Computation Schedule for Claiming Delaware Economic Revenue Delaware Form

What is the Computation Schedule For Claiming Delaware Economic Revenue?

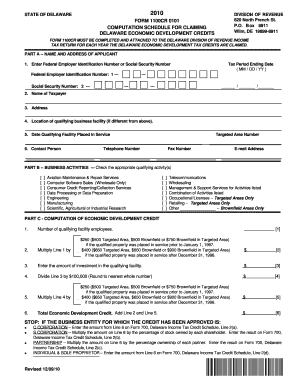

The Computation Schedule for Claiming Delaware Economic Revenue is a specific form used by businesses to report and claim economic revenue generated within the state of Delaware. This form is essential for businesses seeking to take advantage of Delaware's economic incentives and tax benefits. It outlines the necessary calculations and information needed to substantiate claims related to economic revenue, ensuring compliance with state regulations.

How to use the Computation Schedule For Claiming Delaware Economic Revenue

Using the Computation Schedule involves filling out the form with accurate financial data pertaining to your business operations in Delaware. Businesses must provide details such as revenue figures, eligible expenses, and any deductions applicable under Delaware law. It is crucial to follow the instructions precisely to ensure that all necessary information is included, which will facilitate a smoother review process by the state.

Steps to complete the Computation Schedule For Claiming Delaware Economic Revenue

To complete the Computation Schedule, follow these steps:

- Gather all relevant financial documents, including revenue statements and expense reports.

- Fill out the form with accurate figures, ensuring all calculations are correct.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline to the appropriate state agency.

Key elements of the Computation Schedule For Claiming Delaware Economic Revenue

Key elements of the Computation Schedule include:

- Business identification information, such as name and tax identification number.

- Detailed revenue figures from Delaware operations.

- Eligible expenses that can be deducted from gross revenue.

- Calculation methods used to determine net economic revenue.

Required Documents

When submitting the Computation Schedule, businesses must include supporting documents such as:

- Financial statements that detail revenue and expenses.

- Tax returns for the previous year.

- Any additional documentation required by Delaware state regulations.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the Computation Schedule. Typically, the form must be submitted by the end of the fiscal year, but specific dates may vary based on the business's tax situation. Businesses should consult the Delaware Division of Revenue for the most current deadlines to avoid potential penalties.

Quick guide on how to complete computation schedule for claiming delaware economic revenue delaware

Set Up [SKS] Effortlessly on Any Gadget

Digital document management has surged in popularity among businesses and individuals alike. It offers an excellent eco-conscious substitute for conventional printed and signed files, as you can easily locate the right template and securely keep it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents quickly and without obstacles. Oversee [SKS] on any device with airSlate SignNow Android or iOS applications and streamline any document-oriented process today.

The easiest method to alter and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Make use of the tools provided to fill out your form.

- Emphasize important parts of your documents or conceal sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Pencil in no more missing or lost files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any chosen device. Modify and eSign [SKS] to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Computation Schedule For Claiming Delaware Economic Revenue Delaware

Create this form in 5 minutes!

How to create an eSignature for the computation schedule for claiming delaware economic revenue delaware

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Computation Schedule For Claiming Delaware Economic Revenue Delaware?

The Computation Schedule For Claiming Delaware Economic Revenue Delaware is a framework that outlines the necessary steps and timelines for businesses to claim economic revenue incentives in Delaware. This schedule helps companies understand what documentation must be submitted and when to maximize their claims and benefits.

-

How can airSlate SignNow assist in creating a Computation Schedule For Claiming Delaware Economic Revenue Delaware?

airSlate SignNow simplifies the process of preparing and submitting your Computation Schedule For Claiming Delaware Economic Revenue Delaware by allowing you to easily eSign and share necessary documents. Our user-friendly platform ensures that you can manage your documentation efficiently, reducing the time and resources needed to claim your economic incentives.

-

Does airSlate SignNow provide templates for the Computation Schedule For Claiming Delaware Economic Revenue Delaware?

Yes, airSlate SignNow offers customizable templates that can help streamline the creation of your Computation Schedule For Claiming Delaware Economic Revenue Delaware. These templates are designed to ensure compliance with Delaware guidelines while saving you time in preparation.

-

What pricing plans does airSlate SignNow offer for businesses interested in the Computation Schedule For Claiming Delaware Economic Revenue Delaware?

airSlate SignNow provides various pricing plans tailored to fit the needs of different businesses. Our plans are designed to be cost-effective and scalable, ensuring that you have access to the necessary features to efficiently handle your Computation Schedule For Claiming Delaware Economic Revenue Delaware.

-

Are there any integrations available for managing the Computation Schedule For Claiming Delaware Economic Revenue Delaware?

Yes, airSlate SignNow integrates seamlessly with various business tools and platforms, enabling you to manage your Computation Schedule For Claiming Delaware Economic Revenue Delaware efficiently. This allows for smoother workflows and better document management, ensuring that your claims are submitted promptly.

-

What are the benefits of using airSlate SignNow for managing my Computation Schedule For Claiming Delaware Economic Revenue Delaware?

By using airSlate SignNow, businesses can benefit from an easy-to-use document management solution that simplifies the entire process of handling the Computation Schedule For Claiming Delaware Economic Revenue Delaware. This includes automated workflows, secure eSigning features, and the ability to track the status of your documents.

-

How secure is airSlate SignNow when handling my Computation Schedule For Claiming Delaware Economic Revenue Delaware?

airSlate SignNow prioritizes the security of your documents and data. We utilize advanced encryption protocols and offer comprehensive access controls to ensure that your Computation Schedule For Claiming Delaware Economic Revenue Delaware is protected at all times.

Get more for Computation Schedule For Claiming Delaware Economic Revenue Delaware

- Maine form 941p me fill out ampamp sign online dochub

- Form pte ex withholding exemption certificate for members

- What are the tax deadlines for my business starling bank form

- 2021 instructions for form 990 t instructions for form 990 t exempt organization business income tax return and proxy tax under

- Tweets with replies by nick murray nickmurr twitter form

- Sub mainegov form

- What is irs form 6251 turbotax tax tips ampamp videos intuit

- Exempt organization business income tax return red cross form

Find out other Computation Schedule For Claiming Delaware Economic Revenue Delaware

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement