City Property TaxWilmington, DECity Wage & Net Profits TaxesWilmington, DECity Property TaxWilmington, DE 2021-2026

Understanding the Wilmington Net Profits Tax Return

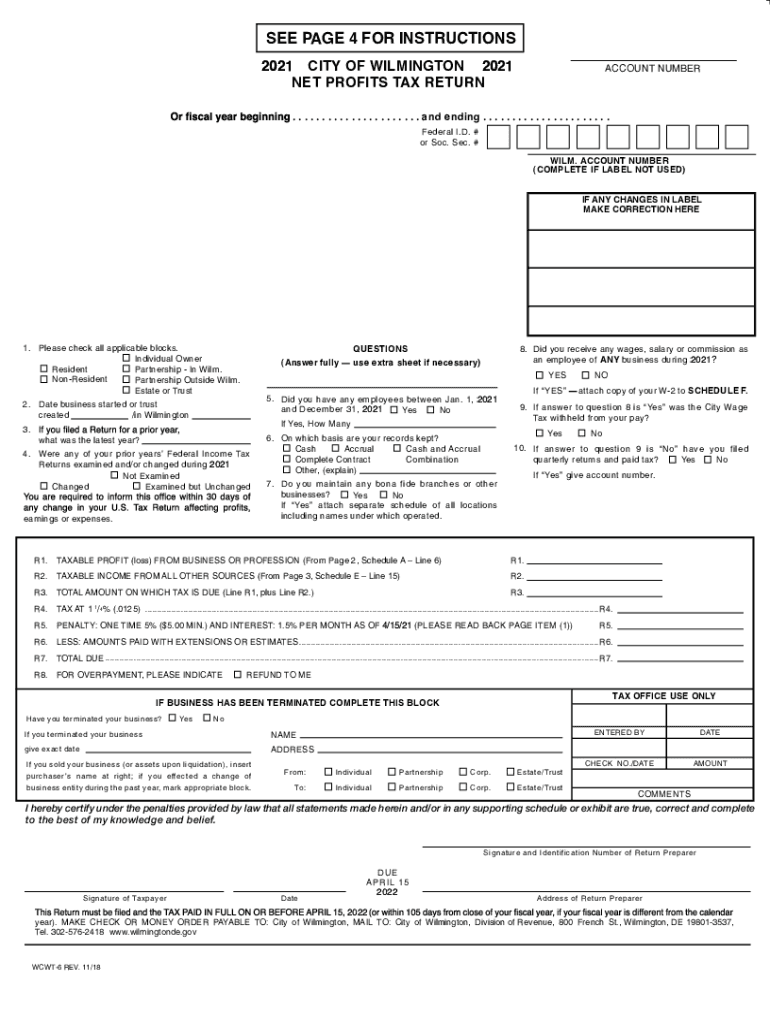

The Wilmington net profits tax return is a crucial document for businesses operating within the city. This tax applies to the net profits of businesses, ensuring that they contribute to the local economy. Understanding this tax is essential for compliance and financial planning. The tax rate is determined by the city and can vary based on the type of business entity. It is important for business owners to familiarize themselves with the specific regulations that govern this tax to avoid penalties.

Steps to Complete the Wilmington Net Profits Tax Return

Completing the Wilmington net profits tax return involves several steps that must be followed carefully. First, gather all necessary financial documents, including profit and loss statements and balance sheets. Next, calculate your net profits by subtracting allowable business expenses from your total income. Once you have your net profit figure, fill out the appropriate tax return form, ensuring that all information is accurate and complete. Finally, submit the form by the designated deadline, either online or via mail, depending on your preference.

Required Documents for Filing

When preparing to file the Wilmington net profits tax return, certain documents are essential. These include:

- Profit and loss statements for the tax year

- Balance sheets

- Records of any deductions or credits claimed

- Previous tax returns for reference

Having these documents ready will streamline the filing process and help ensure accuracy in your submission.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Wilmington net profits tax return to avoid penalties. Typically, the return is due on the fifteenth day of the fourth month following the end of your fiscal year. For businesses operating on a calendar year, this means the deadline is April 15. Marking this date on your calendar can help ensure timely submission and compliance with local tax regulations.

Penalties for Non-Compliance

Failure to file the Wilmington net profits tax return on time can result in significant penalties. These may include late fees, interest on unpaid taxes, and potential legal action for prolonged non-compliance. Understanding these consequences underscores the importance of timely and accurate filing. Business owners should take proactive steps to ensure they meet all tax obligations to avoid these penalties.

Digital vs. Paper Version of the Form

Businesses have the option to file the Wilmington net profits tax return either digitally or using a paper form. The digital version offers convenience, allowing for quick submission and automatic calculations. In contrast, the paper form may be preferred by those who are more comfortable with traditional filing methods. Regardless of the method chosen, ensuring that the form is filled out correctly is essential for compliance.

IRS Guidelines and State-Specific Rules

While filing the Wilmington net profits tax return, it is important to adhere to both IRS guidelines and any state-specific rules that may apply. The IRS provides overarching tax regulations that must be followed, while state rules can offer additional requirements or variations in tax treatment. Familiarizing yourself with both sets of guidelines will help ensure that your filing is compliant and accurate.

Quick guide on how to complete city property taxwilmington decity wage ampamp net profits taxeswilmington decity property taxwilmington de

Effortlessly Prepare City Property TaxWilmington, DECity Wage & Net Profits TaxesWilmington, DECity Property TaxWilmington, DE on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-conscious substitute for conventional printed and signed papers, as you can access the required form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and digitally sign your documents rapidly without delays. Manage City Property TaxWilmington, DECity Wage & Net Profits TaxesWilmington, DECity Property TaxWilmington, DE on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to Modify and eSign City Property TaxWilmington, DECity Wage & Net Profits TaxesWilmington, DECity Property TaxWilmington, DE with Ease

- Obtain City Property TaxWilmington, DECity Wage & Net Profits TaxesWilmington, DECity Property TaxWilmington, DE and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with features that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your updates.

- Select your preferred method to share your form, via email, SMS, invitation link, or download it to your computer.

Wave goodbye to lost or misplaced papers, laborious form searching, or mistakes that necessitate the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign City Property TaxWilmington, DECity Wage & Net Profits TaxesWilmington, DECity Property TaxWilmington, DE to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct city property taxwilmington decity wage ampamp net profits taxeswilmington decity property taxwilmington de

Create this form in 5 minutes!

How to create an eSignature for the city property taxwilmington decity wage ampamp net profits taxeswilmington decity property taxwilmington de

The best way to create an e-signature for a PDF file in the online mode

The best way to create an e-signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your smartphone

The way to generate an e-signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF document on Android

People also ask

-

What is the Wilmington net profits tax return, and why is it important?

The Wilmington net profits tax return is a tax form that businesses in Wilmington must file to report their net profits. It's important because accurate reporting ensures compliance with local tax laws, helps businesses avoid penalties, and allows for proper tax planning.

-

How does airSlate SignNow simplify the Wilmington net profits tax return process?

airSlate SignNow streamlines the Wilmington net profits tax return process by providing an easy-to-use platform for eSigning and sending documents. Its automation features help reduce the time and effort needed to manage tax forms, making the filing process faster and more efficient.

-

What features does airSlate SignNow offer for managing Wilmington net profits tax returns?

airSlate SignNow offers features such as customizable templates, document tracking, and secure cloud storage to manage Wilmington net profits tax returns effectively. These features help ensure your documents are organized and easily accessible throughout the filing process.

-

Is there a cost associated with using airSlate SignNow for Wilmington net profits tax return filings?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective. By choosing the right plan, businesses can access all the necessary features for handling their Wilmington net profits tax return without breaking the bank.

-

Can I integrate airSlate SignNow with my existing accounting software for Wilmington net profits tax returns?

Absolutely! airSlate SignNow integrates seamlessly with major accounting software, streamlining your workflow for Wilmington net profits tax returns. This integration allows you to import data directly into your tax forms, reducing manual entry errors.

-

How secure is airSlate SignNow for submitting Wilmington net profits tax returns?

airSlate SignNow prioritizes security, using advanced encryption and compliance standards to protect your data. This means you can confidently submit your Wilmington net profits tax return, knowing that your information is safe.

-

What are the benefits of using airSlate SignNow for my Wilmington net profits tax return?

Using airSlate SignNow for your Wilmington net profits tax return offers benefits like increased efficiency, reduced paperwork, and faster turnaround times. It provides an organized system for document management, enhancing your overall tax filing experience.

Get more for City Property TaxWilmington, DECity Wage & Net Profits TaxesWilmington, DECity Property TaxWilmington, DE

- Storage business package new jersey form

- Child care services package new jersey form

- New jersey seller form

- Special or limited power of attorney for real estate purchase transaction by purchaser new jersey form

- Limited power of attorney where you specify powers with sample powers included new jersey form

- Limited power of attorney for stock transactions and corporate powers new jersey form

- Special durable power of attorney for bank account matters new jersey form

- New jersey small business startup package new jersey form

Find out other City Property TaxWilmington, DECity Wage & Net Profits TaxesWilmington, DECity Property TaxWilmington, DE

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later