Loan 2020-2026

What is the Loan

The education loan is a financial product designed to help students cover the costs associated with higher education. This type of loan typically covers tuition, fees, and other related expenses, such as textbooks and living costs. Education loans can come from various sources, including federal and private lenders, and they often have specific terms and conditions that borrowers must understand before applying.

Federal education loans usually offer lower interest rates and more flexible repayment options compared to private loans. Understanding the differences between these options is crucial for making informed financial decisions regarding your education.

How to Obtain the Loan

To obtain an education loan, start by researching the types of loans available. Federal loans often require the completion of the Free Application for Federal Student Aid (FAFSA). This application helps determine your eligibility for federal aid, including grants and loans.

For private loans, you will need to apply directly with the lender. This process typically involves providing personal information, financial details, and possibly a credit check. It is advisable to compare interest rates, repayment terms, and fees from multiple lenders to find the best option for your needs.

Required Documents

When applying for an education loan, certain documents are typically required. These may include:

- Proof of identity, such as a driver's license or passport

- Social Security number

- Income information, including tax returns or pay stubs

- School enrollment verification

- Credit history, especially for private loans

Having these documents ready can streamline the application process and help ensure that you meet all lender requirements.

Steps to Complete the Loan

Completing the education loan process involves several key steps:

- Research and compare loan options.

- Complete the FAFSA for federal loans.

- Gather required documentation.

- Submit your loan application to the chosen lender.

- Review and sign the loan agreement.

- Receive funds and apply them to your educational expenses.

Following these steps can help ensure that you successfully obtain the funding needed for your education.

Legal Use of the Loan

Education loans must be used for qualified educational expenses as defined by the lender and federal regulations. These expenses generally include tuition, fees, room and board, and necessary supplies. Misuse of loan funds can lead to penalties, including the requirement to repay the loan immediately.

It is essential to keep accurate records of how loan funds are spent to ensure compliance with legal requirements and to maintain eligibility for future financial aid.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for managing your education loan effectively. For federal loans, the FAFSA must be submitted by specific deadlines each year, which can vary by state and institution. Additionally, if you are applying for private loans, each lender may have its own deadlines.

Staying informed about these dates can help you avoid missing out on financial aid opportunities and ensure that your loan application is processed in a timely manner.

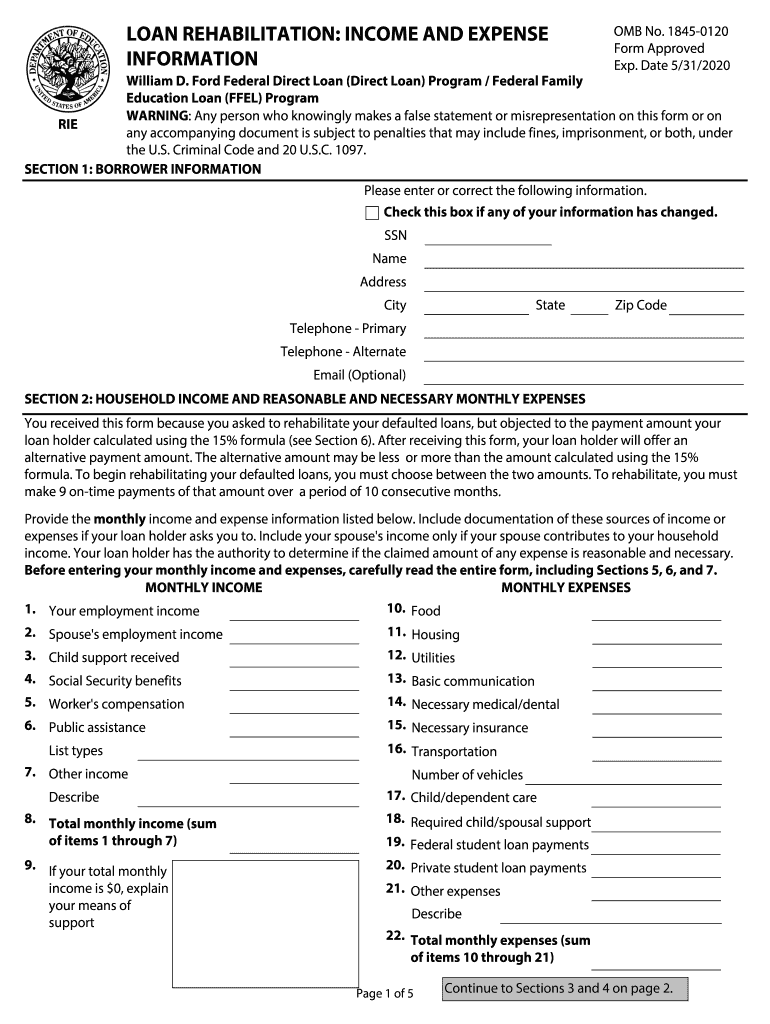

Quick guide on how to complete loan rehabilitation income and expense information form

Discover the most efficient method to complete and endorse your Loan

Are you still spending precious time preparing your official documents on paper instead of online? airSlate SignNow offers a superior approach to finalize and endorse your Loan and comparable forms for public services. Our advanced eSignature solution equips you with all necessary tools to handle documents swiftly and in accordance with official standards - comprehensive PDF editing, management, protection, signing, and sharing functionalities are all easily accessible within a user-friendly interface.

Only a few steps are needed to complete and endorse your Loan:

- Upload the editable template to the editor using the Get Form button.

- Verify what details you need to include in your Loan.

- Navigate between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Modify the content with Text boxes or Images from the top toolbar.

- Highlight what is essential or Blackout areas that are no longer relevant.

- Select Sign to create a legally valid eSignature using any of your preferred methods.

- Add the Date next to your signature and finalize your work with the Done button.

Store your completed Loan in the Documents folder within your account, download it, or send it to your preferred cloud storage. Our solution also provides adaptable form sharing. There’s no necessity to print your templates when you need to submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your profile. Try it out today!

Create this form in 5 minutes or less

FAQs

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

Which form for which ITR do I have to fill out for the income from the salary and income from insurance commission?

You may be filed form no. 1. Under the head salary you may fill the amount of salary and under the head income from other sources you Malay fill commission from LIC.

Create this form in 5 minutes!

How to create an eSignature for the loan rehabilitation income and expense information form

How to create an electronic signature for the Loan Rehabilitation Income And Expense Information Form in the online mode

How to make an electronic signature for your Loan Rehabilitation Income And Expense Information Form in Google Chrome

How to create an electronic signature for putting it on the Loan Rehabilitation Income And Expense Information Form in Gmail

How to generate an eSignature for the Loan Rehabilitation Income And Expense Information Form straight from your mobile device

How to make an eSignature for the Loan Rehabilitation Income And Expense Information Form on iOS devices

How to make an eSignature for the Loan Rehabilitation Income And Expense Information Form on Android OS

People also ask

-

What is a loan income form and why do I need it?

A loan income form is a document used to verify a borrower's income when applying for a loan. This form is essential as it provides lenders with the necessary information to assess your financial stability and creditworthiness, ensuring a smoother loan approval process.

-

How can airSlate SignNow help me create a loan income form?

airSlate SignNow offers an intuitive platform to easily create and customize your loan income form. With our step-by-step templates, you can streamline the form creation process, making it quick and efficient, allowing you to focus on your application.

-

Is there a cost associated with using airSlate SignNow for my loan income form?

Yes, airSlate SignNow provides a cost-effective solution for document management, including loan income forms. Our pricing plans cater to different business needs, ensuring you get the best value for your money while accessing all necessary features.

-

What features does airSlate SignNow offer for loan income forms?

With airSlate SignNow, you can enjoy features such as electronic signatures, document templates, and secure cloud storage for your loan income form. These features help you manage, send, and eSign your forms efficiently while ensuring compliance and security.

-

Can I integrate airSlate SignNow with other tools for managing loan applications?

Absolutely! airSlate SignNow allows easy integration with various applications, such as CRMs and accounting software. This connectivity enhances your workflow and ensures that your loan income form is seamlessly managed alongside your other documents.

-

Is airSlate SignNow secure for managing my loan income form?

Yes, security is a top priority at airSlate SignNow. We employ encryption and robust security protocols to protect your loan income form and any sensitive information contained within, giving you peace of mind during the document signing process.

-

Can I customize the loan income form templates in airSlate SignNow?

Certainly! airSlate SignNow offers customizable templates for your loan income form, allowing you to include specific fields and branding elements. This feature helps tailor the form to your unique needs and enhances your brand's identity.

Get more for Loan

- A i r e registration form and changes of addressfamily status

- Exemption for ignition interlock device form

- Michigan legal last will and testament form for married person with adult children

- Dch 1625 form in michigan

- Cookie contest rules form

- Cosigner agreement template form

- Cosigner loan agreement template form

- Healthcare consult contract template form

Find out other Loan

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation