Form CT 186 P , Utility Services Tax Return Gross Income Tax Ny

What is the Form CT 186 P, Utility Services Tax Return Gross Income Tax NY

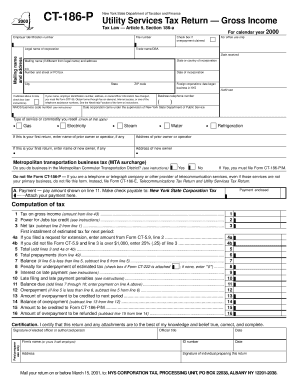

The Form CT 186 P is a tax return specifically designed for utility services in New York. This form is utilized by businesses that provide utility services, allowing them to report their gross income and calculate the associated utility services tax. The form is essential for ensuring compliance with state tax regulations and helps maintain accurate records for both the business and the state. It is important for utility service providers to understand the requirements and implications of this form to avoid potential penalties.

How to use the Form CT 186 P, Utility Services Tax Return Gross Income Tax NY

Using the Form CT 186 P involves several key steps. First, businesses must gather all necessary financial information related to their utility services. This includes total gross income from services rendered during the reporting period. Once the data is collected, businesses can fill out the form, ensuring that all sections are completed accurately. After completing the form, it should be submitted to the appropriate state tax authority, either online or via mail, depending on the submission options available. It is crucial to keep a copy of the submitted form for record-keeping purposes.

Steps to complete the Form CT 186 P, Utility Services Tax Return Gross Income Tax NY

Completing the Form CT 186 P requires careful attention to detail. Follow these steps:

- Gather financial records, including gross income from utility services.

- Obtain the latest version of Form CT 186 P from the state tax authority.

- Fill in the required information, including business details and income figures.

- Calculate the total tax owed based on the provided tax rates.

- Review the form for accuracy before submission.

- Submit the completed form to the state tax authority by the specified deadline.

Key elements of the Form CT 186 P, Utility Services Tax Return Gross Income Tax NY

The Form CT 186 P includes several key elements that must be filled out accurately. These elements typically include:

- Business name and address.

- Tax identification number.

- Total gross income from utility services.

- Applicable deductions, if any.

- Total tax calculated based on gross income.

- Signature of the authorized representative.

Filing Deadlines / Important Dates

Filing deadlines for the Form CT 186 P are crucial for compliance. Typically, the form must be filed annually, with specific due dates determined by the state tax authority. It is important for businesses to be aware of these dates to avoid late filing penalties. Keeping track of any changes in deadlines or tax regulations is also advisable to ensure timely submission.

Penalties for Non-Compliance

Failure to file the Form CT 186 P on time or inaccuracies in the submitted information can result in significant penalties. Common penalties include fines, interest on unpaid taxes, and potential legal action. Businesses should take compliance seriously and ensure that all forms are filled out correctly and submitted on time to avoid these consequences.

Quick guide on how to complete form ct 186 p utility services tax return gross income tax ny

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an excellent environmentally friendly option to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents quickly without interruptions. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to proceed.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from a device of your choosing. Modify and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 186 p utility services tax return gross income tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 186 P, Utility Services Tax Return Gross Income Tax NY?

Form CT 186 P, Utility Services Tax Return Gross Income Tax NY is a tax form required by businesses in New York that provide utility services. This form is used to report gross income received from providing these services, ensuring compliance with state tax regulations. Proper submission helps avoid penalties and ensures that you are accurately reporting your business income.

-

How can airSlate SignNow help with completing Form CT 186 P, Utility Services Tax Return Gross Income Tax NY?

airSlate SignNow simplifies the process of completing Form CT 186 P, Utility Services Tax Return Gross Income Tax NY by allowing you to create, edit, and e-sign documents electronically. Our platform provides templates and guides to help users correctly fill out the form, making the entire experience more efficient and user-friendly. This helps businesses save time and reduce errors in their submissions.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a variety of features for managing tax documents, including electronic signatures, document sharing, and customizable templates. Users can collaborate easily, track the status of documents, and securely store all their tax-related forms, including Form CT 186 P, Utility Services Tax Return Gross Income Tax NY. This enhances workflow efficiency and keeps your important documents organized.

-

Is airSlate SignNow cost-effective for small businesses handling Form CT 186 P?

Yes, airSlate SignNow is a cost-effective solution for small businesses that need to handle Form CT 186 P, Utility Services Tax Return Gross Income Tax NY. With affordable pricing plans and a variety of features included, businesses can streamline their document management processes without excessive costs. The savings on time and resources further enhance its value for small businesses.

-

Can I integrate airSlate SignNow with other software to assist with tax filing?

Absolutely! airSlate SignNow integrates with multiple business software tools, allowing you to streamline processes for tax filing, including the Form CT 186 P, Utility Services Tax Return Gross Income Tax NY. These integrations enable seamless data transfer and enhance the overall efficiency of your tax preparation workflow, improving accuracy and saving time.

-

What are the benefits of using airSlate SignNow for utility tax returns?

Using airSlate SignNow for utility tax returns, like Form CT 186 P, Utility Services Tax Return Gross Income Tax NY, provides benefits such as increased efficiency, reduced paperwork, and enhanced accuracy. The ability to e-sign documents enhances security and speeds up the approval process. Additionally, users can access their forms anytime, ensuring they can meet deadlines without hassle.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes document security by implementing industry-standard encryption protocols and secure user authentication methods. This ensures that your sensitive information, including filings like Form CT 186 P, Utility Services Tax Return Gross Income Tax NY, is protected from unauthorized access. Our commitment to data security gives you peace of mind when handling important tax documents.

Get more for Form CT 186 P , Utility Services Tax Return Gross Income Tax Ny

Find out other Form CT 186 P , Utility Services Tax Return Gross Income Tax Ny

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free