Form CT 186 a , Utility Services Tax Return Gross Operating Tax Ny

Understanding the Form CT 186 A, Utility Services Tax Return Gross Operating Tax NY

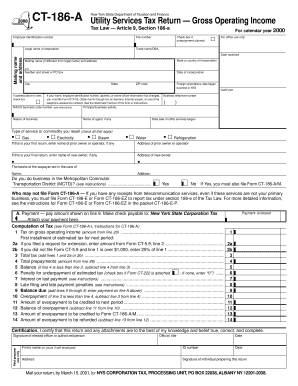

The Form CT 186 A is a crucial document for businesses operating in New York that provide utility services. This form is used to report gross operating revenue and calculate the corresponding utility services tax. It is essential for compliance with state tax regulations, ensuring that businesses contribute their fair share to public services. The form covers various utility services, including electricity, gas, and telecommunications, and is designed to streamline the reporting process for businesses.

Steps to Complete the Form CT 186 A

Completing the Form CT 186 A involves several key steps. First, gather all necessary financial records, including revenue statements and previous tax filings. Next, accurately report the gross operating revenue from utility services provided during the reporting period. Ensure that all calculations are precise, as errors can lead to compliance issues. After filling out the form, review all entries for accuracy before submission. It is advisable to keep a copy of the completed form for your records.

Obtaining the Form CT 186 A

The Form CT 186 A can be obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing businesses to print and complete it manually. Additionally, businesses may also request a physical copy of the form by contacting the department directly. Ensuring you have the latest version of the form is vital, as updates may occur that could affect reporting requirements.

Filing Deadlines for the Form CT 186 A

Filing deadlines for the Form CT 186 A are critical for compliance. Typically, the form must be submitted annually, with specific due dates set by the New York State Department of Taxation and Finance. Businesses should mark their calendars to avoid late submissions, which can incur penalties. It is important to check for any changes in deadlines each tax year, as they may vary based on state regulations.

Legal Use of the Form CT 186 A

The legal use of the Form CT 186 A is governed by New York state tax laws. Businesses must file this form to report their gross operating revenue from utility services, which is necessary for calculating the utility services tax owed. Failure to file or inaccuracies in reporting can lead to legal repercussions, including fines or audits. It is essential for businesses to understand their obligations under state law to avoid any compliance issues.

Key Elements of the Form CT 186 A

Key elements of the Form CT 186 A include sections for reporting gross operating revenue, deductions, and the calculation of the utility services tax owed. The form requires businesses to provide detailed information about the types of services offered and the revenue generated from each. Additionally, there are sections for taxpayer identification and contact information, which are essential for processing the form accurately.

Penalties for Non-Compliance with the Form CT 186 A

Non-compliance with the Form CT 186 A can result in significant penalties for businesses. These may include monetary fines, interest on unpaid taxes, and potential audits by the state tax authority. It is crucial for businesses to adhere to filing requirements and deadlines to avoid these consequences. Understanding the implications of non-compliance helps businesses maintain good standing with state tax authorities.

Quick guide on how to complete form ct 186 a utility services tax return gross operating tax ny

Effortlessly Prepare [SKS] on Any Device

Online document management has gained traction among both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to swiftly create, edit, and eSign your documents without any delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 186 a utility services tax return gross operating tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form CT 186 A, Utility Services Tax Return Gross Operating Tax NY?

Form CT 186 A is a tax return required by New York State for utility companies to report their gross operating income for utility services. This form is essential for compliance with state tax regulations and helps ensure that businesses meet their tax obligations efficiently.

-

How can airSlate SignNow help me with Form CT 186 A, Utility Services Tax Return Gross Operating Tax NY?

airSlate SignNow streamlines the process of completing and submitting Form CT 186 A by providing a user-friendly platform for document signing and sharing. With our solution, you can effortlessly prepare, eSign, and send your utility services tax return, ensuring timely submissions.

-

What features does airSlate SignNow offer for managing tax documents like Form CT 186 A?

Our platform offers a range of features tailored for managing tax documents, such as customizable templates, automated workflows, and real-time collaboration. These tools make it easier to manage Form CT 186 A, Utility Services Tax Return Gross Operating Tax NY while ensuring compliance and accuracy.

-

Is airSlate SignNow a cost-effective solution for handling Form CT 186 A?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans cater to various needs, allowing you to manage Form CT 186 A, Utility Services Tax Return Gross Operating Tax NY without incurring excessive costs, while benefiting from advanced features.

-

Can I integrate airSlate SignNow with my existing accounting software for Form CT 186 A?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and financial software. This allows you to easily incorporate Form CT 186 A, Utility Services Tax Return Gross Operating Tax NY into your existing workflow, simplifying your tax filing process.

-

What are the benefits of using airSlate SignNow for filing tax returns like Form CT 186 A?

Using airSlate SignNow for filing your tax returns, including Form CT 186 A, ensures a more efficient and secure process. Our platform minimizes the risk of errors, enhances collaboration among team members, and provides a clear audit trail, contributing to improved compliance with tax regulations.

-

Is eSigning Form CT 186 A legally binding?

Yes, eSigning Form CT 186 A using airSlate SignNow is legally binding as per the Electronic Signatures in Global and National Commerce (ESIGN) Act. This means you can confidently submit your Utility Services Tax Return Gross Operating Tax NY with an electronic signature, ensuring its validity.

Get more for Form CT 186 A , Utility Services Tax Return Gross Operating Tax Ny

Find out other Form CT 186 A , Utility Services Tax Return Gross Operating Tax Ny

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free