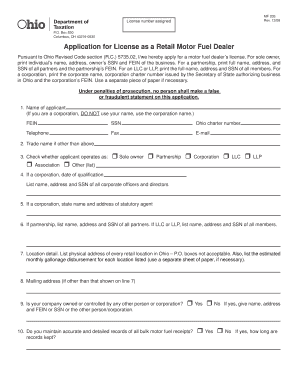

Ohio Form

What is the Ohio Form?

The Ohio Form for tax refunds is a specific document used by residents and businesses in Ohio to request a refund for overpaid taxes. This form is essential for individuals who have paid more tax than they owe or who qualify for a refund due to exemptions or credits. Understanding the purpose of this form is crucial for ensuring that taxpayers receive the money they are entitled to from the state.

Key elements of the Ohio Form

The Ohio Form includes several important sections that must be completed accurately. Key elements typically consist of:

- Taxpayer Information: This section requires personal details such as name, address, and Social Security number.

- Tax Year: The specific year for which the refund is being requested must be indicated.

- Reason for Refund: Taxpayers must provide a clear explanation for the refund request, including any relevant exemptions or credits.

- Signature: The form must be signed by the taxpayer or an authorized representative to validate the request.

Steps to complete the Ohio Form

Completing the Ohio Form requires careful attention to detail. Here are the steps to follow:

- Gather Necessary Documents: Collect all relevant tax documents, including previous tax returns and any supporting documentation for deductions or credits.

- Fill Out the Form: Complete each section of the form, ensuring that all information is accurate and up-to-date.

- Review Your Submission: Double-check all entries for accuracy and completeness to avoid delays.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent to the correct address.

Filing Deadlines / Important Dates

Timely submission of the Ohio Form is crucial for processing refunds. Important dates to remember include:

- Annual Filing Deadline: Typically, tax refund requests must be submitted by April 15 of the following year.

- Extended Deadlines: If you file for an extension, ensure that you are aware of any extended deadlines that may apply to your situation.

Required Documents

When submitting the Ohio Form, certain documents are required to support your refund request. These may include:

- Previous Tax Returns: Copies of the tax returns for the years in question.

- Proof of Payment: Documentation showing the taxes that were paid, such as receipts or bank statements.

- Supporting Documentation: Any additional forms or documents that substantiate your claim for a refund, such as W-2s or 1099s.

Form Submission Methods

Taxpayers have several options for submitting the Ohio Form. These methods include:

- Online Submission: Many taxpayers prefer to submit their forms electronically for faster processing.

- Mail: Forms can be printed and mailed to the appropriate tax authority, ensuring that they are sent to the correct address.

- In-Person Submission: Taxpayers may also choose to submit their forms in person at designated tax offices.

Quick guide on how to complete ohio form

Effortlessly prepare Ohio Form on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Ohio Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based operation today.

Edit and eSign Ohio Form with ease

- Find Ohio Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to deliver your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Ohio Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an application form tax refund?

An application form tax refund is a document submitted to request a refund of overpaid taxes. With airSlate SignNow, you can easily create and eSign your application form tax refund, streamlining the process for faster approval.

-

How does airSlate SignNow facilitate the application form tax refund process?

airSlate SignNow simplifies the application form tax refund process by allowing users to fill out and eSign documents online. This eliminates the need for printing and mailing, saving time and reducing the chance of errors.

-

Is there a cost associated with using airSlate SignNow for the application form tax refund?

Yes, while airSlate SignNow is a cost-effective solution, there are pricing plans available. Each plan includes features to help you efficiently manage your application form tax refund workflows.

-

Can I integrate airSlate SignNow with other applications for my tax refund needs?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems, making it easier to manage your application form tax refund alongside other necessary tools.

-

What are the benefits of using airSlate SignNow for tax refund applications?

Using airSlate SignNow for your application form tax refund provides numerous benefits, including enhanced efficiency, security, and ease of use. These features help ensure that your tax refund applications are processed quickly and securely.

-

Is electronic signing of the application form tax refund legally binding?

Yes, electronic signatures created with airSlate SignNow for your application form tax refund are legally binding. This compliance assures you that your signed documents hold the same validity as traditional signatures.

-

How can I ensure my data is secure while using airSlate SignNow for tax refunds?

airSlate SignNow prioritizes data security by employing advanced encryption methods and complying with data protection regulations. Your application form tax refund and all sensitive information are protected throughout the signing process.

Get more for Ohio Form

- Dcyf forms for special needs

- Sag casting data report form

- Adci intake form

- Emmaus letters for pilgrims form

- Application for employment pdf brightok net form

- Material safety data sheet msds nyc gov form

- Summary of inequality cprcomponents for bls provi form

- F200021 u s national health plan medicare transmittal form

Find out other Ohio Form

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy