Goodwill Donation Receipt Form

What is the Goodwill Donation Receipt

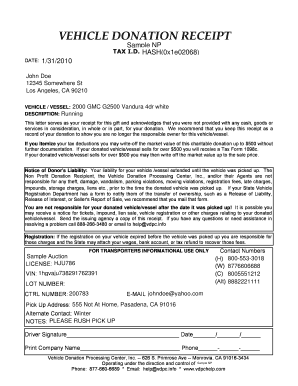

The Goodwill donation receipt is a formal document provided to donors when they contribute goods or services to Goodwill Industries. This receipt serves as proof of the donation and is essential for tax purposes. It typically includes details such as the donor's name, the date of the donation, a description of the items donated, and the estimated value of those items. The receipt allows donors to claim tax deductions during their annual tax filing, adhering to IRS guidelines.

Key elements of the Goodwill Donation Receipt

A Goodwill donation receipt should contain specific information to ensure it meets IRS requirements. Key elements include:

- Donor Information: Name and address of the donor.

- Date of Donation: The date when the items were donated.

- Description of Donated Items: A detailed list of items donated, which can include clothing, furniture, and household goods.

- Estimated Value: An estimate of the fair market value of the donated items.

- Goodwill Information: The name and address of the Goodwill location receiving the donation.

How to obtain the Goodwill Donation Receipt

To obtain a Goodwill donation receipt, donors should follow these steps:

- Visit a local Goodwill location and present the items for donation.

- Request a receipt from the staff at the donation center.

- Ensure all necessary information is included on the receipt before leaving the location.

For online donations, donors may receive a digital receipt via email or through the Goodwill website, depending on the donation method used.

Steps to complete the Goodwill Donation Receipt

Completing a Goodwill donation receipt involves several straightforward steps:

- Gather all relevant details about the donation, including the items and their estimated values.

- Fill out the receipt with the donor's information and the donation details.

- Ensure the receipt is signed by a Goodwill representative to validate the donation.

- Keep a copy of the receipt for personal records and tax filing purposes.

IRS Guidelines

The IRS provides specific guidelines regarding charitable donations, including those made to Goodwill. Donors should be aware that:

- Donations must be made to qualified organizations, such as Goodwill, to be tax-deductible.

- Donors should maintain accurate records of their donations, including receipts, to substantiate claims on their tax returns.

- For items valued over $500, donors may need to complete additional IRS forms, such as Form 8283.

Legal use of the Goodwill Donation Receipt

The Goodwill donation receipt serves a legal purpose in documenting charitable contributions. It is important for donors to understand that:

- The receipt must accurately reflect the donation details to be valid for tax purposes.

- Using the receipt for fraudulent claims can result in penalties from the IRS.

- Donors are responsible for determining the fair market value of their donated items.

Quick guide on how to complete goodwill donation receipt 180210

Complete Goodwill Donation Receipt effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the features you require to create, alter, and eSign your documents promptly without any holdups. Manage Goodwill Donation Receipt on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Goodwill Donation Receipt with ease

- Find Goodwill Donation Receipt and click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with the tools provided by airSlate SignNow crafted specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and provides the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Goodwill Donation Receipt to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the goodwill donation receipt 180210

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a printable donation receipt?

A printable donation receipt is a document provided to donors as proof of their contribution. It includes essential details such as the donor's name, donation amount, and the charitable organization's information. This receipt is crucial for tax deductions and record-keeping.

-

How can I create a printable donation receipt using airSlate SignNow?

Creating a printable donation receipt with airSlate SignNow is simple and efficient. You can use customizable templates to add specific details about the donation. Once completed, the receipt can be downloaded in a printable format for your records or to share with donors.

-

Is there a cost associated with generating a printable donation receipt?

airSlate SignNow offers a cost-effective solution for generating printable donation receipts. The pricing is competitive, allowing organizations of all sizes to access powerful document management features without breaking the bank. Explore our pricing plans to find the best option for your needs.

-

What features does airSlate SignNow offer for creating donation receipts?

airSlate SignNow provides a variety of features to enhance the process of creating donation receipts. You can choose from editable templates, add digital signatures, and automatically store documents in the cloud. These features help streamline your donation management process.

-

Can I customize my printable donation receipt?

Yes, you can fully customize your printable donation receipt in airSlate SignNow. Modify text, add your organization’s logo, and change the layout to match your branding. This ensures that your receipts not only meet legal requirements but also represent your organization professionally.

-

How does airSlate SignNow integrate with other donation platforms?

airSlate SignNow seamlessly integrates with various donation platforms, allowing for efficient receipt generation. This integration enables you to automate the process of creating printable donation receipts from your existing donation records. Enhance your workflow by connecting airSlate SignNow with your favorite tools.

-

What are the benefits of using printable donation receipts for my nonprofit?

Printable donation receipts serve multiple benefits for nonprofits, including tax deduction support and enhancing donor trust. By providing a professional and detailed receipt, you establish credibility with your donors. Additionally, organized records can improve your financial reporting and transparency.

Get more for Goodwill Donation Receipt

- Bof 119 form

- Zen guitar pdf form

- How to fill form sample for 8

- Storyworks stone soup form

- Washington legal last will and testament form for divorced person not remarried with adult children 3194554

- Formspal compdf formsotherapplication for motor vehicle permit number mechanic trainee

- Series llc operating agreement template form

- Single member operating agreement template form

Find out other Goodwill Donation Receipt

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney