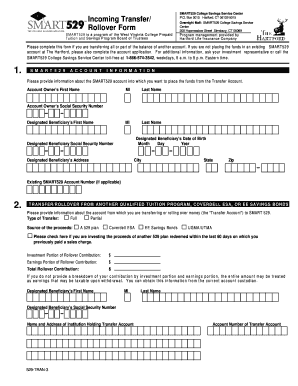

Incoming Transfer Rollover Form

What is the Incoming Transfer Rollover Form

The Incoming Transfer Rollover Form is a document used by individuals to facilitate the transfer of retirement funds from one account to another without incurring tax penalties. This form is essential for ensuring that the rollover is executed correctly, maintaining the tax-deferred status of the transferred funds. It is commonly utilized during retirement planning, especially when individuals switch jobs or wish to consolidate their retirement savings into a single account.

Steps to complete the Incoming Transfer Rollover Form

Completing the Incoming Transfer Rollover Form involves several key steps:

- Gather necessary information: Collect details about the current retirement account, including account numbers and the financial institution's contact information.

- Fill out personal information: Provide your name, address, Social Security number, and other identifying details as required on the form.

- Specify the transfer details: Indicate the amount being transferred and the type of account receiving the funds.

- Review and sign: Carefully review all information for accuracy before signing the form to authorize the transfer.

- Submit the form: Send the completed form to the designated financial institution or follow the specified submission guidelines.

How to obtain the Incoming Transfer Rollover Form

The Incoming Transfer Rollover Form can typically be obtained from the financial institution that will receive the transferred funds. Most institutions provide the form on their official website for easy access. Additionally, you may contact customer service for assistance in acquiring the form. Some employers may also provide the form if the transfer involves a workplace retirement plan.

Key elements of the Incoming Transfer Rollover Form

When filling out the Incoming Transfer Rollover Form, several key elements must be included to ensure proper processing:

- Personal Information: Your full name, address, and Social Security number.

- Account Information: Details of the current retirement account, including account numbers and the name of the financial institution.

- Transfer Amount: The specific amount you wish to transfer.

- Receiving Institution Information: The name and address of the institution where the funds will be transferred.

- Signature: Your signature to authorize the transfer.

Legal use of the Incoming Transfer Rollover Form

The Incoming Transfer Rollover Form is legally recognized as a valid document for transferring retirement funds. Proper use of this form ensures compliance with IRS regulations, allowing individuals to move their retirement savings without triggering immediate tax liabilities. It is crucial to complete the form accurately and submit it within the required timeframes to avoid penalties.

Form Submission Methods

The Incoming Transfer Rollover Form can typically be submitted through various methods, depending on the receiving financial institution's policies:

- Online Submission: Many institutions offer an online portal where you can upload the completed form securely.

- Mail: You can send the form via postal mail to the address specified by the receiving institution.

- In-Person: Some individuals may prefer to deliver the form in person at a local branch of the receiving institution.

Quick guide on how to complete incoming transfer rollover form

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed papers, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The simplest way to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Incoming Transfer Rollover Form

Create this form in 5 minutes!

How to create an eSignature for the incoming transfer rollover form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Incoming Transfer Rollover Form and why do I need it?

The Incoming Transfer Rollover Form is a crucial document for transferring retirement accounts or funds from one financial institution to another without incurring tax penalties. By completing this form, you ensure that your retirement savings continue to grow tax-deferred. Utilizing the Incoming Transfer Rollover Form is a smart move to manage your investments effectively.

-

How does airSlate SignNow facilitate the Incoming Transfer Rollover Form process?

airSlate SignNow simplifies the process of handling your Incoming Transfer Rollover Form by providing an intuitive eSignature platform. Users can easily upload, edit, and electronically sign their forms, ensuring a smooth and efficient transfer process. This functionality reduces paperwork and speeds up the completion of your rollover.

-

Are there any costs associated with using the Incoming Transfer Rollover Form on airSlate SignNow?

While the Incoming Transfer Rollover Form itself may be free, using airSlate SignNow's platform typically requires a subscription or payment, depending on the features you choose. Our pricing is competitive, and we offer various plans to suit different needs, including options that allow unlimited access to essential document management tools.

-

What are the key features of airSlate SignNow that support the Incoming Transfer Rollover Form?

airSlate SignNow provides several features to streamline the handling of the Incoming Transfer Rollover Form, including customizable templates, secure eSignatures, and automated workflows. These tools enhance user experience and signNowly reduce the time spent on document management. Additionally, our platform ensures that your documents are safe with high-level encryption.

-

Can I integrate airSlate SignNow with my existing tools for processing the Incoming Transfer Rollover Form?

Yes, airSlate SignNow offers seamless integration with various third-party applications to enhance your workflow when dealing with the Incoming Transfer Rollover Form. You can connect with popular platforms such as Google Drive, Dropbox, and Salesforce, enabling you to manage your documents in the way that fits your business needs best.

-

What benefits does using airSlate SignNow provide for the Incoming Transfer Rollover Form?

Using airSlate SignNow for your Incoming Transfer Rollover Form provides numerous benefits, such as increased efficiency, improved accuracy, and greater security. The platform ensures that your documents are signed quickly, which helps in meeting deadlines. Additionally, electronic processes reduce the likelihood of errors and storage issues associated with paper documents.

-

Is there customer support available for questions about the Incoming Transfer Rollover Form?

Absolutely! airSlate SignNow provides reliable customer support for any inquiries regarding the Incoming Transfer Rollover Form. Whether you have questions about document preparation or need assistance with the signing process, our support team is ready to help you through live chat, email, or phone consultation.

Get more for Incoming Transfer Rollover Form

- Form it 641 manufacturers real property tax credit tax year

- Form packetsdomestic violence restraining order without

- Ok form ef 2019 2022 fill out tax template online

- Form it 212 investment credit tax year 2022

- 2022 form 513 oklahoma resident fiduciary income tax return packet ampamp instructions

- Hawaii income tax forms by tax year e file your taxes

- Form mo fpt food pantry homeless shelter or soup

- Form it 250 claim for credit for purchase of an automated

Find out other Incoming Transfer Rollover Form

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile