Otsego County Room Occupancy Tax Return Form

Understanding the Otsego County Room Occupancy Tax Return

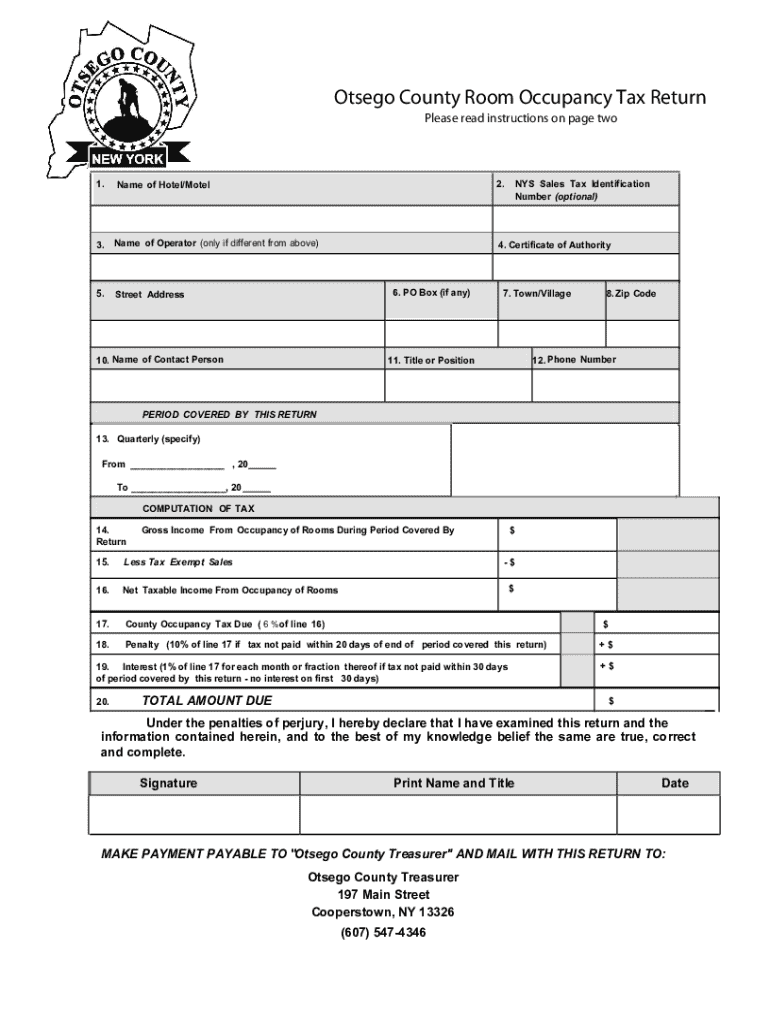

The Otsego County Room Occupancy Tax Return is a specific form used by businesses that provide lodging services in Otsego County, New York. This form is essential for reporting the collection of room occupancy taxes, which are levied on guests staying in hotels, motels, and other short-term rental accommodations. The revenue generated from this tax is typically used to promote tourism and support local infrastructure.

Steps to Complete the Otsego County Room Occupancy Tax Return

Completing the Otsego County Room Occupancy Tax Return involves several key steps:

- Gather necessary information: Collect details about your lodging business, including the total number of rooms, occupancy rates, and the amount of tax collected from guests.

- Fill out the form: Enter the required information accurately on the tax return form, ensuring that all figures are correct to avoid penalties.

- Review your submission: Double-check all entries for accuracy and completeness before submission.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent by the deadline.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the Otsego County Room Occupancy Tax Return. Typically, returns are due on a quarterly basis, with specific dates set by the county. Missing these deadlines can result in penalties, so keeping track of these dates is essential for compliance.

Required Documents for Submission

When submitting the Otsego County Room Occupancy Tax Return, certain documents may be required to support your filing. These can include:

- Proof of tax collected from guests, such as receipts or sales records.

- Any previous tax returns filed for reference.

- Documentation of occupancy rates and room availability.

Form Submission Methods

The Otsego County Room Occupancy Tax Return can be submitted through various methods to accommodate different preferences:

- Online: Many businesses prefer to file electronically for convenience and speed.

- By mail: Paper forms can be mailed to the designated county office.

- In person: Submissions can also be made directly at the county office, allowing for immediate confirmation of receipt.

Penalties for Non-Compliance

Failure to file the Otsego County Room Occupancy Tax Return on time or inaccuracies in reporting can lead to penalties. These may include fines or interest on unpaid taxes. It is important for businesses to understand these consequences and ensure timely and accurate submissions to avoid financial repercussions.

Quick guide on how to complete otsego county room occupancy tax return

Easily Prepare Otsego County Room Occupancy Tax Return on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Handle Otsego County Room Occupancy Tax Return on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Otsego County Room Occupancy Tax Return Effortlessly

- Obtain Otsego County Room Occupancy Tax Return and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, exhausting form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Otsego County Room Occupancy Tax Return while ensuring effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the otsego county room occupancy tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a New York tax return?

A New York tax return is a document that individuals and businesses must file with the state of New York to report income and calculate taxes owed. It details your income, deductions, and credits, ensuring you meet state tax obligations. Filing a New York tax return accurately is crucial to avoid penalties and ensure compliance.

-

How can airSlate SignNow assist with my New York tax return?

AirSlate SignNow enables you to easily send, sign, and manage your New York tax return documents. With a user-friendly interface, you can streamline the e-signing process for your tax forms, making it faster and more efficient. Our platform helps you stay organized, ensuring all necessary filings are completed on time.

-

What features does airSlate SignNow offer for New York tax return preparation?

AirSlate SignNow offers features such as document sharing, templates for common tax forms, and secure, legally binding electronic signatures. These tools simplify the preparation and submission of your New York tax return, saving you time and effort. You can also track document status to stay updated throughout the process.

-

Is there a cost associated with using airSlate SignNow for my New York tax return?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs. Our subscription plans allow you to choose the level of service that fits your budget while ensuring efficient management of your New York tax return. We strive to provide a cost-effective solution without compromising on quality.

-

Can I integrate airSlate SignNow with other platforms for my New York tax return?

Absolutely! AirSlate SignNow integrates seamlessly with various platforms, including accounting software, cloud storage solutions, and project management tools. This integration allows you to efficiently manage your New York tax return alongside other business processes, enhancing overall productivity and workflow.

-

What benefits can I expect when using airSlate SignNow for my New York tax return?

Using airSlate SignNow for your New York tax return offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our e-signature technology ensures that your documents remain secure and compliant with regulations. You'll also enjoy faster turnaround times for document processing.

-

Is airSlate SignNow suitable for both individuals and businesses filing New York tax returns?

Yes, airSlate SignNow is designed to cater to both individuals and businesses when filing New York tax returns. Whether you're managing personal tax documents or handling complex business tax issues, our platform provides the tools you need for a smooth e-signing experience. This versatility makes it an ideal solution for various tax scenarios.

Get more for Otsego County Room Occupancy Tax Return

- Woodmans employment application jobapplicationform

- Ohio it 4nr form

- Guided reading activity the rise of civilization answer key form

- Aice bid form

- Easa technical occurance report form

- Form 1040n nebraska individual income tax return taxhow

- Vfw membership mail in application vfw post 9927 form

- Address registration permission form

Find out other Otsego County Room Occupancy Tax Return

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney