Form 5310 a Rev November Irs 2010-2026

What is the Form 5310 A Rev November IRS

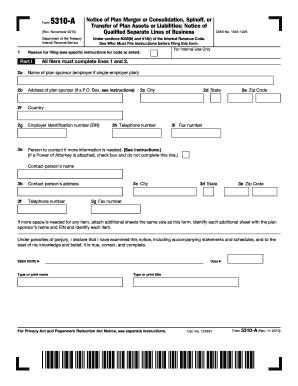

The Form 5310 A, also known as the Application for Determination of Whether the Plan Meets the Qualification Requirements of Section 401(a) of the Internal Revenue Code, is a crucial document used by plan sponsors to request a determination letter from the IRS. This letter confirms that a retirement plan meets the necessary qualification requirements under federal tax law. The form is specifically designed for plans that have undergone significant changes, such as mergers or plan amendments, ensuring compliance with IRS regulations.

How to use the Form 5310 A Rev November IRS

Using the Form 5310 A involves several key steps. First, gather all relevant plan documents, including amendments and prior determination letters. Next, complete the form by providing detailed information about the plan, including its name, sponsor, and the specific changes being made. It is essential to ensure that all information is accurate and complete to avoid delays in processing. After completing the form, submit it to the IRS along with any required fees and supporting documentation.

Steps to complete the Form 5310 A Rev November IRS

Completing the Form 5310 A requires careful attention to detail. Follow these steps:

- Review the instructions provided by the IRS to understand the requirements.

- Fill out the plan sponsor's information, including the name, address, and employer identification number (EIN).

- Describe the plan and the reason for the application, detailing any amendments or changes.

- Attach necessary documents, such as plan amendments and prior determination letters.

- Sign and date the form, ensuring that the person signing has the authority to do so.

Legal use of the Form 5310 A Rev November IRS

The legal use of the Form 5310 A is vital for maintaining compliance with the Internal Revenue Code. This form is used to ensure that retirement plans adhere to tax qualification standards. Failure to submit this form when required can lead to penalties and loss of tax-exempt status for the plan. It is important for plan sponsors to understand the legal implications of their submissions and to keep records of all correspondence with the IRS regarding the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 5310 A are crucial for plan sponsors to note. Typically, the form must be filed within a specific timeframe following the adoption of a plan amendment or change. The IRS provides guidelines on these deadlines, which can vary based on the nature of the changes being made. It is advisable to check the latest IRS publications for any updates regarding filing dates to ensure compliance and avoid potential penalties.

Required Documents

When submitting the Form 5310 A, several supporting documents are required to facilitate the review process. These may include:

- Copies of the plan document and any amendments.

- Prior determination letters, if applicable.

- Any additional documentation that supports the changes made to the plan.

Providing complete and accurate documentation is essential for a smooth review process by the IRS.

Quick guide on how to complete form 5310 a rev november irs

Complete Form 5310 A Rev November Irs effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Form 5310 A Rev November Irs on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to modify and eSign Form 5310 A Rev November Irs with ease

- Obtain Form 5310 A Rev November Irs and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 5310 A Rev November Irs and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5310 a rev november irs

Create this form in 5 minutes!

How to create an eSignature for the form 5310 a rev november irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 5310 a form and why is it important?

The 5310 a form is a critical document used in various business processes, particularly in compliance and regulatory settings. It helps in streamlining document submission and record-keeping, ensuring that businesses stay compliant with relevant regulations.

-

How can airSlate SignNow help me with the 5310 a form?

airSlate SignNow allows you to easily create, send, and eSign the 5310 a form, making the entire process more efficient and less time-consuming. With our platform, you can ensure that your 5310 a form is completed accurately and securely.

-

What are the pricing options for using airSlate SignNow to manage the 5310 a form?

Our pricing plans for airSlate SignNow are designed to cater to businesses of all sizes, making it cost-effective for managing documents like the 5310 a form. You can choose from monthly or annual subscriptions, each offering specific features and support tailored to your needs.

-

What features does airSlate SignNow offer for the 5310 a form?

Key features of airSlate SignNow for the 5310 a form include customizable templates, secure eSigning, and real-time tracking of document status. These functionalities ensure that your forms are not only completed swiftly but also maintained with high security.

-

Can I integrate airSlate SignNow with other tools for my 5310 a form?

Yes, airSlate SignNow supports integration with various third-party tools and platforms. This means you can streamline your workflow and easily manage the 5310 a form alongside your other business applications for enhanced productivity.

-

What benefits does eSigning the 5310 a form provide?

eSigning the 5310 a form through airSlate SignNow offers numerous benefits, including faster turnaround times and reduced paper usage. This not only enhances efficiency but also supports environmentally friendly practices, which is increasingly important for businesses today.

-

Is airSlate SignNow user-friendly for completing the 5310 a form?

Absolutely! airSlate SignNow is designed with user experience in mind, ensuring that completing the 5310 a form is straightforward and intuitive. With a simple interface, users can navigate the platform with ease, regardless of their technical skills.

Get more for Form 5310 A Rev November Irs

- Copyright form ijecs

- Cosmos insurance claim form

- Lesson 4 algebra write expressions page 467 answers form

- Fumigation notice to neighbors sample form

- Arizona fillable tax forms

- Anesthesiologist per diem malpractice application form

- Credit hire agreement template form

- Credit facility agreement template form

Find out other Form 5310 A Rev November Irs

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word