Out of State Corporation Notice State of Indiana in Form

What is the Out of State Corporation Notice for the State of Indiana?

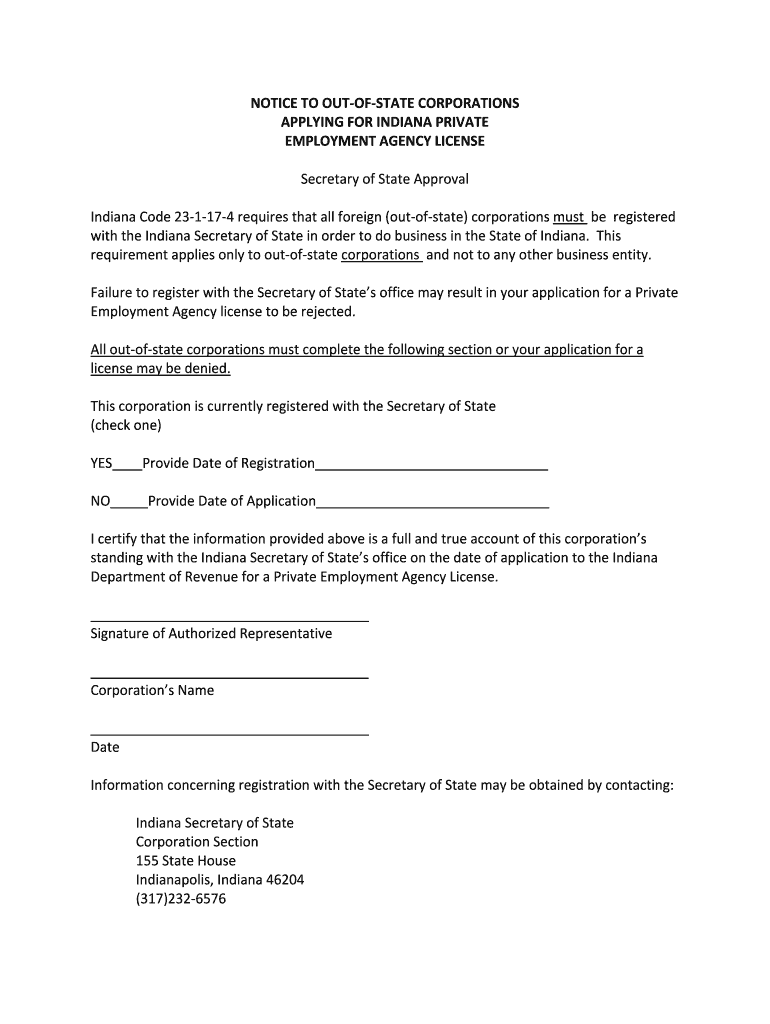

The Out of State Corporation Notice in Indiana is a formal document required for foreign corporations wishing to conduct business within the state. This notice serves to inform the state of Indiana about the corporation's intent to operate and provides essential details regarding its business activities. It is a crucial step in ensuring compliance with state regulations and maintaining good standing while operating outside the corporation's home state.

Key Elements of the Out of State Corporation Notice

The Out of State Corporation Notice contains several important elements, including:

- Corporation Name: The legal name of the corporation as registered in its home state.

- Principal Office Address: The primary location of the corporation's operations.

- Registered Agent: The individual or business entity designated to receive legal documents on behalf of the corporation.

- Business Purpose: A brief description of the nature of the business activities the corporation intends to engage in within Indiana.

- State of Incorporation: The state where the corporation was originally formed.

Steps to Complete the Out of State Corporation Notice

Completing the Out of State Corporation Notice involves several steps to ensure accuracy and compliance:

- Gather necessary information about the corporation, including its name, address, and registered agent.

- Fill out the notice form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed notice to the appropriate Indiana state office, either online or via mail.

How to Obtain the Out of State Corporation Notice

The Out of State Corporation Notice can typically be obtained through the Indiana Secretary of State's website. It is available as a downloadable form that can be filled out digitally or printed for manual completion. Ensure that you have the most current version of the form to avoid any issues during the filing process.

Legal Use of the Out of State Corporation Notice

Filing the Out of State Corporation Notice is a legal requirement for foreign corporations wishing to do business in Indiana. Failure to file this notice can result in penalties, including fines and restrictions on business operations within the state. It is essential for corporations to comply with this requirement to maintain their legal status and avoid any disruptions in their business activities.

Form Submission Methods

The Out of State Corporation Notice can be submitted through various methods, including:

- Online Submission: Many states offer an online portal for filing business documents, which can expedite the process.

- Mail: The completed form can be mailed to the Indiana Secretary of State's office at the designated address.

- In-Person: Corporations may also choose to submit the notice in person at the state office, allowing for immediate confirmation of receipt.

Quick guide on how to complete out of state corporation notice state of indiana in

Easily Prepare [SKS] on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sharing your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choosing. Edit and electronically sign [SKS] and ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Out of State Corporation Notice State Of Indiana In

Create this form in 5 minutes!

How to create an eSignature for the out of state corporation notice state of indiana in

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Out of State Corporation Notice State Of Indiana In?

The Out of State Corporation Notice State Of Indiana In is a formal requirement for businesses incorporated in other states to inform Indiana authorities of their operation. This notice ensures compliance with state regulations, allowing businesses to legally conduct affairs in Indiana. Proper submission is crucial for maintaining good standing and avoiding penalties.

-

How does airSlate SignNow assist with the Out of State Corporation Notice State Of Indiana In?

airSlate SignNow simplifies the document signing process for the Out of State Corporation Notice State Of Indiana In. Our platform allows you to easily create, send, and eSign the necessary paperwork, ensuring compliance with Indiana’s regulations. It streamlines the process, making it accessible and efficient for business owners.

-

Is there a cost associated with submitting the Out of State Corporation Notice State Of Indiana In using airSlate SignNow?

While airSlate SignNow offers a cost-effective solution for eSigning, the fee for submitting the Out of State Corporation Notice State Of Indiana In varies based on state requirements. Utilizing our platform reduces operational costs by minimizing paperwork and processing time. We provide clear pricing plans to fit various business needs.

-

What features does airSlate SignNow offer to help with the Out of State Corporation Notice State Of Indiana In?

airSlate SignNow includes features like customizable templates, real-time tracking, and secure cloud storage to assist with the Out of State Corporation Notice State Of Indiana In. These tools enhance document management and ensure that all parties can easily access and sign necessary forms. Our platform is designed to optimize your workflow.

-

Can I integrate airSlate SignNow with other tools for managing the Out of State Corporation Notice State Of Indiana In?

Yes, airSlate SignNow allows seamless integrations with various business applications to streamline the management of the Out of State Corporation Notice State Of Indiana In. Integrations with CRM systems and project management tools enhance efficiency and communication. This means you can handle your documents within your existing workflows.

-

What are the benefits of using airSlate SignNow for the Out of State Corporation Notice State Of Indiana In?

Using airSlate SignNow for the Out of State Corporation Notice State Of Indiana In offers numerous benefits, including faster processing times and increased accuracy. Our user-friendly interface reduces the chances of errors, and eSigning documents ensures that everything is legally binding. This ultimately saves time and sculpts a professional image for your business.

-

How does airSlate SignNow ensure the security of documents like the Out of State Corporation Notice State Of Indiana In?

airSlate SignNow prioritizes document security with end-to-end encryption and secure data storage. When handling sensitive documents such as the Out of State Corporation Notice State Of Indiana In, we implement advanced security measures to protect your information. Trust our platform to keep your business documents safe and compliant with regulations.

Get more for Out of State Corporation Notice State Of Indiana In

- Ngaaf bursary application form

- Driving licence download pdf rajasthan form

- Chase bank policy on power of attorney form

- Aadhar card blank format

- Sbi life insurance premium receipt pdf download form

- Liberty blouse cutting books pdf download form

- Amazon receipt generator form

- Motion to quash warrant form colorado

Find out other Out of State Corporation Notice State Of Indiana In

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now