2770 1 5 Tp Kansas Form

What is the 2770 1 5 tp Kansas

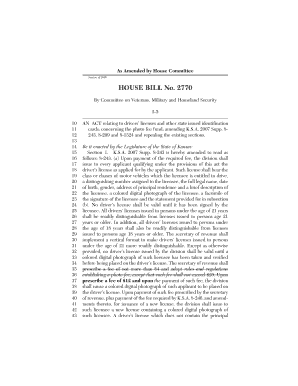

The 2770 1 5 tp Kansas is a specific form used for various administrative and legal purposes within the state of Kansas. This form is essential for individuals and businesses to comply with state regulations. It often pertains to documentation required for tax filings, business registrations, or other legal matters. Understanding the function and requirements of this form is crucial for ensuring compliance and avoiding penalties.

How to use the 2770 1 5 tp Kansas

Using the 2770 1 5 tp Kansas involves several steps to ensure accurate completion and submission. First, gather all necessary information and documentation required for the form. This may include personal identification, business details, or financial records. Next, fill out the form carefully, ensuring that all fields are completed accurately. Once the form is filled, review it for any errors or omissions before submitting it according to the specified guidelines.

Steps to complete the 2770 1 5 tp Kansas

Completing the 2770 1 5 tp Kansas requires a systematic approach. Follow these steps:

- Gather required documents, such as identification and financial records.

- Access the form, either online or through a physical copy.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any mistakes or missing information.

- Submit the form via the designated method, whether online, by mail, or in person.

Legal use of the 2770 1 5 tp Kansas

The legal use of the 2770 1 5 tp Kansas is critical for compliance with state laws. This form may be required for tax reporting, business licensing, or other legal obligations. Failing to use the form correctly can result in legal repercussions, including fines or other penalties. It is important to understand the specific legal context in which this form is applicable to ensure proper usage.

Required Documents

When preparing to complete the 2770 1 5 tp Kansas, certain documents are typically required. These may include:

- Proof of identity, such as a driver's license or state ID.

- Tax identification numbers for individuals or businesses.

- Financial statements or records relevant to the form's purpose.

- Any previous forms or documentation related to the current submission.

Filing Deadlines / Important Dates

Adhering to filing deadlines is essential when submitting the 2770 1 5 tp Kansas. Specific deadlines may vary depending on the purpose of the form, such as tax submissions or business registrations. It is advisable to check the relevant state guidelines to ensure timely submission and avoid any late fees or penalties.

Quick guide on how to complete 2770 1 5 tp kansas

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can easily access the correct template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Handle [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The simplest way to edit and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and guarantee excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 2770 1 5 tp Kansas

Create this form in 5 minutes!

How to create an eSignature for the 2770 1 5 tp kansas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 2770 1 5 tp Kansas?

airSlate SignNow is a powerful e-signature solution that enables businesses to send and sign documents efficiently. For those in the Kansas area, utilizing the 2770 1 5 tp Kansas feature ensures compliance while streamlining your document management process.

-

How much does airSlate SignNow cost for users in Kansas?

The pricing for airSlate SignNow varies based on the number of users and additional features. Specifically, the 2770 1 5 tp Kansas plan provides a cost-effective solution tailored to meet the needs of businesses in the region.

-

What features does airSlate SignNow offer to enhance document signing?

airSlate SignNow offers a range of features including customizable templates, secure cloud storage, and real-time tracking of your documents. The 2770 1 5 tp Kansas functions are specifically designed to simplify the document signing process for local businesses.

-

What benefits can Kansas businesses expect from using airSlate SignNow?

Kansas businesses implementing airSlate SignNow can expect increased efficiency and reduced turnaround times for document signing. With the 2770 1 5 tp Kansas integrated features, companies can signNowly lower their operational costs while ensuring secure transactions.

-

Does airSlate SignNow integrate with other software I use?

Yes, airSlate SignNow provides integrations with popular software, including CRM and project management tools. This capability is especially useful in Kansas, enabling seamless workflows and better project tracking through the 2770 1 5 tp Kansas integration.

-

How secure is my data with airSlate SignNow?

airSlate SignNow prioritizes security by utilizing encryption and compliance with data protection regulations. Businesses in Kansas can trust that their documents signed through the 2770 1 5 tp Kansas will remain secure throughout the signing process.

-

Is it easy to switch to airSlate SignNow from other e-signature providers?

Absolutely! Transitioning to airSlate SignNow from other providers is straightforward, thanks to its user-friendly interface. For those in Kansas, the 2770 1 5 tp Kansas support assists in making the switch smooth and efficient.

Get more for 2770 1 5 tp Kansas

- Application to enrol in a nsw government school application to enrol in a nsw government school annandalepublicschool nsw edu form

- Hi3751 form

- Dues authorization form illinois fraternal order of police fop

- Download the membership form habitat film club

- Prenuptial agreement thailand sample form

- The doodle revolution pdf form

- Pre tenancy application form 14374759

- Batelco careers form

Find out other 2770 1 5 tp Kansas

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT