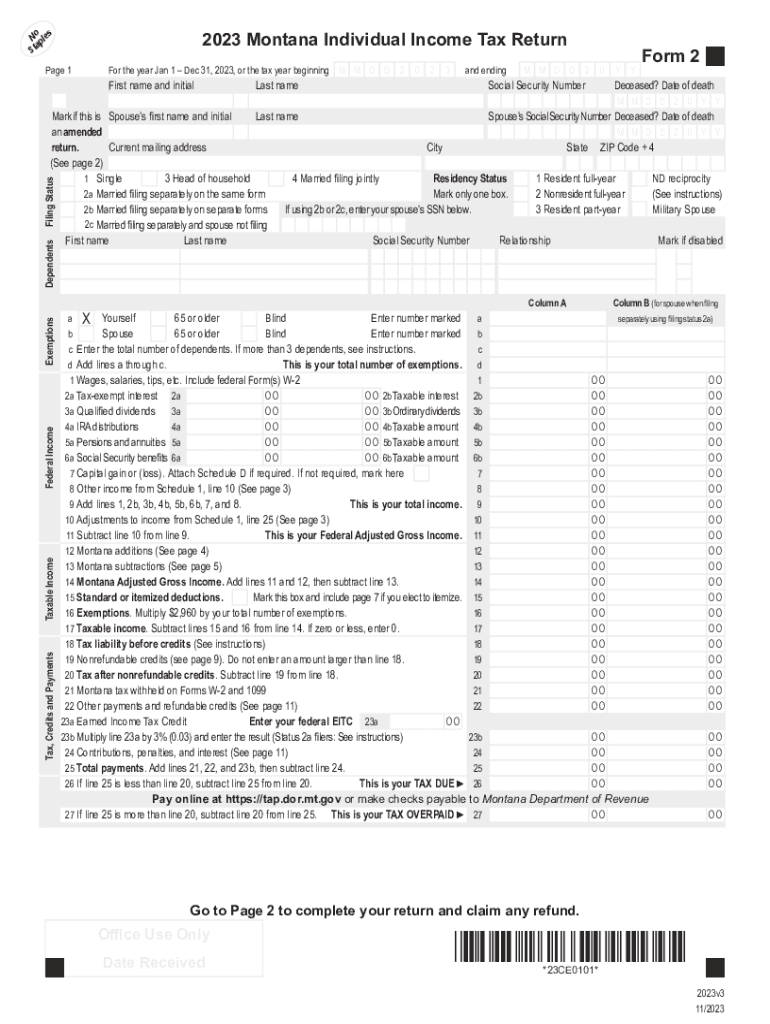

Montana Individual Income Tax Return 2023

Understanding the Montana Individual Income Tax Return

The Montana Individual Income Tax Return, commonly referred to as the 2023 Montana return, is a crucial document for residents who earn income in Montana. This form is used to report individual income, calculate tax liability, and determine eligibility for various credits and deductions. It is essential for ensuring compliance with state tax laws and for contributing to the funding of public services in Montana.

Steps to Complete the Montana Individual Income Tax Return

Completing the 2023 Montana form 2 requires careful attention to detail. Here are the general steps to follow:

- Gather all necessary documents, including W-2s, 1099s, and any other income records.

- Determine your filing status, which can affect your tax rate and eligibility for certain credits.

- Fill out the form by entering your personal information, income, and any deductions or credits you qualify for.

- Double-check your calculations to ensure accuracy.

- Sign and date the form before submission.

Filing Deadlines and Important Dates

For the 2023 Montana return, it is important to be aware of key deadlines to avoid penalties. Typically, individual income tax returns are due on April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, if you are unable to file by the deadline, you may apply for an extension, but it is crucial to pay any estimated taxes owed to avoid interest and penalties.

Required Documents for Filing

To successfully file your 2023 Montana return, you will need several documents. These typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits you plan to claim, such as student loan interest or mortgage interest statements

- Identification information, including your Social Security number

Form Submission Methods

The 2023 Montana form 2 can be submitted through various methods, providing flexibility for taxpayers. You can file online using the Montana Department of Revenue’s e-filing system, which is often the fastest method. Alternatively, you may choose to mail your completed form to the appropriate address provided by the state. In-person submissions may also be available at designated tax offices, allowing for direct assistance if needed.

Key Elements of the Montana Individual Income Tax Return

The Montana return includes several key elements that taxpayers must understand. These include:

- Personal information section for taxpayer identification

- Income section to report all sources of income

- Deductions and credits that can reduce tax liability

- Signature section to validate the return

Eligibility Criteria for Filing

To file the 2023 Montana return, individuals must meet specific eligibility criteria. Generally, residents who earn income in Montana are required to file. This includes individuals with wages, self-employment income, or other taxable income sources. Additionally, certain income thresholds may determine whether you are required to file or if you can file voluntarily to claim a refund for overpaid taxes.

Quick guide on how to complete montana individual income tax return 708733372

Prepare Montana Individual Income Tax Return with ease on any device

Managing documents online has gained popularity among businesses and individuals. It presents an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it in the cloud. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly and without hiccups. Handle Montana Individual Income Tax Return on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and electronically sign Montana Individual Income Tax Return effortlessly

- Obtain Montana Individual Income Tax Return and click on Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive data using tools that airSlate SignNow has specifically designed for this purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form: by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form navigation, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Montana Individual Income Tax Return to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct montana individual income tax return 708733372

Create this form in 5 minutes!

How to create an eSignature for the montana individual income tax return 708733372

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow solution for the 2023 Montana return?

The airSlate SignNow platform provides a streamlined way to eSign documents for your 2023 Montana return. With our user-friendly interface, you can easily create, send, and manage your tax documents, ensuring a hassle-free filing experience.

-

How much does airSlate SignNow cost for handling the 2023 Montana return?

airSlate SignNow offers competitive pricing tailored to meet the needs of businesses preparing the 2023 Montana return. Our affordable plans allow you to eSign documents without breaking the bank, making compliance simple and cost-effective.

-

What features does airSlate SignNow have for the 2023 Montana return?

Our platform includes a variety of features designed for the 2023 Montana return, such as customizable templates, cloud storage integration, and advanced tracking tools. These features enhance the efficiency of your document management process.

-

Are there any benefits to using airSlate SignNow for the 2023 Montana return?

Using airSlate SignNow for your 2023 Montana return offers numerous benefits, including reduced turnaround times and increased document security. Our digital solution simplifies collaboration, letting you focus on your business while we handle the paperwork.

-

Can I integrate airSlate SignNow with other tools to manage my 2023 Montana return?

Yes, airSlate SignNow can easily integrate with various applications to help you manage your 2023 Montana return more effectively. Whether you use CRM software or productivity tools, our integrations streamline the process and enhance interoperability.

-

How does airSlate SignNow ensure the security of my 2023 Montana return documents?

Security is a top priority at airSlate SignNow. For your 2023 Montana return, we implement robust encryption protocols and comply with industry standards to ensure that your sensitive documents are protected from unauthorized access.

-

Is training needed to use airSlate SignNow for the 2023 Montana return?

No extensive training is necessary to use airSlate SignNow for your 2023 Montana return. Our intuitive interface makes it easy for anyone to start eSigning and managing documents quickly, allowing you to get started without delay.

Get more for Montana Individual Income Tax Return

- Legal services american bar association dpaweb hss state ak form

- Adph online incident reporting form

- Blue cross blue shield of alabama reimbursement form

- Birth certificate application arkansas department of humanservices arkansas form

- Printable medicaid application for arkansas 2010 form

- Letter of phlebotomy experience for california certification cdph ca form

- Associate family therapist application form

- Letter of phlebotomy experience for california certification form

Find out other Montana Individual Income Tax Return

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation