Ok Goodwill Industries Donation Receipt 2016-2026

Understanding the Ok Goodwill Industries Donation Receipt

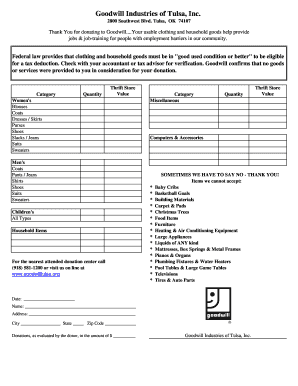

The Ok Goodwill Industries donation receipt serves as a formal acknowledgment of donations made to Goodwill Industries. This receipt is essential for donors who wish to claim tax deductions for their charitable contributions. It includes details such as the donor's name, the date of the donation, a description of the items donated, and the estimated value of those items. This documentation is crucial for compliance with IRS regulations, ensuring that donors can substantiate their charitable contributions during tax filing.

Key Elements of the Ok Goodwill Industries Donation Receipt

A comprehensive Goodwill donation receipt includes several key elements that are important for both the donor and the organization. These elements typically consist of:

- Donor Information: Name and address of the individual or entity making the donation.

- Date of Donation: The exact date when the items were donated.

- Description of Donated Items: A detailed list of the items donated, which helps in determining their value.

- Estimated Value: A good faith estimate of the fair market value of the donated items.

- Goodwill Information: The name and address of the Goodwill Industries location receiving the donation.

How to Obtain the Ok Goodwill Industries Donation Receipt

To obtain a Goodwill donation receipt, donors can follow a straightforward process. After making a donation, individuals should request a receipt from the Goodwill representative. Many Goodwill locations provide printed receipts at the time of donation. If a printed receipt is not available, donors can ask for a digital version, which can often be emailed or sent via text. It is advisable to keep a copy of the receipt for personal records and tax purposes.

Steps to Complete the Ok Goodwill Industries Donation Receipt

Completing a Goodwill donation receipt involves a few simple steps. Donors should:

- Fill Out Donor Information: Provide your name and address accurately.

- Specify the Date: Enter the date of the donation.

- List Donated Items: Clearly describe each item donated, including quantities.

- Estimate Values: Assign a fair market value to each item based on current market conditions.

- Keep a Copy: Retain a copy of the completed receipt for your records.

IRS Guidelines for Using the Ok Goodwill Industries Donation Receipt

The IRS has specific guidelines regarding the use of donation receipts for tax deductions. Donors must ensure that their receipts are properly filled out and include all necessary information. For donations valued over $500, the IRS requires the completion of Form 8283, which must be attached to the tax return. It is important to maintain accurate records and receipts for all donations, as the IRS may request documentation during an audit. Donors should familiarize themselves with IRS Publication 526, which outlines the rules for charitable contributions.

Legal Use of the Ok Goodwill Industries Donation Receipt

The Goodwill donation receipt is legally recognized as proof of charitable contribution for tax purposes. To ensure compliance, donors should follow the IRS requirements for documentation. This includes having a valid receipt for any donation claimed on their tax return. Failure to provide proper documentation can result in disallowed deductions, which may lead to penalties. Therefore, it is essential for donors to understand the legal implications of their donations and keep accurate records.

Quick guide on how to complete ok goodwill industries donation receipt

Manage Ok Goodwill Industries Donation Receipt effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing easy access to the correct form and secure online storage. airSlate SignNow equips you with all the tools needed to create, amend, and eSign your documents swiftly without delays. Manage Ok Goodwill Industries Donation Receipt on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Ok Goodwill Industries Donation Receipt with ease

- Locate Ok Goodwill Industries Donation Receipt and click Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Highlight important sections of your documents or obscure sensitive information with tools provided specifically by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate the hassle of missing or lost documents, the tedious process of searching for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Ok Goodwill Industries Donation Receipt while ensuring excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ok goodwill industries donation receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a printable goodwill donation receipt?

A printable goodwill donation receipt is a formal document that acknowledges the receipt of donated goods to a charitable organization, like Goodwill. It typically includes details such as the donor's name, date of the donation, item descriptions, and estimated values, which are essential for tax purposes.

-

How can I obtain a printable goodwill donation receipt?

You can obtain a printable goodwill donation receipt through a variety of online platforms, including airSlate SignNow. By using our electronic signature solutions, you can easily create, customize, and download your printable goodwill donation receipt in just a few clicks.

-

Are there any costs associated with creating a printable goodwill donation receipt?

Creating a printable goodwill donation receipt with airSlate SignNow is cost-effective. Our pricing options are designed to fit your budget while providing valuable features for document management and eSigning. Explore our plans to find one that suits your needs for generating receipts.

-

What features does airSlate SignNow offer for creating printable goodwill donation receipts?

airSlate SignNow provides a user-friendly interface that allows you to easily create customizable printable goodwill donation receipts. Features include text fields for necessary information, templates for quick generation, and multiple export formats for easy printing or sharing.

-

Can I integrate airSlate SignNow with other tools to manage my donation receipts?

Yes, airSlate SignNow supports integration with various tools and platforms, allowing you to streamline the management of your printable goodwill donation receipts. Whether using CRM systems or accounting software, our integrations help keep your documents organized and accessible.

-

What are the benefits of using airSlate SignNow for donation receipts?

Using airSlate SignNow for your printable goodwill donation receipts offers convenience and efficiency. You can quickly create, sign, and send documents while ensuring compliance and maintaining a professional appearance, which adds credibility to your charitable efforts.

-

Is it easy to customize a printable goodwill donation receipt?

Absolutely! airSlate SignNow makes it easy to customize your printable goodwill donation receipts. You can add logos, modify text fields, and adjust formatting to fit your organization's branding, ensuring that your receipts are both professional and personalized.

Get more for Ok Goodwill Industries Donation Receipt

- Winter spring dental lab jobs form

- Glar1 application form ny i danmark

- Debt settlement agreement picb form

- Sarasota tree permit form

- Lourdes camp health form

- And treatment consent form ivory dental

- Direct deposit enrolmentchange request alberta health services form

- Refund to payor by direct deposit deposit this form is used to authorize mep to deposit refund payments directly into the

Find out other Ok Goodwill Industries Donation Receipt

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple