Pdffiller9465 2011-2026

What is the IRS payment plan form?

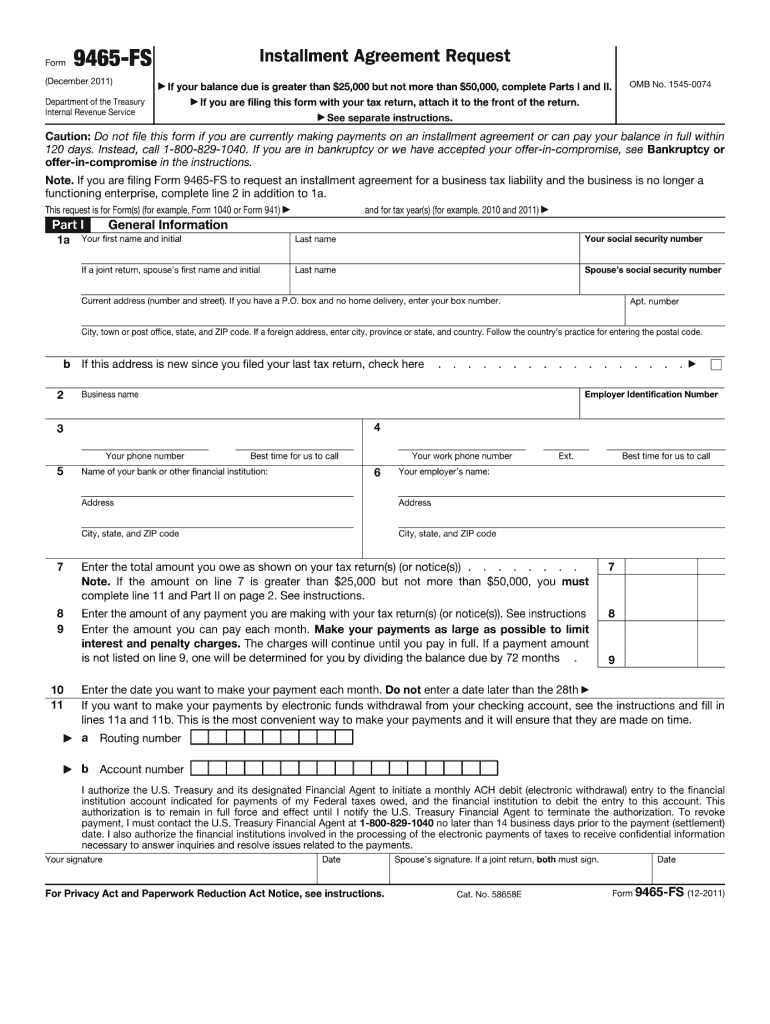

The IRS payment plan form, commonly referred to as Form 9465, is a request for an installment agreement with the Internal Revenue Service. This form allows taxpayers who cannot pay their tax liabilities in full to set up a payment plan. By completing this form, individuals can propose a monthly payment amount that fits their financial situation while ensuring compliance with IRS regulations. Understanding the purpose of this form is crucial for those seeking relief from immediate tax payment obligations.

Steps to complete the IRS payment plan form

Completing the IRS payment plan form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information, including your total tax liability, income, and monthly expenses. Next, fill out Form 9465, providing details such as your name, address, Social Security number, and the amount you owe. It is important to specify the monthly payment amount you can afford and the preferred payment date. After filling out the form, review it carefully to ensure all information is correct before submission.

Eligibility criteria for the IRS payment plan form

To qualify for an installment agreement using the IRS payment plan form, certain eligibility criteria must be met. Taxpayers should owe less than $50,000 in combined tax, penalties, and interest. Additionally, individuals must have filed all required tax returns. If you are a business entity, the threshold for eligibility may differ. It is essential to confirm that you meet these criteria before submitting the form to avoid delays in processing your request.

Form submission methods for the IRS payment plan form

Taxpayers have several options for submitting the IRS payment plan form. The form can be filed electronically through the IRS website if you are eligible for online services. Alternatively, you can mail a paper version of Form 9465 to the address specified in the form instructions. In-person submission is also an option at local IRS offices, although appointments may be required. Choosing the appropriate submission method can streamline the process and ensure timely handling of your request.

IRS guidelines for payment plans

The IRS has established guidelines that govern the terms and conditions of installment agreements. These guidelines specify the maximum duration for repayment plans, typically up to 72 months for taxpayers with lower balances. It is important to adhere to the payment schedule established in the agreement to avoid default, which can lead to additional penalties and interest. Familiarizing yourself with these guidelines helps ensure that you remain compliant throughout the repayment period.

Required documents for the IRS payment plan form

When completing the IRS payment plan form, certain documents may be required to support your application. These documents can include proof of income, such as pay stubs or bank statements, and a detailed list of monthly expenses to demonstrate your financial situation. Having these documents ready can facilitate the review process and increase the likelihood of approval for your installment agreement.

Penalties for non-compliance with IRS payment plans

Failure to comply with the terms of an installment agreement can result in significant penalties. If payments are missed or not made on time, the IRS may terminate the agreement, leading to immediate collection actions, including wage garnishments or bank levies. Additionally, interest and penalties on the unpaid balance may continue to accrue, increasing the total amount owed. Understanding these potential consequences emphasizes the importance of adhering to the payment plan established through Form 9465.

Quick guide on how to complete tax form 9465

Discover the easiest method to complete and endorse your Pdffiller9465

Are you still spending time preparing your official paperwork on hard copies instead of handling it online? airSlate SignNow offers a superior approach to finalize and endorse your Pdffiller9465 and related documents for public services. Our intelligent electronic signature system equips you with everything necessary to manage paperwork swiftly and in compliance with official regulations - comprehensive PDF editing, organization, safeguarding, signing, and distribution tools all available within a user-friendly interface.

There are just a few steps needed to finish filling out and signing your Pdffiller9465:

- Upload the editable template to the editor using the Get Form button.

- Review what information you need to include in your Pdffiller9465.

- Navigate between the fields using the Next button to avoid missing anything.

- Employ Text, Check, and Cross tools to fill in the sections with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Conceal sections that no longer apply.

- Click on Sign to generate a legally binding electronic signature using any method you prefer.

- Add the Date beside your signature and conclude your task with the Done button.

Store your finished Pdffiller9465 in the Documents folder of your profile, download it, or export it to your preferred cloud storage. Our solution also provides adaptable form sharing options. There's no need to print out your documents when you need to submit them at the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

FAQs

-

What is the best course of action if I owe back taxes I cannot afford to pay?

See http://www.irs.gov/taxtopics/tc2.... If you owe less than $25,000, you probably should fill out and submit Form 9465, Request for Installment Agreement, see http://www.irs.gov/pub/irs-pdf/f.... You can make this request online as well, http://www.irs.gov/individuals/a.... If you owe more than $25,000, you will probably have to provide the IRS with a Collection Information Statement, Form 433-A, http://www.irs.gov/pub/irs-pdf/f..., so that the IRS can assess how much you can actually pay.I would also urge you to seek out an enrolled agent or a CPA who specializes in tax matters in your area; he/she can advise you on your best course of action and can represent you before the IRS should that become necessary.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

Create this form in 5 minutes!

How to create an eSignature for the tax form 9465

How to create an electronic signature for your Tax Form 9465 in the online mode

How to create an electronic signature for the Tax Form 9465 in Google Chrome

How to generate an eSignature for signing the Tax Form 9465 in Gmail

How to make an electronic signature for the Tax Form 9465 straight from your mobile device

How to create an eSignature for the Tax Form 9465 on iOS devices

How to create an electronic signature for the Tax Form 9465 on Android OS

People also ask

-

What is an IRS payment plan form?

An IRS payment plan form is a document that allows taxpayers to establish a payment arrangement with the IRS for outstanding tax liabilities. This form is essential for individuals who are unable to pay their taxes in full by the due date. By using this form, taxpayers can spread their payments over time, easing financial stress.

-

How do I fill out the IRS payment plan form?

To fill out the IRS payment plan form, start by gathering your financial information, including income and expenses. Next, complete the required sections of the form accurately, ensuring all personal and tax details are correct. If you need assistance, airSlate SignNow can simplify the process of eSigning and sharing your completed form.

-

What are the costs associated with the IRS payment plan form?

The costs associated with the IRS payment plan form can vary based on the chosen plan and whether you apply online or via mail. The IRS typically charges a setup fee, which may be reduced for low-income taxpayers. Using airSlate SignNow can help minimize additional costs by providing an efficient, cost-effective platform for your document management needs.

-

Can I eSign the IRS payment plan form with airSlate SignNow?

Yes, you can eSign the IRS payment plan form using airSlate SignNow’s easy-to-use platform. Our digital signature solution ensures your form is securely signed and delivered promptly. This eliminates the hassle of printing and mailing, streamlining your tax resolution process.

-

What features does airSlate SignNow offer for managing IRS payment plan forms?

airSlate SignNow offers a variety of features for managing IRS payment plan forms, including seamless eSigning, document sharing, and custom templates. Our platform also allows for real-time tracking of document statuses. This ensures that users can efficiently manage their tax-related documents in one centralized place.

-

Is airSlate SignNow secure for completing IRS payment plan forms?

Absolutely, airSlate SignNow prioritizes security and compliance in handling sensitive documents such as IRS payment plan forms. Our platform employs advanced encryption and security protocols to protect your information, ensuring that your tax documents remain confidential and secure.

-

How quickly can I send the IRS payment plan form using airSlate SignNow?

You can send the IRS payment plan form quickly using airSlate SignNow, often within just minutes. The platform allows you to upload, eSign, and send documents instantly to the IRS or your tax advisor. This speed can potentially expedite the response from the IRS concerning your payment arrangement.

Get more for Pdffiller9465

Find out other Pdffiller9465

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile