Loan or Lien Payoff Request Form

What is the Loan Or Lien Payoff Request Form

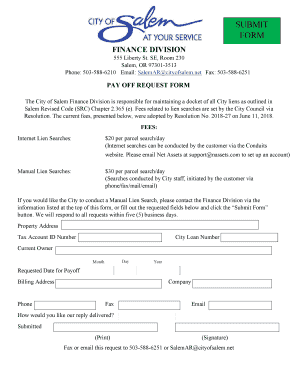

The Loan Or Lien Payoff Request Form is a crucial document used by borrowers to request the total payoff amount required to settle a loan or lien. This form is typically utilized when individuals or businesses wish to pay off their debts early or need to clear a lien on a property. By submitting this form, borrowers can obtain the necessary information regarding the outstanding balance, including any applicable fees or interest that may be due at the time of payoff.

How to use the Loan Or Lien Payoff Request Form

Using the Loan Or Lien Payoff Request Form involves several straightforward steps. First, ensure you have the correct form, which can usually be obtained from your lender or financial institution. Next, fill out the form with accurate details, including your account number, contact information, and the specific loan or lien in question. After completing the form, submit it according to your lender's instructions, which may include online submission, mailing, or delivering it in person.

Steps to complete the Loan Or Lien Payoff Request Form

Completing the Loan Or Lien Payoff Request Form requires careful attention to detail. Follow these steps:

- Gather necessary information, such as your loan account number and personal identification.

- Fill in your name, address, and contact details accurately.

- Specify the loan or lien for which you are requesting a payoff amount.

- Indicate the preferred method of receiving the payoff information, whether by mail or email.

- Review the form for accuracy before submission.

Key elements of the Loan Or Lien Payoff Request Form

The Loan Or Lien Payoff Request Form contains several key elements that are essential for processing your request. These include:

- Borrower Information: Personal details such as name, address, and contact information.

- Loan or Lien Details: Information about the specific loan or lien, including account numbers.

- Request Details: A section where you specify the request for the total payoff amount.

- Delivery Method: Options for how you wish to receive the payoff information.

Form Submission Methods

The Loan Or Lien Payoff Request Form can typically be submitted through various methods, depending on your lender's preferences. Common submission methods include:

- Online: Many lenders provide an online portal for submitting forms electronically.

- Mail: You can print the completed form and send it via postal service to your lender.

- In-Person: Some borrowers prefer to deliver the form directly to their lender's office.

Legal use of the Loan Or Lien Payoff Request Form

The Loan Or Lien Payoff Request Form is legally recognized as a formal request for payoff information. It is important to complete the form accurately to ensure compliance with your lender's requirements. Misrepresentation or errors in the form can lead to delays in processing your request and may affect the payoff amount provided. Always retain a copy of the submitted form for your records as proof of your request.

Quick guide on how to complete loan or lien payoff request form

Effortlessly Prepare Loan Or Lien Payoff Request Form on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delay. Handle Loan Or Lien Payoff Request Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Edit and eSign Loan Or Lien Payoff Request Form with Ease

- Obtain Loan Or Lien Payoff Request Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your changes.

- Choose how you wish to send your form: by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Loan Or Lien Payoff Request Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan or lien payoff request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Loan Or Lien Payoff Request Form?

A Loan Or Lien Payoff Request Form is a specific document used to request information about the total payoff amount for a loan or a lien. This form is essential for borrowers looking to settle their debt and is designed to help ensure all parties have accurate and clear information regarding the total amounts due.

-

How can I create a Loan Or Lien Payoff Request Form using airSlate SignNow?

Creating a Loan Or Lien Payoff Request Form with airSlate SignNow is simple. You can use our intuitive template builder to customize your form, ensuring it meets all the necessary requirements. Once designed, you can easily share it with recipients for eSigning.

-

What are the benefits of using airSlate SignNow for my Loan Or Lien Payoff Request Form?

Using airSlate SignNow for your Loan Or Lien Payoff Request Form provides several benefits, including ease of use, faster processing times, and enhanced security. Our platform allows you to manage documents efficiently, ensuring all communications are streamlined and secure.

-

Is there a pricing plan available for using the Loan Or Lien Payoff Request Form feature?

Yes, airSlate SignNow offers a variety of pricing plans that include access to the Loan Or Lien Payoff Request Form feature. We provide flexible pricing options tailored for businesses of all sizes, ensuring you can find a plan that suits your needs and budget.

-

Can I integrate airSlate SignNow with other applications for processing my Loan Or Lien Payoff Request Form?

Absolutely! airSlate SignNow can be easily integrated with various applications, including CRM systems and document management platforms. This capability allows you to streamline workflows related to your Loan Or Lien Payoff Request Form and enhance overall productivity.

-

How secure is the information shared in the Loan Or Lien Payoff Request Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect all information shared in your Loan Or Lien Payoff Request Form. Rest assured, your documents are safe and secure throughout the signing process.

-

Can I track the status of my Loan Or Lien Payoff Request Form?

Yes, airSlate SignNow provides real-time tracking for your Loan Or Lien Payoff Request Form. This feature allows you to see when the document has been viewed, signed, and completed, helping you stay informed throughout the process.

Get more for Loan Or Lien Payoff Request Form

- Site pollution incident legal liability select spills application form

- Academic journal the effects of using financial ratios on auditor opinion form

- Form 8300 worksheet

- North carolina parks recreation form

- Recipient created tax invoice rcti agreement form

- Va central irb reviewer checklist for pisc new project application form

- Ui ux design contract template form

- Funeral arrangement funeral contract template form

Find out other Loan Or Lien Payoff Request Form

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation