral provided by the borrower. Another example is in real estate transactions, where multiple investors may share ownership of a property and require a pari passu letter to outline their equal claims to the asset.

Obtaining the Pari Passu Letter Format

To obtain a pari passu letter format, businesses and legal professionals can refer to templates available through legal resources or financial institutions. Many law firms also provide customizable templates that can be tailored to specific transactions. It is advisable to consult with a legal expert to ensure that the format meets all necessary legal requirements and is suitable for the intended use.

Quick guide on how to complete pari passu letter format 89390338

Complete Pari Passu Letter Format effortlessly on any device

Online document handling has become favored by businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without interruptions. Manage Pari Passu Letter Format on any platform using airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to modify and eSign Pari Passu Letter Format with ease

- Locate Pari Passu Letter Format and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for this purpose.

- Generate your eSignature using the Sign tool, which takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then press the Done button to save your adjustments.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require creating new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Pari Passu Letter Format and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pari passu letter format 89390338

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process of ceding a pari passu charge?

Ceding a pari passu charge involves assigning a security interest in an asset to multiple creditors at the same level of priority. This ensures that all secured parties receive equal treatment in the event of default. It's essential to follow the correct legal procedures to effectively cede a pari passu charge.

-

How does airSlate SignNow facilitate ceding a pari passu charge?

airSlate SignNow provides a streamlined platform for documenting and electronically signing agreements related to ceding a pari passu charge. Users can generate templates, collect signatures, and maintain secure records of transactions, simplifying the entire process. Our solution is designed for efficiency and compliance.

-

What are the benefits of ceding a pari passu charge?

Ceding a pari passu charge allows businesses to access multiple funding sources while ensuring fairness among creditors. This method can enhance a company's creditworthiness and financial flexibility. The structured approach helps protect the interests of all stakeholders involved.

-

What pricing plans does airSlate SignNow offer for businesses dealing with ceding a pari passu charge?

airSlate SignNow offers various pricing plans tailored for businesses of all sizes. Each plan includes features that support electronic signing and document management necessary for ceding a pari passu charge. Visit our pricing page to find the plan that best suits your needs.

-

Can I integrate airSlate SignNow with other financial software for ceding a pari passu charge?

Yes, airSlate SignNow integrates seamlessly with various financial and document management software. This allows for a more streamlined approach when ceding a pari passu charge, enabling users to manage all related documents in one place. Check our integration options for more details.

-

Is airSlate SignNow compliant with regulations for ceding a pari passu charge?

Yes, airSlate SignNow adheres to legal standards and regulations required for electronic signatures, which applies to ceding a pari passu charge. Our platform complies with laws like ESIGN and UETA, ensuring the legality of all signed documents. You can trust our solution for secure and compliant transactions.

-

What features does airSlate SignNow provide to assist in ceding a pari passu charge?

airSlate SignNow offers key features such as customizable templates, real-time tracking, and secure storage of signed documents, all of which aid in ceding a pari passu charge. These tools enhance efficiency and help ensure that all parties are informed throughout the process. Utilize these features to simplify your documentation.

Get more for Pari Passu Letter Format

- Pmbok guide 6th edition process input output combo matrix form

- Hud housing application online form

- Af form 2282 missed meals

- Uti login with folio number form

- Kyc form download 24537305

- Client retainer agreement hunt private investigations form

- Incident and injury form all things child care

- Punnett square cheat sheet form

Find out other Pari Passu Letter Format

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document