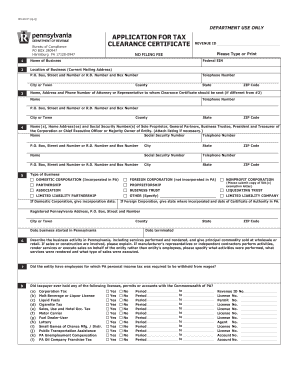

Pa Tax Form

What is the PA Tax?

The PA tax refers to the tax revenue system implemented by the state of Pennsylvania. This system encompasses various taxes collected by the Pennsylvania Department of Revenue (PA DOR), including income tax, sales tax, and property tax. Understanding the PA tax framework is essential for residents and businesses to ensure compliance with state regulations.

How to Obtain the PA Tax Form

To obtain the PA tax form, individuals can visit the official Pennsylvania Department of Revenue website. Forms are available for download in various formats, including PDF. The most commonly used forms include the PA-40 for personal income tax and the PA-100 for business taxes. It is important to ensure that you are using the most current version of the form to avoid any issues during filing.

Steps to Complete the PA Tax Form

Completing the PA tax form involves several key steps:

- Gather necessary documentation, including W-2s, 1099s, and any other income statements.

- Fill out the form accurately, ensuring all personal information and income details are correct.

- Calculate your total tax liability based on the provided instructions.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either online, by mail, or in person.

Required Documents for PA Tax Filing

When filing your PA tax, certain documents are essential to ensure a smooth process. These include:

- W-2 forms from employers showing annual earnings.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation of deductions and credits, such as receipts for charitable donations.

Filing Deadlines for PA Tax

Filing deadlines for the PA tax vary depending on the type of tax being filed. Generally, the personal income tax return (PA-40) is due on April 15. If this date falls on a weekend or holiday, the deadline may be extended. Businesses should consult the PA DOR for specific deadlines related to corporate tax filings and other business-related taxes.

Penalties for Non-Compliance with PA Tax Regulations

Failure to comply with PA tax regulations can result in significant penalties. These may include:

- Late filing penalties, which can accrue daily after the deadline.

- Interest on unpaid taxes, which compounds over time.

- Potential legal action for severe non-compliance, including liens on property or garnishment of wages.

Eligibility Criteria for PA Tax Benefits

Eligibility for various PA tax benefits, such as credits and deductions, depends on specific criteria. Common eligibility factors include:

- Residency status in Pennsylvania.

- Income level, which may determine qualification for certain tax credits.

- Filing status, such as single, married, or head of household.

Quick guide on how to complete pa tax

Effortlessly prepare Pa Tax on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, as you can obtain the correct form and securely save it online. airSlate SignNow provides all the tools necessary to quickly create, modify, and eSign your documents without delays. Handle Pa Tax on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Pa Tax with ease

- Obtain Pa Tax and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your liking. Edit and eSign Pa Tax and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help with PA tax revenue?

airSlate SignNow is an eSignature tool that streamlines document signing processes for businesses. By digitizing workflow, it reduces the time spent on paperwork, allowing companies to focus on activities that positively impact PA tax revenue. Through improved efficiency, businesses can enhance their financial reporting and compliance related to state tax obligations.

-

How does airSlate SignNow improve workflow for PA tax revenue documentation?

With airSlate SignNow, businesses can automate document workflows related to PA tax revenue, ensuring that forms are signed and submitted quickly. This reduces delays and errors often associated with manual processes, helping organizations maintain compliance with state laws and regulations. The intuitive interface makes it easy for teams to collaborate on tax-related documents efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to different business sizes and needs. The cost-effective solution allows organizations to choose plans according to their document volume and features required, making it accessible for managing PA tax revenue effectively. Pricing is transparent, and users can benefit from a free trial to assess its suitability before committing.

-

Can airSlate SignNow integrate with other tax software?

Yes, airSlate SignNow integrates seamlessly with various tax software to enhance management of PA tax revenue. This feature allows for easy import and export of tax documents, reducing the risk of errors. Integration capabilities streamline workflows and improve overall accuracy in tax reporting, crucial for businesses operating in Pennsylvania.

-

What are the security features of airSlate SignNow related to tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and authentication protocols to protect sensitive PA tax revenue documents. Compliance with industry standards ensures that your data is safeguarded against bsignNowes. Users can confidently handle tax-related transactions knowing their information is secure and compliant with regulatory requirements.

-

How can airSlate SignNow benefit businesses looking to optimize PA tax revenue?

By using airSlate SignNow, businesses can optimize their operational efficiency, leading to better management of PA tax revenue. The platform automates tedious tasks, allowing teams to focus on strategic decisions rather than paperwork. This can ultimately contribute to improved financial outcomes and compliance with Pennsylvania tax laws.

-

What types of documents can be managed with airSlate SignNow for PA tax revenue purposes?

airSlate SignNow can manage a wide variety of documents critical to PA tax revenue, including tax returns, forms, and compliance paperwork. This flexibility allows businesses to streamline the signing and submission process for all tax-related documents. Its user-friendly interface makes it easy to manage and track these crucial documents in one centralized platform.

Get more for Pa Tax

- Case referral sample form

- Jahres netto arbeitsverdienst form

- Pers 195 texas department of criminal justice tdcj state tx form

- 73a525 06 16 monthly report commonwealth of kentucky of revenue ky form

- Mv2119 form

- Pershing llc fillable account transfer form rpd 150 acat

- Form 8002 bargain sale deed

- Boe a 19605 resolucin de 15 de noviembre boe es form

Find out other Pa Tax

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF