The Contractor's Weekly Workforce Utilization Report Massport Form

Understanding the Massachusetts Weekly Workforce Utilization Report

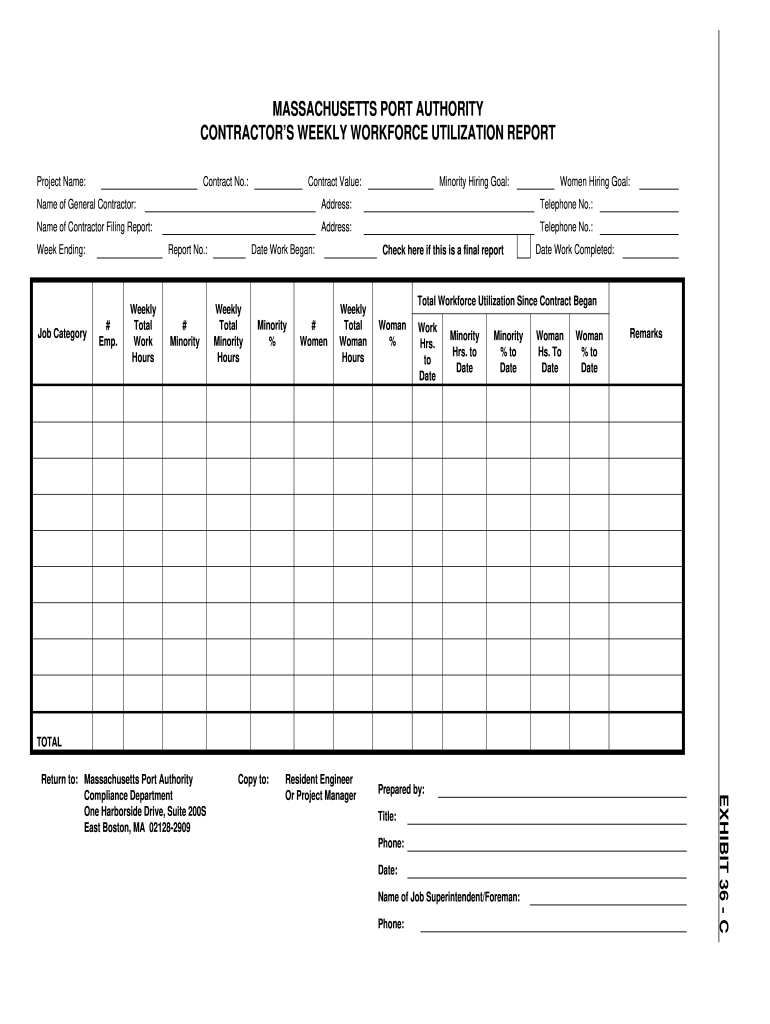

The Massachusetts Weekly Workforce Utilization Report is a critical document for contractors working on state-funded projects. This report tracks the employment of workers on these projects, ensuring compliance with state regulations regarding workforce diversity and inclusion. It provides essential data on the demographics of the workforce, which is vital for meeting the goals set forth by the Massachusetts Office of Diversity and Inclusion. By accurately completing this report, contractors can demonstrate their commitment to equitable hiring practices.

Steps to Complete the Massachusetts Weekly Workforce Utilization Report

Completing the Massachusetts Weekly Workforce Utilization Report involves several key steps. First, gather all relevant data regarding the workforce employed on the project, including the number of workers, their classifications, and demographic information. Next, ensure that all entries are accurate and reflect the current workforce composition. It is essential to follow the specific format outlined by the Massachusetts authorities to avoid any discrepancies. Finally, submit the report through the designated online portal or in accordance with the submission guidelines provided by the state.

Key Elements of the Massachusetts Weekly Workforce Utilization Report

The report includes several key elements that must be accurately filled out. These elements typically encompass:

- Total number of workers on site

- Job classifications of workers

- Demographic information, including race and gender

- Hours worked by each classification

- Any subcontractors employed and their workforce details

Each of these components is crucial for compliance and helps in assessing the effectiveness of workforce diversity initiatives.

Legal Use of the Massachusetts Weekly Workforce Utilization Report

The Massachusetts Weekly Workforce Utilization Report serves a legal purpose in documenting compliance with state laws regarding workforce diversity. By submitting this report, contractors affirm that they are adhering to the requirements set forth by the Massachusetts government. Failure to accurately complete and submit this report can result in penalties, including fines or disqualification from future contracts. Therefore, understanding the legal implications of this report is essential for all contractors operating within the state.

How to Obtain the Massachusetts Weekly Workforce Utilization Report

Contractors can obtain the Massachusetts Weekly Workforce Utilization Report through the official state website or the relevant government agency overseeing workforce compliance. The report is typically available in a downloadable format, allowing for easy access and completion. It is advisable to check for any updates or changes to the report format or submission requirements regularly to ensure compliance.

Examples of Using the Massachusetts Weekly Workforce Utilization Report

Utilizing the Massachusetts Weekly Workforce Utilization Report can be seen in various scenarios. For instance, a contractor may use the report to track workforce diversity on a public construction project, ensuring they meet the state's diversity goals. Additionally, the report can serve as a tool for internal assessments, helping contractors identify areas for improvement in their hiring practices. By analyzing the data collected in the report, contractors can make informed decisions to enhance workforce diversity and compliance.

Quick guide on how to complete the contractors weekly workforce utilization report massport

Effortlessly Complete The Contractor's Weekly Workforce Utilization Report Massport on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent environmentally-friendly substitute for conventional printed and signed documentation, enabling you to locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage The Contractor's Weekly Workforce Utilization Report Massport on any platform with the airSlate SignNow apps for Android or iOS, and streamline your document-related tasks today.

Edit and eSign The Contractor's Weekly Workforce Utilization Report Massport with Ease

- Obtain The Contractor's Weekly Workforce Utilization Report Massport and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools offered by airSlate SignNow designed specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Leave behind the worries of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow efficiently manages all your document-related needs with just a few clicks from your device of choice. Modify and eSign The Contractor's Weekly Workforce Utilization Report Massport and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Does a NAFTA TN Management consultant in the U.S. still need to fill out an i-9 form even though they are an independent contractor?

Yes.You must still prove work authorization even though you are a contractor. You will fill out the I9 and indicate that you are an alien authorized to work, and provide the relevant details of your TN visa in support of your application.Hope this helps.

-

If you pay a contractor (in the US) do you need to fill out tax forms? Is it different if I am in the US paying contractors outside the US?

If you are paying contractors in the U.S. in connection with a trade or business, and you pay any one of them in aggregate in excess of $600, you are required to prepare a 1099 form. In aggregate means that if you paid someone $ 400, and then later paid them $ 201, you’d be liable to prepare the 1099.If you pay persons that are not in the U.S., then your only requirement is to ascertain that they are not U.S. citizens or U.S. permanent residents. If either of those situations apply, then the $ 600 rule applies.

-

When you start working as an independent contractor for companies like Leapforce/Appen, how do you file for taxes? Do you fill out the W-8BEN form?

Austin Martin’s answer is spot on. When you are an independent contractor, you are in business for yourself. In other words, you are the business! That means you must pay taxes, and since you aren’t an employee of someone else, you have to make estimated tax payments, which will be “squared up” at year end when you file your tax return

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the the contractors weekly workforce utilization report massport

How to generate an electronic signature for your The Contractors Weekly Workforce Utilization Report Massport in the online mode

How to make an eSignature for your The Contractors Weekly Workforce Utilization Report Massport in Chrome

How to create an eSignature for signing the The Contractors Weekly Workforce Utilization Report Massport in Gmail

How to make an eSignature for the The Contractors Weekly Workforce Utilization Report Massport from your smartphone

How to make an eSignature for the The Contractors Weekly Workforce Utilization Report Massport on iOS

How to generate an eSignature for the The Contractors Weekly Workforce Utilization Report Massport on Android OS

People also ask

-

What is The Contractor's Weekly Workforce Utilization Report Massport?

The Contractor's Weekly Workforce Utilization Report Massport is a vital document used to track workforce deployment and compliance on Massport projects. This report helps contractors ensure they are meeting workforce goals while providing transparency to stakeholders.

-

How can I create The Contractor's Weekly Workforce Utilization Report Massport using airSlate SignNow?

Creating The Contractor's Weekly Workforce Utilization Report Massport with airSlate SignNow is simple and efficient. Our platform allows you to customize templates, input necessary data, and electronically sign the report, streamlining the entire process.

-

What are the benefits of using The Contractor's Weekly Workforce Utilization Report Massport?

Using The Contractor's Weekly Workforce Utilization Report Massport helps improve project oversight and labor compliance. It ensures that contractors align with Massport's workforce goals, enhancing accountability and project efficiency.

-

Is there a cost associated with generating The Contractor's Weekly Workforce Utilization Report Massport?

While airSlate SignNow offers various pricing plans, generating The Contractor's Weekly Workforce Utilization Report Massport is included within these plans. Our cost-effective solution provides great value for businesses needing to manage compliance and documentation.

-

Can The Contractor's Weekly Workforce Utilization Report Massport be integrated with other tools?

Yes, The Contractor's Weekly Workforce Utilization Report Massport can be integrated with various project management and HR tools. airSlate SignNow supports these integrations, ensuring seamless data flow and improved workflow efficiency.

-

How does airSlate SignNow ensure the security of The Contractor's Weekly Workforce Utilization Report Massport?

airSlate SignNow prioritizes security for all documents, including The Contractor's Weekly Workforce Utilization Report Massport. Our platform utilizes encryption, secure access controls, and compliance with industry standards to protect sensitive information.

-

What features does airSlate SignNow offer for The Contractor's Weekly Workforce Utilization Report Massport?

airSlate SignNow provides features like customizable templates, electronic signatures, and real-time tracking for The Contractor's Weekly Workforce Utilization Report Massport. These features enhance usability and streamline the reporting process for contractors.

Get more for The Contractor's Weekly Workforce Utilization Report Massport

Find out other The Contractor's Weekly Workforce Utilization Report Massport

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document