Ny Quarterly Form

What is the NY Quarterly?

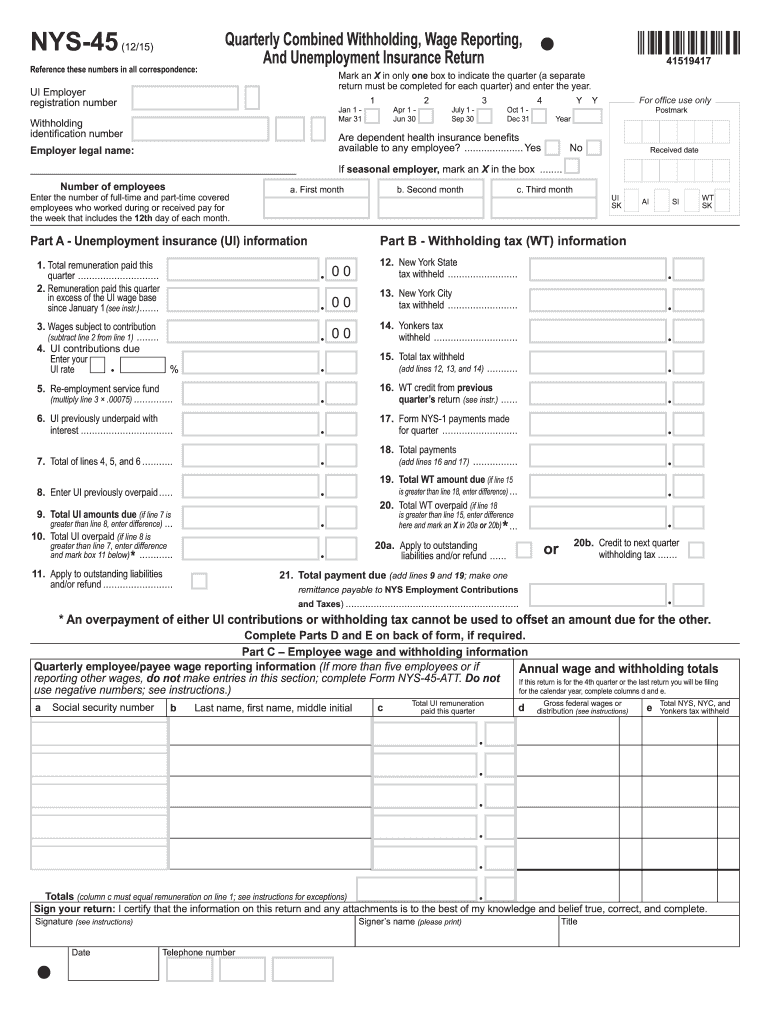

The NY Quarterly refers to the NYS-45 form, which is a crucial document for employers in New York State. This form is used to report employee wages and the associated unemployment insurance contributions. It is essential for maintaining compliance with state regulations regarding unemployment insurance and ensuring that employees receive the benefits they are entitled to in case of job loss.

Steps to Complete the NY Quarterly

Completing the NYS-45 form involves several key steps:

- Gather necessary information, including employee names, Social Security numbers, and total wages paid during the quarter.

- Calculate the total contributions for unemployment insurance based on the wages reported.

- Fill out the NYS-45 form accurately, ensuring all sections are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the form by the due date to avoid penalties.

Filing Deadlines / Important Dates

It is important for employers to be aware of the filing deadlines for the NYS-45 form. The form must be submitted quarterly, with specific due dates:

- For the first quarter (January to March), the due date is April 30.

- For the second quarter (April to June), the due date is July 31.

- For the third quarter (July to September), the due date is October 31.

- For the fourth quarter (October to December), the due date is January 31 of the following year.

Required Documents

When preparing to file the NYS-45 form, employers should have the following documents ready:

- Employee wage records for the reporting period.

- Records of unemployment insurance contributions made during the quarter.

- Any previous NYS-45 forms filed, if applicable.

Penalties for Non-Compliance

Failure to file the NYS-45 form on time or inaccuracies in reporting can result in significant penalties. Employers may face fines or increased unemployment insurance rates. It is crucial to ensure timely and accurate submissions to avoid these consequences.

Form Submission Methods

Employers can submit the NYS-45 form through various methods:

- Online submission through the New York State Department of Labor website.

- Mailing a paper form to the appropriate address.

- In-person submission at designated state offices, if necessary.

Quick guide on how to complete ny quarterly

Complete Ny Quarterly seamlessly on any device

Online document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly and without interruptions. Manage Ny Quarterly on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Ny Quarterly effortlessly

- Obtain Ny Quarterly and click on Get Form to begin.

- Use the tools available to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specially offers for that purpose.

- Design your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the data and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors requiring you to print new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ny Quarterly and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ny quarterly

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NY unemployment insurance and who qualifies for it?

NY unemployment insurance provides financial assistance to individuals who have lost their job through no fault of their own. To qualify, applicants must have worked in New York and earned sufficient wages during a specified base period. It's essential to apply as soon as you lose your job to secure your benefits.

-

How can I apply for NY unemployment insurance?

To apply for NY unemployment insurance, you can visit the New York State Department of Labor's website. The application process is straightforward and can be completed online, allowing you to submit your claim quickly. Be ready to provide personal information and details about your earnings and employment history.

-

What documents do I need to provide for NY unemployment insurance?

For NY unemployment insurance, you typically need to present proof of identity, your Social Security number, and details about your previous employment. Gathering documents like your pay stubs, W-2 forms, and bank account information can expedite the application process. Ensure all information is accurate to avoid delays.

-

How much can I receive from NY unemployment insurance?

The amount you can receive from NY unemployment insurance varies based on your previous earnings, with the maximum benefit signNowing $504 per week as of 2023. Your weekly benefit amount is determined by the highest wages in your base period. The duration of benefits may also depend on the overall economic conditions.

-

How long can I receive NY unemployment insurance?

Typically, NY unemployment insurance benefits last for up to 26 weeks, depending on the state’s economic situation. Extensions may be available during periods of high unemployment, and different programs may offer additional weeks of support. It is crucial to stay updated through the New York State Department of Labor for any changes.

-

What are the benefits of eSigning documents related to NY unemployment insurance?

Using airSlate SignNow to eSign documents for NY unemployment insurance simplifies the submission process. It provides a secure and fast way to complete your applications and required documentation digitally. This method ensures your forms are processed quickly and efficiently, helping you receive your benefits without unnecessary delays.

-

Can I track my NY unemployment insurance application status?

Yes, once you've applied for NY unemployment insurance, you can track the status of your application online through the New York State Department of Labor's portal. Regular updates are provided to keep you informed about your claim's progress. Being proactive in checking your status can help you address any issues quickly.

Get more for Ny Quarterly

- Firearms transaction record form

- Permiso obra menor form

- Patient history form for non invasive prenatal testing nipt

- Fibromyalgia impact questionnaire online form

- Return to school formnote for lvhs

- Application for rental rentprep com form

- Triad mls coming soon seller authorization form final version 3 28 docx

- Hafa short sale agreement form form 184 short sale shop

Find out other Ny Quarterly

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free