WCWT 6 Net Profits Tax Return WCWT 6 Net Profits Tax Return 2020

Understanding the WCWT 6 Net Profits Tax Return

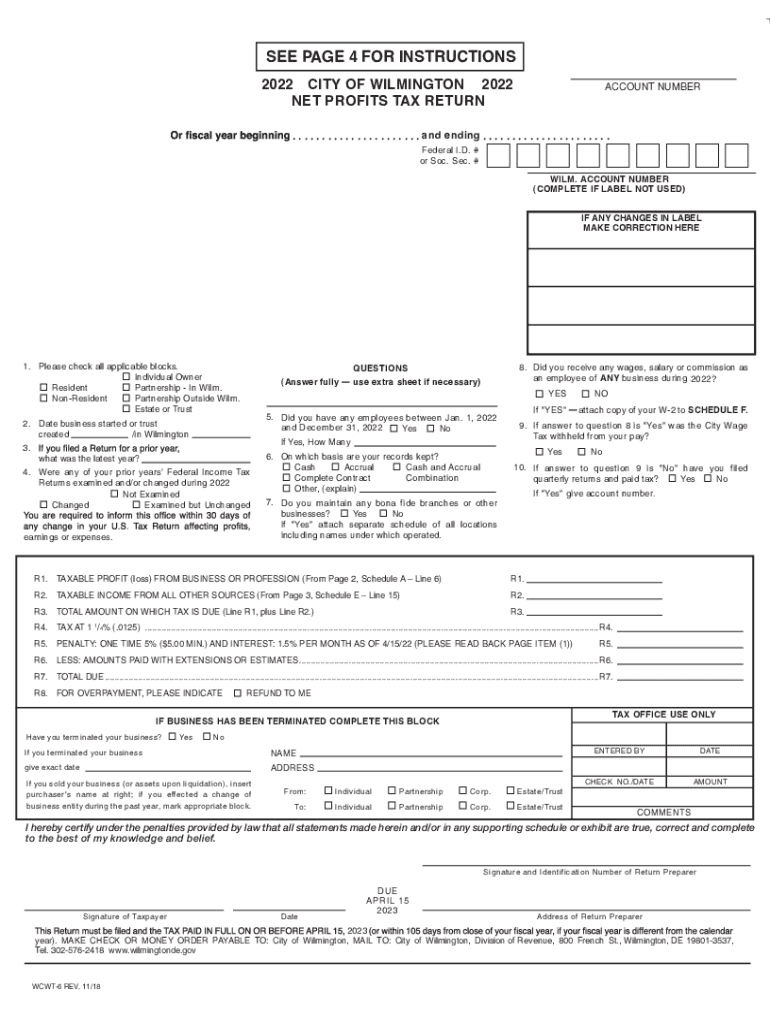

The WCWT 6 Net Profits Tax Return is a crucial document for businesses operating in Wilmington, Delaware. This form is specifically designed to report net profits and calculate the associated tax obligations. It is essential for ensuring compliance with local tax regulations. Businesses must accurately complete this form to avoid potential penalties and ensure they meet their financial responsibilities within the city.

Steps to Complete the WCWT 6 Net Profits Tax Return

Completing the WCWT 6 involves several key steps. First, gather all necessary financial documents, including income statements and expense reports. Next, calculate your total net profits by subtracting allowable deductions from your gross income. Once you have this figure, fill out the WCWT 6 form, ensuring all sections are completed accurately. Finally, review your entries for any discrepancies before submitting the form to the appropriate tax authority.

How to Obtain the WCWT 6 Net Profits Tax Return

Businesses can obtain the WCWT 6 Net Profits Tax Return through the City of Wilmington's official website or by visiting the local tax office. The form is typically available in both digital and paper formats, allowing for flexibility in how businesses choose to file. It is advisable to check for the latest version to ensure compliance with current tax regulations.

Key Elements of the WCWT 6 Net Profits Tax Return

The WCWT 6 form includes several key elements that must be addressed. These include the business's name, address, and federal tax identification number. Additionally, the form requires detailed reporting of gross receipts, allowable deductions, and the final net profit figure. Each section must be filled out with precision to ensure accurate tax calculations.

Filing Deadlines for the WCWT 6 Net Profits Tax Return

Timely filing of the WCWT 6 is essential to avoid penalties. The deadline for submitting this form is typically aligned with the business's fiscal year-end. Businesses should mark their calendars and prepare in advance to ensure they meet the required submission date. Late filings may incur additional fees and interest on owed taxes.

Penalties for Non-Compliance with the WCWT 6

Failure to file the WCWT 6 Net Profits Tax Return can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to understand their obligations and ensure timely and accurate filing to mitigate these risks. Regular consultations with a tax professional can help maintain compliance.

Quick guide on how to complete wcwt 6 net profits tax return wcwt 6 net profits tax return

Complete WCWT 6 Net Profits Tax Return WCWT 6 Net Profits Tax Return seamlessly on any device

Web-based document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage WCWT 6 Net Profits Tax Return WCWT 6 Net Profits Tax Return on any platform using airSlate SignNow's Android or iOS applications and optimize any document-related task today.

The easiest way to modify and eSign WCWT 6 Net Profits Tax Return WCWT 6 Net Profits Tax Return effortlessly

- Obtain WCWT 6 Net Profits Tax Return WCWT 6 Net Profits Tax Return and then click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Decide how you would like to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign WCWT 6 Net Profits Tax Return WCWT 6 Net Profits Tax Return and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wcwt 6 net profits tax return wcwt 6 net profits tax return

Create this form in 5 minutes!

How to create an eSignature for the wcwt 6 net profits tax return wcwt 6 net profits tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is wcwt 6 and how does it benefit businesses using airSlate SignNow?

wcwt 6 is a streamlined electronic signature solution offered by airSlate SignNow that enhances document workflow efficiency. By integrating wcwt 6, businesses can easily send, sign, and manage documents digitally, reducing the time and resources spent on traditional paper-based processes.

-

How much does airSlate SignNow cost with wcwt 6 features?

The pricing for airSlate SignNow varies based on the plan selected, but it remains competitive and affordable when utilizing wcwt 6 features. As your business scales, you can choose from different subscription tiers that cater to varying needs, ensuring you receive the best value for your investment.

-

What are the primary features of wcwt 6 in airSlate SignNow?

wcwt 6 includes key features such as customizable templates, real-time collaboration, and secure cloud storage. These functionalities not only simplify document handling but also enhance the overall signing experience for both senders and recipients using airSlate SignNow.

-

Is airSlate SignNow with wcwt 6 easy to integrate with existing systems?

Absolutely! airSlate SignNow's wcwt 6 can seamlessly integrate with a variety of popular business applications. This eliminates any barriers and allows users to incorporate eSigning into their existing workflows, ensuring a smooth transition and enhancing productivity.

-

Can I track the status of documents signed using wcwt 6?

Yes, airSlate SignNow provides comprehensive tracking capabilities for documents processed through wcwt 6. Users can monitor the signing status in real-time, receive notifications, and generate detailed reports, ensuring full control over their document workflows.

-

What types of documents can I send for eSigning with wcwt 6?

You can send a wide range of documents for eSigning with airSlate SignNow's wcwt 6, including contracts, agreements, forms, and more. This versatility helps businesses streamline their operations by allowing them to manage all types of documentation in one efficient platform.

-

Is airSlate SignNow with wcwt 6 secure for handling sensitive information?

Yes, airSlate SignNow prioritizes security, and wcwt 6 adheres to high standards of data protection. It implements encryption protocols and adheres to industry regulations to ensure that your sensitive information remains safe and confidential during the signing process.

Get more for WCWT 6 Net Profits Tax Return WCWT 6 Net Profits Tax Return

- Nebraska 1040n fillable form

- Email form

- Schs cheer teacher recommendation form pdf sch rcschools

- Form m100 request for copy of tax return pdf find laws

- Product pick up amp delivery scrub acknowledgement form

- Xfdl viewer online 403832092 form

- Cowlitz county health department restaurants form

- Hypertension evaluation worksheet form

Find out other WCWT 6 Net Profits Tax Return WCWT 6 Net Profits Tax Return

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form