Application for Licenses of Motor Fuels Tax Ok Form

What is the Application For Licenses Of Motor Fuels Tax Ok

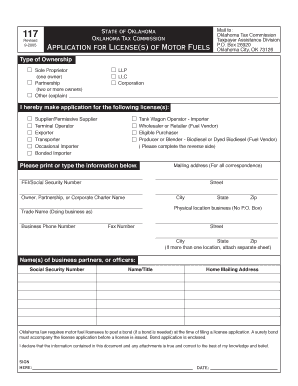

The Application For Licenses Of Motor Fuels Tax Ok is a formal document required by state authorities for businesses involved in the distribution and sale of motor fuels. This application ensures compliance with state regulations regarding fuel taxation. By submitting this form, businesses can obtain the necessary licenses to operate legally within the state, thereby facilitating the collection and remittance of motor fuel taxes. Understanding the purpose and requirements of this application is crucial for any entity looking to engage in motor fuel sales.

Steps to complete the Application For Licenses Of Motor Fuels Tax Ok

Completing the Application For Licenses Of Motor Fuels Tax Ok involves several key steps:

- Gather necessary information about your business, including ownership details and tax identification numbers.

- Fill out the application form accurately, ensuring all required fields are completed.

- Attach any supporting documents, such as proof of business registration and financial statements.

- Review the application for accuracy and completeness before submission.

- Submit the application through the designated method, whether online, by mail, or in person.

Following these steps carefully can help streamline the application process and reduce the likelihood of delays.

Required Documents

When submitting the Application For Licenses Of Motor Fuels Tax Ok, several documents are typically required to support your application:

- Proof of business registration, such as a certificate of incorporation or a business license.

- Tax identification number (TIN) or employer identification number (EIN).

- Financial statements that demonstrate the business's ability to comply with tax obligations.

- Any additional documentation specified by the state authority, which may vary by jurisdiction.

Having these documents ready can help ensure a smooth application process.

Eligibility Criteria

To qualify for the Application For Licenses Of Motor Fuels Tax Ok, applicants must meet specific eligibility criteria, which can include:

- Being a registered business entity in the state where the application is submitted.

- Having a valid tax identification number.

- Demonstrating compliance with all local, state, and federal regulations related to fuel sales.

- Meeting any additional requirements set forth by the state’s tax authority.

Understanding these criteria is essential for ensuring that your application is accepted without issues.

Form Submission Methods

The Application For Licenses Of Motor Fuels Tax Ok can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state’s tax authority website, which may offer a streamlined process.

- Mailing a hard copy of the application to the appropriate state office.

- In-person submission at designated state offices or tax authority locations.

Choosing the appropriate submission method can affect the processing time, so it is advisable to check the state’s guidelines.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Application For Licenses Of Motor Fuels Tax Ok can result in significant penalties. These may include:

- Fines imposed by the state for operating without the necessary licenses.

- Potential legal action against the business for tax evasion or non-compliance.

- Revocation of existing licenses or permits related to fuel sales.

Understanding the consequences of non-compliance is crucial for businesses to maintain their operations legally.

Quick guide on how to complete application for licenses of motor fuels tax ok

Complete [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork since you can access the correct form and securely save it online. airSlate SignNow equips you with all the capabilities required to create, edit, and eSign your documents rapidly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

The simplest way to edit and eSign [SKS] effortlessly

- Acquire [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to preserve your changes.

- Choose how you wish to send your form, by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searching, or mistakes requiring printing new document copies. airSlate SignNow meets all your needs in document management in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for licenses of motor fuels tax ok

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Licenses Of Motor Fuels Tax Ok?

The Application For Licenses Of Motor Fuels Tax Ok is a form required for businesses involved in handling motor fuels to apply for necessary licenses. This application ensures compliance with state regulations and helps in the proper management of fuel taxes.

-

How can airSlate SignNow assist with the Application For Licenses Of Motor Fuels Tax Ok?

airSlate SignNow simplifies the process of completing and submitting the Application For Licenses Of Motor Fuels Tax Ok. With our easy-to-use platform, you can fill out, sign, and send this important document in just a few clicks.

-

Is there a cost associated with using airSlate SignNow for my Application For Licenses Of Motor Fuels Tax Ok?

Yes, there are various pricing plans available depending on your business needs. airSlate SignNow offers cost-effective solutions to manage your documents, including the Application For Licenses Of Motor Fuels Tax Ok, ensuring affordability without compromising features.

-

What features does airSlate SignNow offer for document management related to the Application For Licenses Of Motor Fuels Tax Ok?

airSlate SignNow provides several features including customizable templates, real-time collaboration, and secure eSigning. These tools streamline the process of managing your Application For Licenses Of Motor Fuels Tax Ok and other critical documents.

-

Are there integrations available with airSlate SignNow for managing the Application For Licenses Of Motor Fuels Tax Ok?

Absolutely! airSlate SignNow integrates seamlessly with various business applications, making it easier to manage your Application For Licenses Of Motor Fuels Tax Ok along with other related tasks. These integrations enhance workflow efficiency within your organization.

-

How secure is the information provided in the Application For Licenses Of Motor Fuels Tax Ok when using airSlate SignNow?

Security is a top priority for airSlate SignNow. When you use our platform to submit your Application For Licenses Of Motor Fuels Tax Ok, your data is encrypted and stored securely, ensuring compliance with industry standards and protecting sensitive information.

-

What are the benefits of using airSlate SignNow for my Application For Licenses Of Motor Fuels Tax Ok?

Using airSlate SignNow for your Application For Licenses Of Motor Fuels Tax Ok increases efficiency, reduces paperwork, and accelerates the signing process. Our solution is user-friendly and designed to meet the evolving needs of businesses handling fuel licenses.

Get more for Application For Licenses Of Motor Fuels Tax Ok

Find out other Application For Licenses Of Motor Fuels Tax Ok

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application