SBA Form 1149 Lender's Transcript of Account Interest Payable to Lender 2018

Understanding the SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender

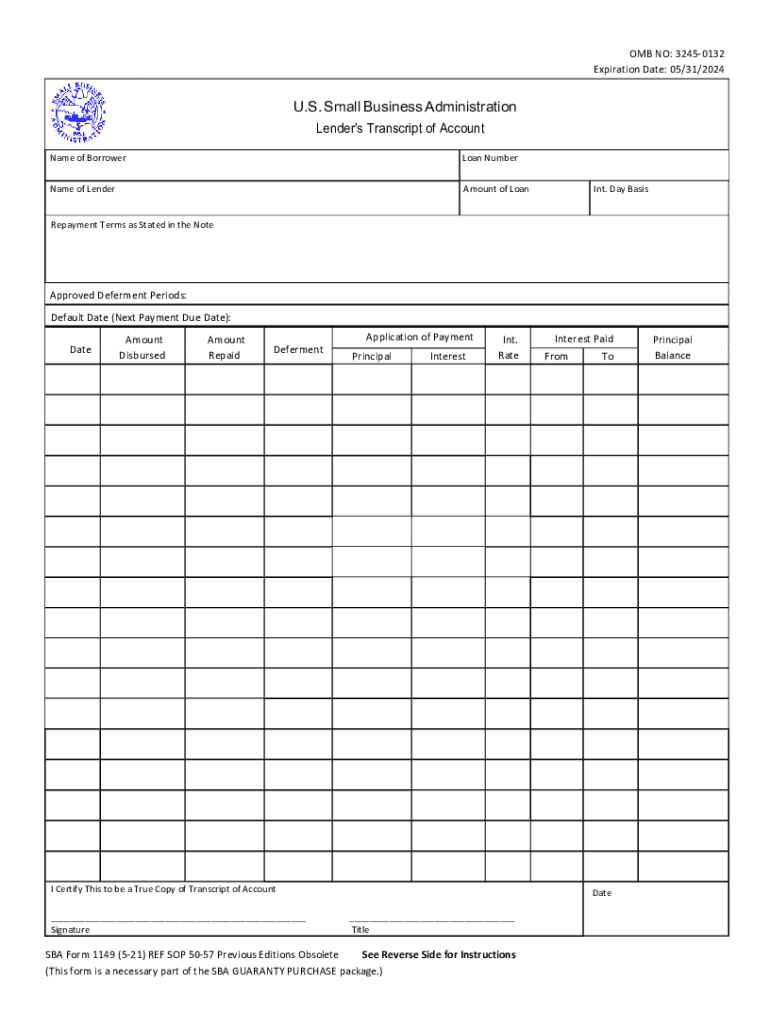

The SBA Form 1149, also known as the Lender's Transcript Of Account Interest Payable To Lender, is a critical document used by lenders to report the interest payable on loans backed by the Small Business Administration (SBA). This form provides detailed information regarding the loan account, including the balance, interest accrued, and payment history. It is essential for both lenders and borrowers to ensure accurate reporting and compliance with SBA regulations.

How to Use the SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender

The SBA Form 1149 is primarily utilized by lenders to document the interest amounts that are due on SBA-backed loans. Lenders should fill out this form to provide a clear record of the interest payable, which can be essential for financial reporting and loan servicing. Borrowers may also request this form to verify their loan details and ensure that all payments are accurately recorded. Proper use of this form helps maintain transparency between lenders and borrowers.

Steps to Complete the SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender

Completing the SBA Form 1149 involves several key steps:

- Gather all relevant loan documentation, including loan agreements and payment history.

- Input the borrower’s information, including name, address, and loan account number.

- Detail the loan amount, interest rate, and terms of the loan.

- Calculate the total interest payable and provide a breakdown of any payments made.

- Review the information for accuracy before submission.

Once completed, the form should be submitted to the appropriate SBA office or lender for processing.

Legal Use of the SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender

The SBA Form 1149 serves a legal purpose by documenting the financial obligations of borrowers under SBA-backed loans. It is important for lenders to maintain accurate records, as this form can be used in legal proceedings to verify the terms of the loan and the status of payments. Both lenders and borrowers should understand the legal implications of the information provided on this form, ensuring compliance with all relevant regulations.

Key Elements of the SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender

Several key elements are essential to the SBA Form 1149:

- Borrower Information: Includes the name and address of the borrower.

- Loan Details: Specifies the loan amount, interest rate, and maturity date.

- Payment History: A record of all payments made, including dates and amounts.

- Interest Calculation: Total interest payable, broken down by period.

These elements ensure that the form provides a comprehensive overview of the loan account, facilitating effective communication between lenders and borrowers.

Obtaining the SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender

The SBA Form 1149 can be obtained directly from the lender or through the SBA’s official channels. Lenders typically have copies available for their borrowers upon request. Additionally, the form may be accessible through SBA resources or financial institutions that participate in SBA loan programs. It is advisable for borrowers to reach out to their lenders for the most accurate and up-to-date version of the form.

Quick guide on how to complete sba form 1149 lenders transcript of account interest payable to lender

Effortlessly Prepare SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender Easily

- Find SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you would like to send your form—via email, SMS, or invite link—or download it to your computer.

Eliminate the stress of lost or misplaced documents, laborious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your preference. Modify and electronically sign SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender to ensure excellent communication at any stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sba form 1149 lenders transcript of account interest payable to lender

Create this form in 5 minutes!

How to create an eSignature for the sba form 1149 lenders transcript of account interest payable to lender

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender?

SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender is a crucial financial document that provides detailed information regarding the interest payments applicable to lenders under the SBA loan programs. This form is essential for both lenders and borrowers to maintain clarity on interest obligations.

-

How can airSlate SignNow simplify the completion of SBA Form 1149?

With airSlate SignNow, users can easily fill out and eSign the SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender through our intuitive platform. This simplifies the documentation process, ensuring that all necessary signatures and data are completed efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for SBA Form 1149?

Yes, airSlate SignNow offers various subscription plans that cater to different business needs, allowing users to complete and manage the SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender. Our pricing is competitive and designed to provide value through cost-effective eSigning solutions.

-

What features does airSlate SignNow offer for managing SBA Form 1149?

airSlate SignNow provides key features such as automated workflows, cloud storage, and customizable templates to help you manage the SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender. These functionalities streamline your document handling, ensuring compliance and reducing processing times.

-

Can I integrate airSlate SignNow with other software for SBA Form 1149 processing?

Absolutely! airSlate SignNow seamlessly integrates with popular business applications, enhancing your workflow when dealing with SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender. This integration allows for better document management and improved inter-departmental communication.

-

What are the benefits of eSigning the SBA Form 1149 with airSlate SignNow?

By eSigning the SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender through airSlate SignNow, you enjoy a faster turnaround time and enhanced security. Our platform also provides an audit trail, which ensures accountability and transparency in the document flow.

-

How does airSlate SignNow ensure the security of SBA Form 1149 information?

airSlate SignNow employs advanced encryption and security protocols to protect all data associated with the SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender. This guarantees that sensitive information remains confidential and secure throughout the signing process.

Get more for SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender

- Privacy release form congressman a drew ferguson

- Form ta 2 hawaii

- Mom declare business activity form

- Northern great lakes realtors multiple listing form

- Laguardia community college transcript request form

- Form 04an016e

- Form n 311 rev refundable foodexcise tax credit forms fillable

- State earned income tax credit form

Find out other SBA Form 1149 Lender's Transcript Of Account Interest Payable To Lender

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online