Application for Income Tax Exemption Nd Form

What is the Application For Income Tax Exemption Nd

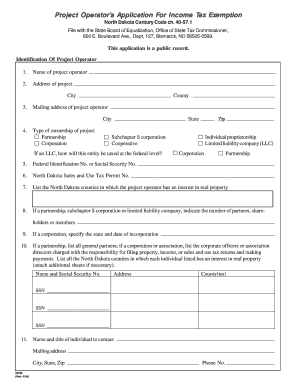

The Application For Income Tax Exemption Nd is a formal request submitted by individuals or organizations seeking exemption from certain income taxes under specific conditions. This application is typically used by non-profit organizations, religious institutions, and other entities that qualify for tax-exempt status according to federal and state regulations. By obtaining this exemption, eligible applicants can benefit from reduced tax liabilities, allowing them to allocate more resources towards their missions and services.

How to use the Application For Income Tax Exemption Nd

Using the Application For Income Tax Exemption Nd involves several key steps. First, applicants must gather all necessary documentation that supports their eligibility for tax exemption. This may include financial statements, organizational bylaws, and proof of charitable activities. Next, the completed application form must be submitted to the appropriate tax authority, either at the state or federal level, depending on the specific exemption being sought. It is crucial to ensure that all information is accurate and complete to avoid delays in processing.

Steps to complete the Application For Income Tax Exemption Nd

Completing the Application For Income Tax Exemption Nd requires careful attention to detail. Here are the essential steps:

- Review eligibility criteria to confirm that your organization qualifies for tax exemption.

- Gather required documents, including financial records and organizational information.

- Fill out the application form accurately, ensuring all sections are completed.

- Double-check the form for any errors or missing information.

- Submit the application to the relevant tax authority via the preferred submission method, such as online, by mail, or in person.

Eligibility Criteria

Eligibility for the Application For Income Tax Exemption Nd varies based on the type of organization and the specific tax exemption being sought. Generally, organizations must demonstrate that they operate for charitable, religious, educational, or similar purposes. Additionally, they must provide evidence of their activities and how these align with the criteria set forth by the Internal Revenue Service (IRS) or state tax authorities. Meeting these criteria is essential for successful approval of the application.

Required Documents

When submitting the Application For Income Tax Exemption Nd, several documents are typically required to support the application. These may include:

- Organizational bylaws or articles of incorporation.

- Financial statements for the past few years.

- Proof of charitable activities or missions.

- List of board members and their roles.

- Any additional documentation requested by the tax authority.

Form Submission Methods

The Application For Income Tax Exemption Nd can be submitted through various methods, depending on the preferences of the applicant and the requirements of the tax authority. Common submission methods include:

- Online submission via the tax authority's website.

- Mailing the completed form and supporting documents to the designated office.

- In-person submission at local tax authority offices.

Quick guide on how to complete application for income tax exemption nd

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools essential for swiftly creating, editing, and electronically signing your documents without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to modify and electronically sign [SKS] without hassle

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and electronically sign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application For Income Tax Exemption Nd

Create this form in 5 minutes!

How to create an eSignature for the application for income tax exemption nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Income Tax Exemption Nd?

The Application For Income Tax Exemption Nd is a crucial document for taxpayers seeking to qualify for certain tax benefits. This application allows eligible individuals and businesses to request an exemption from income tax, enhancing financial relief. With airSlate SignNow, you can easily manage and eSign this application online.

-

How can airSlate SignNow help with the Application For Income Tax Exemption Nd?

airSlate SignNow simplifies the process of completing the Application For Income Tax Exemption Nd by providing an intuitive platform for document management. Our solution enables users to fill out, sign, and share the application seamlessly, ensuring every step is efficient and legally compliant.

-

What features are included with airSlate SignNow for processing the Application For Income Tax Exemption Nd?

When using airSlate SignNow for the Application For Income Tax Exemption Nd, users benefit from features like document templates, advanced eSignature options, and real-time tracking. These features enhance the user experience by making it easier to manage and submit the required documents without confusion.

-

Is there a cost associated with using airSlate SignNow for tax exemption applications?

Yes, there is a pricing structure for airSlate SignNow, but it offers cost-effective solutions tailored to businesses of all sizes. Our plans include various features specifically designed to streamline the submission of the Application For Income Tax Exemption Nd, making it accessible for everyone.

-

Are there any integrations available for the Application For Income Tax Exemption Nd?

Absolutely! airSlate SignNow integrates with numerous applications, enhancing your ability to manage documents effectively. This capability allows you to connect with your preferred accounting or tax software directly when completing the Application For Income Tax Exemption Nd.

-

What are the benefits of using airSlate SignNow for tax exemption applications?

Using airSlate SignNow for the Application For Income Tax Exemption Nd provides various benefits, including faster processing times and reduced paperwork. The platform increases efficiency by enabling electronic signatures and document routing, ultimately saving you time and resources.

-

Can I track the status of my Application For Income Tax Exemption Nd with airSlate SignNow?

Yes, airSlate SignNow offers real-time tracking for documents, including the Application For Income Tax Exemption Nd. This feature allows you to see when your application is viewed, signed, or completed, giving you peace of mind and ensuring you never miss a deadline.

Get more for Application For Income Tax Exemption Nd

Find out other Application For Income Tax Exemption Nd

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now