Form Minnesota

Understanding the Form Minnesota

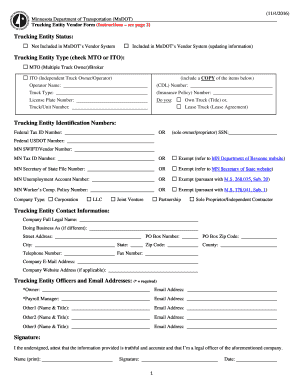

The Form Minnesota is a crucial document used in various administrative and legal processes within the state. It serves to collect essential information regarding the entity type of businesses operating in Minnesota. This form is particularly relevant for those establishing a new business or making significant changes to an existing entity's structure. Understanding its purpose can help ensure compliance with state regulations.

Steps to Complete the Form Minnesota

Completing the Form Minnesota involves several key steps to ensure accuracy and compliance. First, gather all necessary information about your business, including its name, address, and the specific entity type, such as LLC, corporation, or partnership. Next, carefully fill out each section of the form, ensuring that all details are correct. After completing the form, review it for any errors before submission. It's also advisable to consult with a legal professional if you have questions about specific sections.

Legal Use of the Form Minnesota

The legal use of the Form Minnesota is vital for maintaining compliance with state laws. This form not only registers the entity type but also establishes the legal framework under which the business operates. Properly filing the form helps protect the business's legal status and can prevent potential disputes or penalties. It is essential to understand the implications of the entity type selected, as it affects liability, taxation, and regulatory obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form Minnesota can vary based on the entity type and specific circumstances. Generally, new businesses must submit the form before commencing operations. Annual renewals or updates may also be required, depending on changes in ownership or structure. Keeping track of these important dates is crucial to avoid penalties and ensure continuous compliance with state regulations.

Required Documents

To complete the Form Minnesota, several documents may be required. These typically include proof of business name registration, identification for the owners or partners, and any relevant agreements or bylaws that govern the entity. Having these documents ready can streamline the filing process and help avoid delays in registration.

Business Entity Types

Understanding the different business entity types is essential when completing the Form Minnesota. Common entity types include Limited Liability Companies (LLCs), corporations, and partnerships. Each type has distinct legal and tax implications, affecting how the business operates and is taxed. Choosing the appropriate entity type is crucial for aligning with business goals and ensuring compliance with state laws.

Quick guide on how to complete form minnesota

Effortlessly prepare Form Minnesota on any gadget

Digital document management has gained popularity among companies and individuals alike. It offers a great eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, alter, and eSign your documents swiftly without delays. Handle Form Minnesota on any device utilizing the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign Form Minnesota with ease

- Locate Form Minnesota and click Get Form to initiate.

- Utilize the tools we offer to finish your document.

- Mark important sections of the documents or redact sensitive details using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes requiring printing new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form Minnesota and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form minnesota

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an entity type in airSlate SignNow?

In airSlate SignNow, an entity type refers to the category of organization or person that is utilizing our eSignature solutions. This classification helps us tailor services to specific needs, whether for individual users, small businesses, or large enterprises. Understanding your entity type allows us to provide better features suitable for your operational size and complexity.

-

How does the entity type affect pricing on airSlate SignNow?

The entity type can influence the pricing plans available on airSlate SignNow. Different entity types, such as businesses versus individuals, may have varying access to features and scalability options. We offer competitive pricing tailored to the needs of each entity type, ensuring that you only pay for what suits your organization.

-

What features are available based on entity type?

airSlate SignNow provides features tailored to different entity types to enhance productivity. For instance, large enterprises may benefit from advanced team management and security features, while small businesses might find value in simplified document sharing. Each entity type receives targeted functionalities designed to maximize efficiency and user satisfaction.

-

Can I change my entity type later on airSlate SignNow?

Yes, you can change your entity type at any time on airSlate SignNow. As your organization evolves, we allow you to update your profile to reflect your current needs. This flexibility ensures that you always have the right tools and features according to your current entity type.

-

Does airSlate SignNow integrate with other platforms based on entity type?

Indeed, airSlate SignNow offers integrations that cater to different entity types. Whether you are an individual user or part of a larger enterprise, you can connect with various CRM systems and productivity tools. This adaptability ensures that users across all entity types can streamline their workflow effectively.

-

What benefits does airSlate SignNow offer to different entity types?

airSlate SignNow provides numerous benefits tailored to various entity types, enhancing productivity and reducing operational costs. For businesses, features like multiple user management, advanced security, and analytics are beneficial, while individuals can enjoy ease-of-use and affordability. Each entity type experiences unique advantages designed to meet their requirements.

-

Is airSlate SignNow suitable for my entity type if I handle sensitive documents?

Yes, airSlate SignNow is designed to be secure and compliant, regardless of your entity type. We employ top-tier encryption and allow for customizable security settings, ensuring that sensitive documents are handled with the utmost care. Our platform is equipped to support the needs of various entity types while maintaining document confidentiality.

Get more for Form Minnesota

- Ptr functional behavior assessment checklist form

- Benefit street partners forms

- Usda direct deposit form

- Aberdeen breast cancer awareness sponsorship donation request letter 7 july 2015docx thinkpinkaberdeenmd form

- Spain visa information colombia spanish all vfs global

- Boise phlebectomy form

- Kelsey seybold doctors note 404900249 form

- Discharge notification home health agency phone number form

Find out other Form Minnesota

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word