Bov Fatca Form

What is the BOV FATCA?

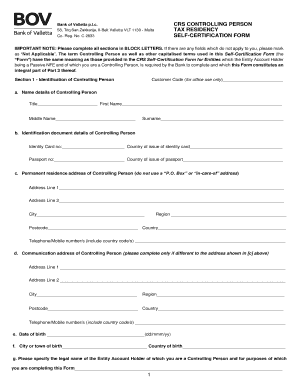

The BOV FATCA is a financial form that facilitates compliance with the Foreign Account Tax Compliance Act (FATCA) regulations. This form is essential for U.S. taxpayers who have foreign financial accounts or assets, ensuring that they report these holdings to the Internal Revenue Service (IRS). The BOV FATCA helps financial institutions identify U.S. account holders and report their information to the IRS, thereby promoting transparency in international financial dealings.

How to Use the BOV FATCA

Using the BOV FATCA involves several steps to ensure accurate reporting. First, individuals must gather all relevant financial information regarding their foreign accounts. This includes account numbers, balances, and the names of the financial institutions. Once the necessary information is compiled, taxpayers can fill out the BOV FATCA form, ensuring that all fields are completed accurately. After completing the form, it must be submitted to the appropriate financial institution or directly to the IRS, depending on the specific requirements outlined for the form.

Steps to Complete the BOV FATCA

Completing the BOV FATCA requires careful attention to detail. Here are the steps to follow:

- Gather all relevant documentation regarding foreign accounts.

- Obtain the BOV FATCA form from the appropriate source.

- Fill out the form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form to the designated financial institution or the IRS.

Legal Use of the BOV FATCA

The BOV FATCA serves a legal purpose by ensuring compliance with U.S. tax laws. It is crucial for U.S. citizens and residents to report their foreign financial accounts to avoid penalties. The legal framework surrounding the BOV FATCA mandates that financial institutions adhere to strict reporting guidelines, which helps maintain the integrity of the U.S. tax system. Failure to comply with these regulations can result in significant fines and legal repercussions.

Required Documents

When preparing to complete the BOV FATCA, certain documents are necessary to provide accurate information. These typically include:

- Bank statements from foreign accounts.

- Account opening documents from the financial institutions.

- Identification documents, such as a passport or driver's license.

- Any previous tax returns that may include foreign income.

Penalties for Non-Compliance

Non-compliance with the BOV FATCA can lead to severe penalties. The IRS imposes fines for failing to report foreign accounts, which can be substantial. Additionally, taxpayers may face increased scrutiny and potential audits if they do not adhere to reporting requirements. It is essential to understand these risks and ensure that the BOV FATCA is completed and submitted accurately and on time.

Quick guide on how to complete bov fatca 458597297

Complete Bov Fatca effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Bov Fatca on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to modify and eSign Bov Fatca seamlessly

- Obtain Bov Fatca and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Select important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for such tasks.

- Compose your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your preference. Edit and eSign Bov Fatca and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bov fatca 458597297

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is BOV FATCA and how does airSlate SignNow address it?

BOV FATCA refers to the compliance measures surrounding the Foreign Account Tax Compliance Act. airSlate SignNow provides solutions that help businesses streamline their eSigning processes, ensuring compliance with BOV FATCA regulations. Our platform allows users to easily manage and sign necessary documents, minimizing the risks associated with non-compliance.

-

How does airSlate SignNow simplify the BOV FATCA compliance process?

airSlate SignNow simplifies the BOV FATCA compliance process by offering customizable templates and automated workflows. Users can create, send, and sign documents electronically, reducing the burden of manual compliance actions. This ensures that all necessary documents align with BOV FATCA requirements efficiently.

-

Are there specific features in airSlate SignNow for BOV FATCA documents?

Yes, airSlate SignNow includes specific features tailored for BOV FATCA documents, such as advanced encryption and audit trails. These features ensure that all signed documents are secure, traceable, and comply with international regulations. This gives businesses peace of mind when handling sensitive financial information.

-

What pricing plans does airSlate SignNow offer for businesses dealing with BOV FATCA?

airSlate SignNow offers flexible pricing plans suitable for businesses managing BOV FATCA requirements. Plans are designed to accommodate various business sizes and needs, providing access to essential features without any hidden fees. This affordability makes it a perfect choice for companies striving to maintain compliance cost-effectively.

-

Can I integrate airSlate SignNow with other software for BOV FATCA purposes?

Indeed, airSlate SignNow seamlessly integrates with various software applications, enhancing processes related to BOV FATCA compliance. By connecting with existing systems like CRM and ERP platforms, businesses can streamline their document management and signing workflows. This integration ensures that all financial operations remain compliant and efficient.

-

How secure is airSlate SignNow when handling BOV FATCA documents?

Security is a top priority at airSlate SignNow, especially for handling BOV FATCA documents. Our platform employs advanced security measures including encryption and GDPR-compliance to protect sensitive data. Users can trust that their documents are secure and meet the rigorous requirements set forth by BOV FATCA.

-

What support does airSlate SignNow provide for BOV FATCA compliance issues?

airSlate SignNow offers dedicated customer support to assist users with any BOV FATCA compliance issues. Our team of experts is available to provide guidance and answer questions about utilizing the platform effectively. Whether you're new to BOV FATCA or need advanced assistance, we're here to help.

Get more for Bov Fatca

- Federal lead based paint disclosure form in microsoft word

- Pet addendum pdf mystudentvillage com form

- New client registration form milner veterinary hospital

- Act 101 section 902 municipal recycling program grant disbursement request form

- Fredonia state university of new york learning contract for fredonia form

- Fillable online tot transient occupancy tax form

- Employee termination agreement template form

- Employee theft restitution agreement template form

Find out other Bov Fatca

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer