Massachusetts Department of Revenue Form M 706 Mas

What is the Massachusetts Department Of Revenue Form M-706?

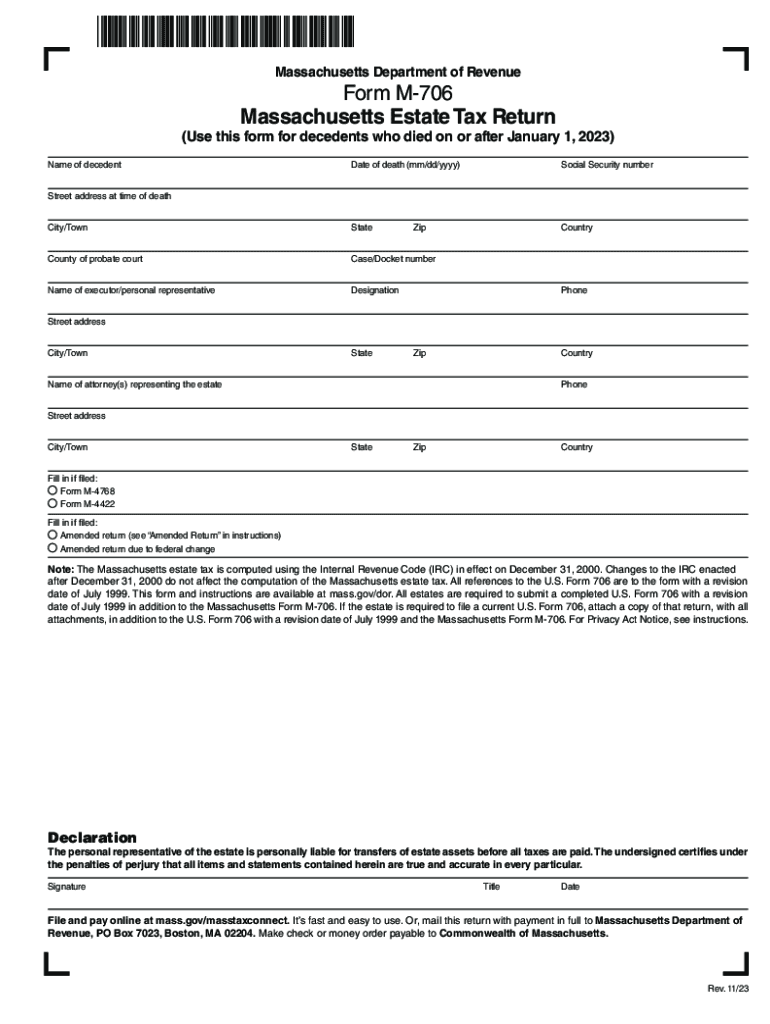

The Massachusetts Department of Revenue Form M-706 is the official estate tax return used to report the estate of a deceased individual. This form is essential for estates that exceed the Massachusetts estate tax exemption threshold. It is designed to calculate the estate tax owed to the state and ensure compliance with Massachusetts tax laws. The form requires detailed information about the decedent's assets, liabilities, and the value of the estate at the time of death.

Steps to Complete the Massachusetts Department Of Revenue Form M-706

Completing Form M-706 involves several key steps:

- Gather necessary documentation, including the decedent's death certificate, asset valuations, and any outstanding liabilities.

- Begin filling out the form by providing the decedent's personal information, including name, date of birth, and date of death.

- List all assets owned by the decedent, including real estate, bank accounts, investments, and personal property.

- Calculate the total value of the estate and any deductions that may apply, such as debts and funeral expenses.

- Determine the estate tax owed based on the calculated value and the applicable tax rates.

- Review the completed form for accuracy before submitting it to the Massachusetts Department of Revenue.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for Form M-706. The estate tax return must be filed within nine months of the decedent's date of death. If additional time is needed, an extension may be requested, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

When filing Form M-706, certain documents are required to support the information provided on the form. These include:

- The decedent's death certificate.

- Documentation of all assets, such as appraisals or bank statements.

- Records of any debts or liabilities that need to be deducted from the estate value.

- Any prior tax returns that may be relevant to the estate.

Legal Use of the Massachusetts Department Of Revenue Form M-706

Form M-706 serves a legal purpose in the estate settlement process. It is used to report the estate's value to the Massachusetts Department of Revenue and calculate the estate tax owed. Filing this form is a legal requirement for estates that meet the specified value threshold. Failure to file can result in penalties and interest on unpaid taxes, as well as potential legal issues for the estate's executor or administrator.

How to Obtain the Massachusetts Department Of Revenue Form M-706

The Massachusetts Department of Revenue Form M-706 can be obtained directly from the Massachusetts Department of Revenue's official website. The form is available in a fillable PDF format, allowing users to complete it digitally before printing. Additionally, physical copies of the form can be requested from local tax offices or by contacting the Department of Revenue directly.

Quick guide on how to complete massachusetts department of revenue form m 706 mas

Effortlessly prepare Massachusetts Department Of Revenue Form M 706 Mas on any device

The management of online documents has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Massachusetts Department Of Revenue Form M 706 Mas on any platform using airSlate SignNow's Android or iOS applications, and streamline your document-related processes today.

The easiest way to edit and eSign Massachusetts Department Of Revenue Form M 706 Mas with ease

- Locate Massachusetts Department Of Revenue Form M 706 Mas and select Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Edit and eSign Massachusetts Department Of Revenue Form M 706 Mas to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massachusetts department of revenue form m 706 mas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ma form 706 and how does it relate to airSlate SignNow?

The ma form 706 is the Massachusetts estate tax return, essential for reporting and calculating estate taxes. With airSlate SignNow, you can easily eSign and manage your ma form 706 documents electronically, ensuring a smooth and efficient process for your estate planning.

-

How can airSlate SignNow help with completing the ma form 706?

airSlate SignNow provides templates and tools that simplify the process of filling out the ma form 706. You can collaborate with others, streamline document management, and ensure all necessary signatures are obtained electronically, enhancing efficiency in your estate planning.

-

What pricing plans does airSlate SignNow offer for using the ma form 706?

airSlate SignNow offers flexible pricing plans that cater to different needs, starting with a free trial. For users looking to manage ma form 706 documents regularly, premium plans provide additional features like advanced integrations and support tailored for estate management.

-

Are there any special features in airSlate SignNow for managing the ma form 706?

Yes, airSlate SignNow includes features like real-time collaboration, customizable templates, and automated reminders that are particularly useful for handling the ma form 706. These features ensure that you stay organized and compliant throughout the estate planning process.

-

Can I integrate airSlate SignNow with other tools when working on the ma form 706?

Absolutely! airSlate SignNow offers seamless integrations with various tools and platforms, making it easier to manage the ma form 706 alongside your existing systems. Whether you use CRM software or document storage solutions, you can enhance your workflow with these integrations.

-

Is airSlate SignNow secure for handling sensitive information in the ma form 706?

Yes, airSlate SignNow prioritizes security and compliance. When dealing with the ma form 706 and other sensitive documents, data encryption, secure storage, and compliance with privacy regulations ensure your information remains protected at all times.

-

How can I ensure proper signature collection for the ma form 706 using airSlate SignNow?

With airSlate SignNow, you can set up signing workflows that automatically send the ma form 706 to all required signatories. The platform allows you to track status updates, send reminders, and collect signatures effortlessly, ensuring nothing is overlooked in your estate planning.

Get more for Massachusetts Department Of Revenue Form M 706 Mas

Find out other Massachusetts Department Of Revenue Form M 706 Mas

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now